- ADA is struggling beneath the important thing EMA, indicating continued bearish market dominance.

- A decline in futures open curiosity signifies waning dealer confidence and diminished leverage.

- Continued international alternate outflows spotlight weak accumulation and declining liquidity.

Cardano (ADA) continues to be beneath bearish strain because the cryptocurrency struggles to interrupt above the $0.49 assist zone. The asset has been on a downward trajectory for a number of weeks, with short-term momentum favoring sellers.

ADA is presently buying and selling round $0.534, nonetheless properly beneath the most important shifting averages. This sustained weak point displays the general market slowdown as merchants exit leveraged positions and general altcoin sentiment cools.

Persistent downtrend and resistance clusters

ADA is buying and selling beneath the 20, 50, 100, and 200 EMA ranges, highlighting continued bearish momentum. All makes an attempt to rebound in direction of the $0.60-$0.65 vary have failed, making a constant sample of decrease highs since early October. The Supertrend indicator stays pink, confirming that sellers are nonetheless answerable for the market.

The latest Fibonacci retracement stage from the excessive close to $0.94 to the low close to $0.49 presents vital resistance at $0.66 and $0.77. These zones coincide with EMA100 and EMA200 and type a powerful provide area. For ADA to vary sentiment, the bulls must regain these ranges and set up a stable shut above $0.66.

Market sentiment and futures buying and selling actions

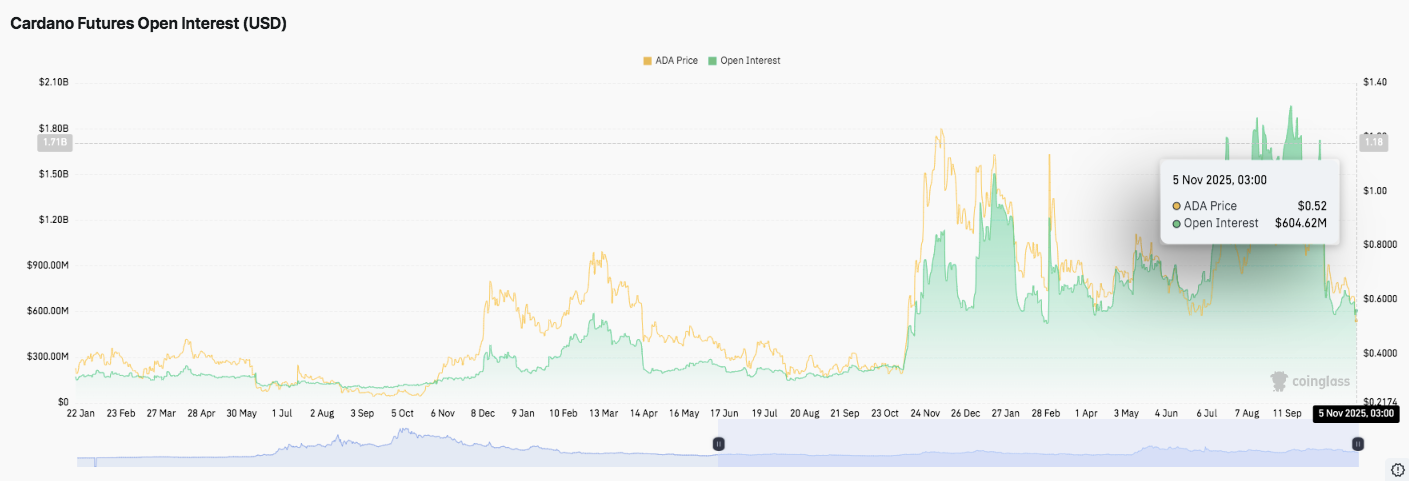

ADA futures open curiosity declined considerably, reflecting waning enthusiasm amongst leveraged merchants. Open curiosity, which reached practically $1.8 billion when the worth rose above $1.10, has declined to about $604 million. This sharp contraction means that merchants are closing positions moderately than opening new ones. Consequently, markets seem much less speculative and extra cautious.

