- Zcash is displaying bullish momentum, buying and selling close to $477 with highs and a robust EMA.

- Futures open curiosity surged to $655 million, indicating elevated dealer engagement and confidence.

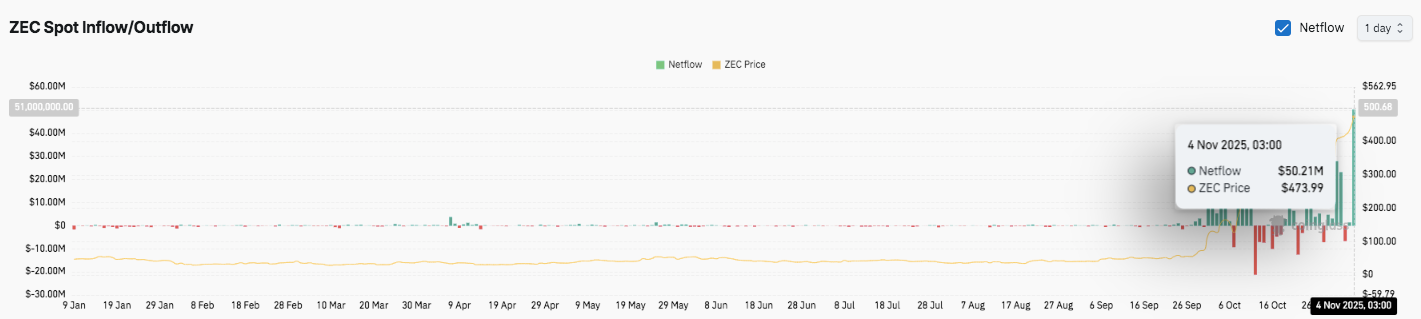

- The inflow of huge holders reached $50 million, indicating accumulation and rising investor confidence.

Zcash (ZEC) is gaining momentum after weeks of consolidation, displaying new bullish exercise in each spot and derivatives markets. The altcoin is buying and selling round $477, indicating a gentle upward development supported by robust market participation and bettering liquidity metrics.

The elevated inflows and surge in open curiosity point out that merchants and traders are as soon as once more listening to Zcash and expect it to interrupt above a key resistance degree.

Market construction displaying robust momentum

The 4-hour chart displays a transparent uptrend construction outlined by a collection of consecutive highs and lows. ZEC lately examined assist close to $452 however has rebounded, rising greater than 2% within the final session.

The consistency of the 20, 50, 100, and 200 interval exponential shifting averages (EMAs) helps a bullish bias. Importantly, the supertrend indicator reveals continued shopping for energy above $370, reinforcing the constructive sentiment.

Speedy resistance is close to $484, however ZEC has examined this worth a number of instances with out affirmation. A break above this zone may create momentum in direction of $500 after which $540 on the again of elevated quantity and bettering development indicators.

In the meantime, assist is situated round $417 and $380. If the worth can not maintain these ranges, it may fall in direction of $334 and even $270.

Derivatives market alerts elevated exercise

In keeping with information on November 4, open curiosity in Zcash futures elevated sharply, reaching $655.28 million from lower than $100 million the earlier month. This represents some of the important spikes in leverage exercise in 2025.

This spike coincided with ZEC worth rising to $433, indicating renewed involvement by merchants and potential for brief protecting. The sharp improve in open curiosity means that market individuals are more and more assured that Zcash can keep its present upward development.

Inflows point out accumulation by massive holders

Capital inflows additionally assist the constructive outlook. On November 4, ZEC recorded one among its strongest days of the quarter with web inflows of $50.21 million. After weeks of impartial liquidity, inflows immediately elevated, suggesting accumulation by massive holders. This modification displays elevated investor confidence and will set the stage for additional worth will increase.

Zcash (ZEC) Technical Outlook: Key Ranges to Watch Heading into November

Zcash (ZEC) continues to commerce in a bullish formation, displaying indicators of sustained upward momentum whereas staying above key assist zones. The value construction stays well-defined, with clear upside and draw back thresholds that form short-term sentiment.

- Prime degree: $484 stays the closest resistance degree, adopted by $500 and $540 as potential breakout targets. If quantity strengthens and momentum continues, a transfer above $484 may widen the rally in direction of $600.

- Lower cost degree: $417 acts as instant assist aligned with the 20-EMA. A break beneath this zone may expose the following helps close to $380 and $334. The 200-EMA at $270 represents a key long-term defensive space that bulls should defend to keep up the broad uptrend.

- Higher restrict of resistance: The $484-$500 vary serves as an necessary pivot zone for medium-term momentum. A decisive closing worth above this vary may sign the beginning of an acceleration section supported by robust capital inflows and elevated open curiosity.

The technical panorama means that ZEC is consolidating close to the highest of the bullish channel, indicating the potential for extra volatility going ahead. Value compression on this vary usually precedes robust directional actions, particularly when derivatives exercise and capital inflows coincide.

Can Zcash keep its momentum?

Zcash’s November outlook will largely rely on whether or not consumers can defend the $417-$380 assist cluster. If this zone holds, the bullish construction will stay intact, paving the way in which for a retest of $500 and $540. The latest surge in open curiosity and inflows signifies renewed investor participation, suggesting that the present development may transfer larger if shopping for stress continues.

Nevertheless, failure to maintain above $380 may invite a deeper retracement in direction of $334 and even $270, with the long-term EMA doubtlessly offering assist. For now, ZEC stays in a key correction, with near-term sentiment leaning bullish however delicate to quantity affirmation. November may determine whether or not Zcash enters a stronger development continuation or re-enters a correction section earlier than the following leg strikes larger.

Disclaimer: The knowledge contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any variety. Coin Version shouldn’t be liable for any losses incurred because of the usage of the content material, merchandise, or providers talked about. We encourage our readers to do their due diligence earlier than taking any motion associated to our firm.