- The Shiba Inu loses triangle assist whereas the sellers defend the downtrend line and the EMA turns into resistance.

- Alternate outflows have been over $3.06 million, indicating that distributions can be made as liquidity returns to the exchanges.

- The breakdown reveals a liquidity zone at $0.0000080, with a deeper draw back anticipated in direction of $0.0000072 if assist fails.

Shiba Inu worth as we speak is buying and selling round $0.00000905, under its multi-week worth vary as sellers reject the worth on the downtrend line. This breakdown places short-term strain on patrons, revealing the $0.0000080 liquidity shelf as the following main draw back goal.

Spot outflows improve as patrons pull out

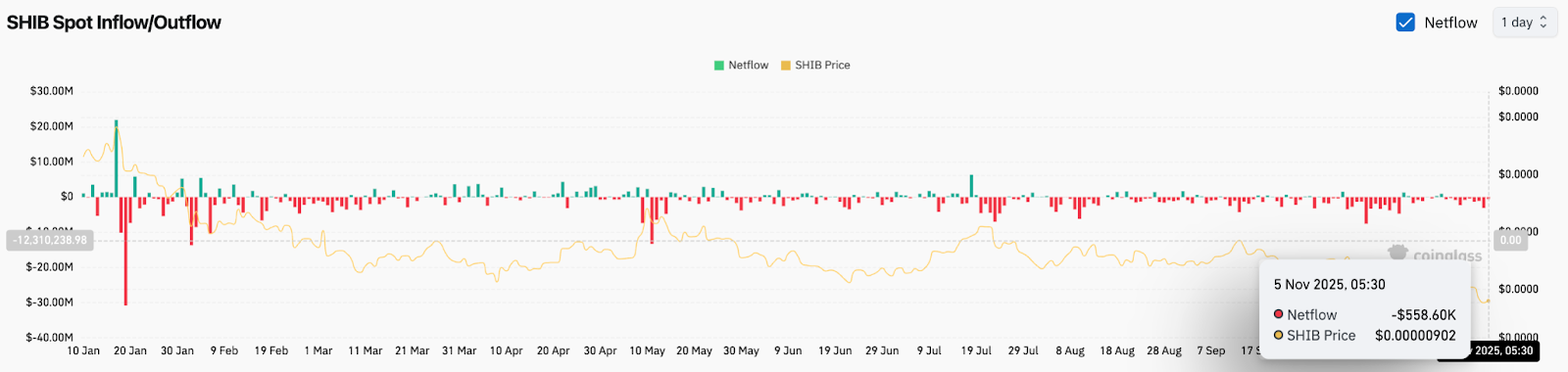

In response to Coinglass information, there was an outflow of $3.06 million yesterday, and a further $558,600 continued to move as we speak, indicating lively circulation. The continual look of pink netflow bars from October to November signifies that holders are transferring their tokens to exchanges fairly than withdrawing them to chilly storage.

If flows stay detrimental for consecutive periods, liquidity leaves the ecosystem and the worth sometimes continues its downward development. Within the case of SHIB, promoting strain instantly corresponds to a technical failure. No proof of spot buildup but. The patrons should not stepping in to save lots of the collapsing construction.

The breakdown confirms the energy of the development and the EMA reverses to resistance.

The Shiba Inu misplaced the triangular assist it had maintained for practically two weeks. This rejection occurred proper on the downtrend line drawn from the August excessive, confirming that the broader downtrend remained intact.

Worth is at the moment under all main transferring averages.

- 20-day EMA: $0.00001062

- 50-day EMA: $0.00001163

- 100 days EMA: $0.00001252

- 200 days EMA: $0.00001271

All EMAs are stacked under and sit above the worth, forming a ceiling. All makes an attempt to regain the 20-day EMA have been met with quick sell-offs, indicating that patrons lack leverage even on the bailout rebound.

The supertrend indicator stays solidly pink. The development is neither bullish nor impartial till SHIB closes above the supertrend band.

Concentrate on key assist ranges

SHIB’s present worth motion locations quick significance on the $0.0000088 to $0.0000080 zone, a degree that final served as a requirement pocket in July. Dropping this area opens up a transparent air pocket for a swing low in June.

As soon as under $0.0000080, the following seen space of liquidity doesn’t seem till $0.0000072.

This creates a easy falling sequence.

- Bears stay in management under $0.0000090

- Lack of $0.0000080 confirms a deeper correction

- The subsequent main magnet can be $0.0000072

Brief-term charts present makes an attempt at stabilization

On shorter time frames, we are able to see that patrons try to sluggish the decline. On the 30-minute chart, SHIB regained the VWAP band after a short oversold flash. RSI recovered above 50, indicating intraday stabilization after the failure.

Nonetheless, the rebound lacks affirmation till the worth closes above $0.00000930, the intraday provide zone that coincides with the session VWAP. Till then, each rally is a reactive pullback inside a bigger downtrend.

outlook. Will Shiba Inu rise?

The subsequent transfer will rely upon how the worth reacts on the $0.0000088 to $0.0000080 assist zone.

- Bullish Case: SHIB rebounds from $0.0000088 and closes above $0.00001062 with quantity. This clears the primary degree of resistance and permits us to go in direction of the $0.00001200 higher trendline.

- Bearish Case: A each day shut under $0.0000080 exposes $0.0000072 and confirms the continuation of the broader downtrend.

If the worth regains $0.00001062 and breaks out of the supertrend, the momentum will change. A lack of $0.0000080 turns the transfer right into a full correction in direction of $0.0000072.

Disclaimer: The knowledge contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any type. Coin Version will not be chargeable for any losses incurred because of the usage of the content material, merchandise, or companies talked about. We encourage our readers to do their due diligence earlier than taking any motion associated to our firm.