Moreover, the decline in leveraged participation signifies that merchants are ready for affirmation of a transparent backside. A gradual enhance in open curiosity as the worth rises would sign renewed confidence. Till that occurs, ADA’s short-term features are more likely to be restricted.

Foreign money flows and liquidity tendencies

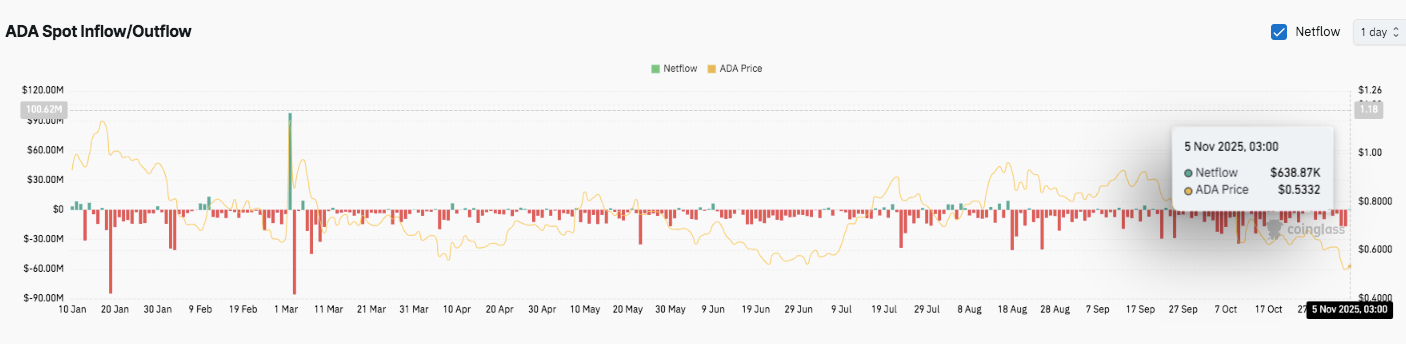

All through 2025, the Cardano spot market has proven continued outflows, an indication of continued profit-taking and weakening accumulation. Regardless of a slight spike in inflows in March and July, pink bar periods prevailed, revealing sustained promoting strain. On November fifth, ADA recorded modest inflows of $638,870 whereas buying and selling round $0.5332.

Moreover, the coincidence of value declines and regular outflows signifies that liquidity continues to movement out of exchanges. Subsequently, with out constant capital inflows, ADA might battle to keep up the $0.50 assist till November. A decisive break beneath this threshold may pave the best way to $0.45, whereas a powerful rebound may set off a short-term restoration in direction of $0.59.

Cardano (ADA) Technical Outlook – Crucial Stage Stays Vital Heading into November

- Prime stage: Fast resistance factors are $0.55, $0.59, and $0.66. If the worth is confirmed to rise above $0.66, the rally may widen in direction of $0.71 and $0.77.

- Lower cost stage: The principle assist stays at $0.49, adopted by $0.45 and $0.41 if promoting strain accelerates.

- Higher restrict of resistance: The 200-EMA close to $0.77 is a key stage for a medium-term bullish reversal.

Wanting on the technical image, we see Cardano compressing between the horizontal assist base at $0.49 and trendline resistance round $0.60. A discount in value actions signifies that volatility might enhance if a breakout happens.

Will Cardano value recuperate?

Cardano’s near-term outlook will rely upon whether or not patrons can maintain on to the $0.49 assist lengthy sufficient and reclaim the 20-EMA close to $0.55. If it features momentum, ADA may attempt to recuperate in direction of the $0.59-$0.66 cluster, confirming early indicators of a pattern reversal.

Nonetheless, if $0.49 will not be retained, the token will likely be uncovered to even larger losses in direction of $0.45 and $0.41. Market sentiment, on-chain flows, and Bitcoin stability will play a decisive function in ADA’s subsequent directional transfer. For now, the asset stays in a key consolidation zone, with restricted bullish conviction, however a rebound is probably going if macro circumstances enhance.

Disclaimer: The knowledge contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any form. Coin Version will not be chargeable for any losses incurred on account of using the content material, merchandise, or providers talked about. We encourage our readers to do their due diligence earlier than taking any motion associated to our firm.