- Gigglefund’s rally above $200 confirms bullish pattern with sturdy technical assist

- Improve in open curiosity alerts elevated speculative exercise and a return to dealer optimism

- Sustained spot outflows reveal lingering investor warning regardless of enhancing value developments

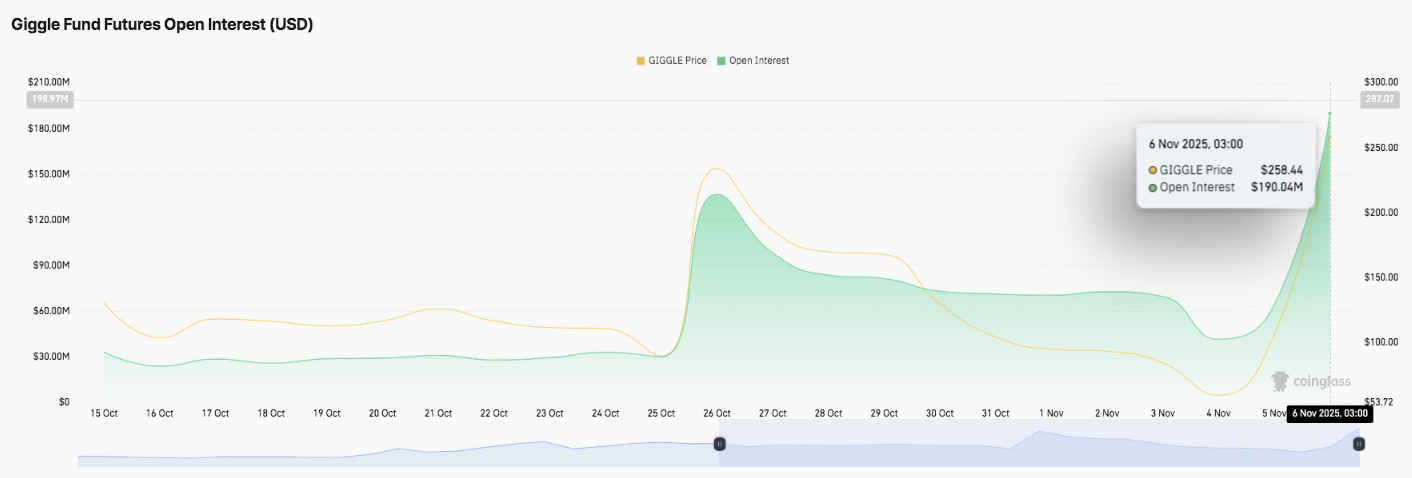

The GIGGLE market has rebounded strongly after weeks of heavy losses, exhibiting renewed optimism amongst merchants. After plummeting from a excessive round $287.96 to a low of $8, the token has now made a powerful restoration and is hitting $258.44. This upward momentum has coincided with a pointy enhance in open curiosity reflecting a surge in speculative buying and selling exercise and new inflows into the Giggle Fund futures market.

Market restoration and pattern formation

Giggle Fund’s value construction turned bullish after recovering a number of technical ranges. The rebound above $200 has put the token firmly above all main exponential shifting averages, suggesting near-term energy.

The 20, 50, 100, and 200 EMA strains vary from $107 to $145 and are trending upward. This alignment signifies rising market confidence and the potential for the upward pattern to proceed.

The Supertrend indicator confirmed a bullish reversal close to $87, marking the start of the most recent bull run. Moreover, the 0.618 Fibonacci retracement degree round $147.99 has became sturdy assist and is a crucial safety for the bulls.

If Giggle Fund maintains its place above $200, analysts count on that it could retest the $260-$287 resistance zone. Nonetheless, a fall beneath $152 might set off a recent selloff in direction of $126 and even $87.

Fast enhance in open curiosity suggests resurgence of hypothesis

Open curiosity in Gigglefund futures soared in early November, in line with the info. It jumped from $60 million in late October to $190 million by November 6.

This enhance signifies that merchants are actively re-entering the market and maybe getting ready for an additional breakout. The correlation between value restoration and elevated open curiosity signifies elevated speculative urge for food and confidence in short-term volatility.

Nonetheless, such spikes are sometimes preceded by a rise in danger, as leverage will increase the chance of a correction. If excessive open curiosity continues with out corresponding inflows, liquidation strain could also be amplified throughout financial downturns. Subsequently, merchants stay cautious whereas monitoring funding charges and market depth.

Persistent capital outflows mirror investor uncertainty

Regardless of bullish technical alerts, spot market flows stay unfavorable. Giggle Fund recorded continued web outflows via October, reaching $2.54 million by November sixth. These outflows recommend that some traders are taking income or lowering publicity amid macro uncertainty.

Giggle funds might face near-term liquidity strain except inflows stabilize. However, if market sentiment improves and the token sustains above $200, the continued restoration might appeal to recent capital and strengthen the bullish construction.

Giggle Fund Value Technical Outlook

Key ranges stay nicely outlined heading into mid-November. Upside targets embody $228 as rapid resistance, adopted by $260, the earlier swing excessive and key psychological mark at $287.96. If the momentum continues, a break above $228 might prolong the rally in direction of the $260-$287 zone.

On the draw back, assist is established round $152, bolstered by the supertrend indicator and the 20-EMA cluster. Secondary assist lies close to the 50-EMA at $126, whereas key assist stays on the earlier accumulation zone at $87. The 0.618 Fibonacci pivot at $147.99 can also be an essential line to defend for bulls.

Technical construction exhibits that Gigglefund is compressing between $152 and $228, and falling volatility signifies potential breakout formation. A sustained commerce above $200 might affirm a continuation of the pattern, however failure to maintain $152 might set off a retracement to $126 and even $87.

Can the Couscous Fund maintain its rise?

The short-term bias stays cautiously bullish so long as the worth stays above the 20EMA and 50EMA vary. Rising open curiosity and strengthening momentum indicators recommend sustained shopping for strain. Nonetheless, constant capital outflows and profit-taking conduct proceed to restrict upside.

If patrons keep on with the $147-$152 zone, Giggle Fund might try one other rally in direction of the $260-$287 resistance cluster. Conversely, if the promoting intensifies and the worth drops beneath $152, the construction might weaken and open the door to a decrease retracement zone.

All in all, Giggle Fund is at a pivotal level. The approaching periods will resolve whether or not this consolidation results in a brand new breakout or additional correction. Market confidence, a restoration in capital inflows, and stability above $200 might be decisive for the following directional transfer.

Disclaimer: The data contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any type. Coin Version shouldn’t be answerable for any losses incurred on account of the usage of the content material, merchandise, or companies talked about. We encourage our readers to conduct due diligence earlier than taking any motion associated to our firm.