- XRP’s worth in 2025 is pegged at a spread of $1.90 to $3.38, leaving merchants in an unsure state of affairs.

- encryptionanalyst Ali Martinez mentioned patrons may see a clear entry close to $1.90 earlier than heading in direction of $10 within the 2025 bull section.

- Spot XRP ETF momentum, DTCC itemizing, and return of US liquidity all assist the macro bullish construction.

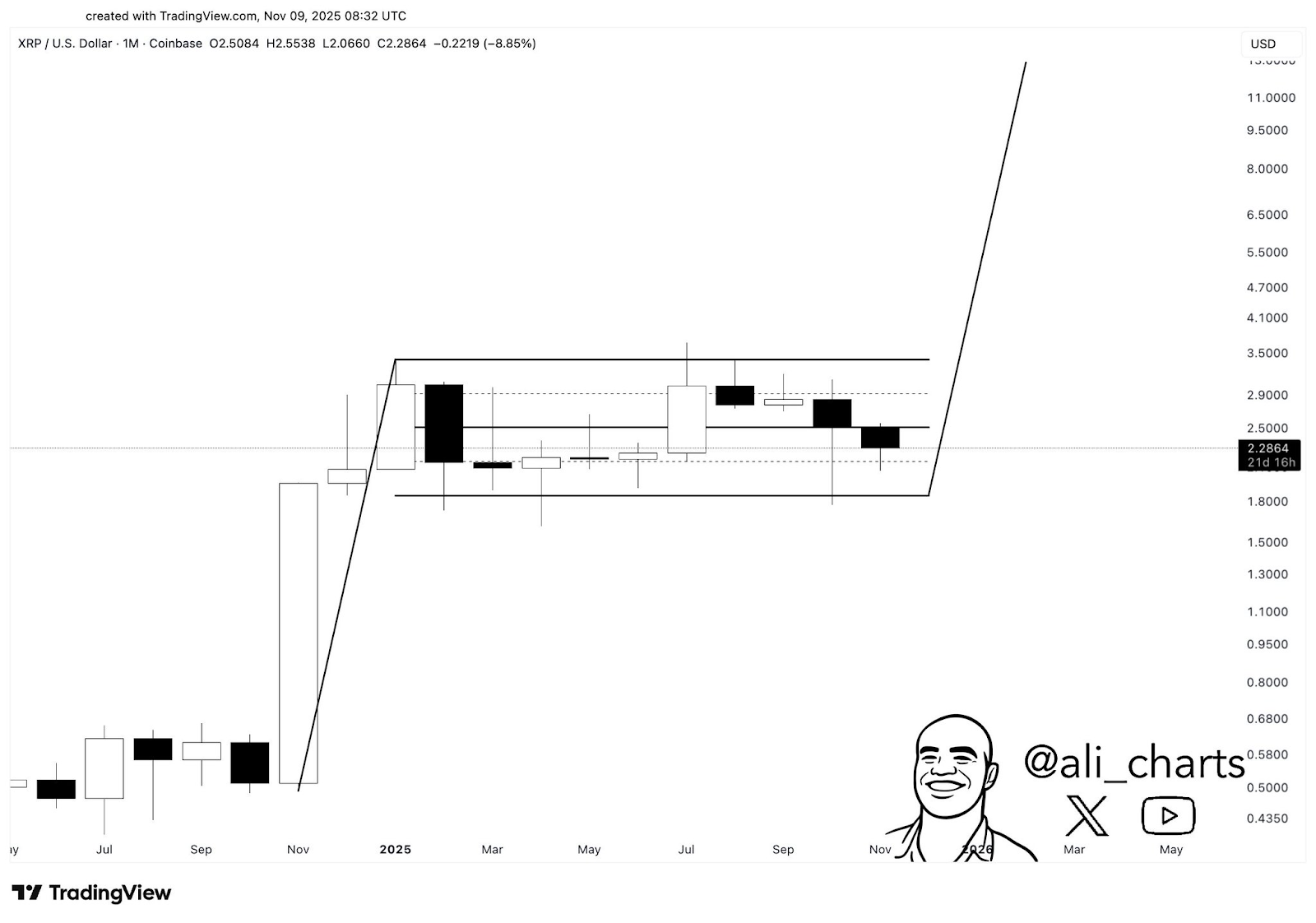

Right now, XRP worth remains to be buying and selling throughout the similar year-to-date sq. that outlined 2025, with most actions held between the $1.90 assist and $3.38 resistance.

Crypto analyst Ali Martinez advised his followers that this sample is an accumulation relatively than a breakout, and that the identical construction may ship XRP in direction of $10 if a breakout happens. He additionally cautioned that merchants who push lengthy too early ought to count on another drop to the $1.90 zone earlier than the subsequent leg strikes larger.

Associated: XRP Dominance Checks Multi-12 months Cap as Ledger Burn Jumps 60.87%

Between $1.90 and $3.38, the oblong construction stays

Martinez bases his opinion on the every day chart, the place XRP has repeatedly revered the decrease band round $1.90, however didn’t clear the higher band round $3.38. The October 11 crypto crash worn out round $20 billion from leveraged gamers, pushing XRP beneath the $2.70 ledge, with sellers taking management in the course of the vary.

This shift brings focus again to areas of low demand first. A second analyst, Axel Kibar, reached an identical conclusion, noting that even after the market absorbs this consolidation, the early breakout from the multi-year triangle nonetheless helps the rally on larger time frames.

Supply: X

ETF tracks and authorities bonds for institutional buyers stay macro bullish

The requires an increase to $10 will not be simply technical. XRP Spot ETF lanes are filling up. DTCC has listed spot XRP ETF merchandise from Bitwise, Franklin Templeton, 21Shares, Canary Capital, and CoinShares, which buyers are taking as a sign of readiness forward of formal buying and selling.

On the similar time, Evernorth and different publicly traded corporations are including XRP to their monetary plans, indicating that regulated holders need scale publicity. The activation of a number of spot XRP ETFs within the present itemizing cycle will give the token the demand supply it must proceed to interrupt above the $3.38 cap.

Cryptocurrency liquidity positive aspects tailwind after US authorities reopens vote

The U.S. Senate voted 60-40 to reopen the federal government and resume funding by means of January 30, 2026, giving the Federal Reserve extra room to proceed reducing rates of interest and pursuing beforehand signaled quantitative easing.

Extra greenback liquidity often helps giant tokens first, and XRP is already one of many clearest candidates for institutional funds, particularly with RLUSD dwell throughout Ripple’s funds stack. If liquidity expands as deliberate, XRP will not want to interrupt out of its year-to-date rectangle even with weak flows, permitting analysts to comfortably maintain $10 on the board heading into 2025, at the same time as they name for a greater entry at $1.90.

Associated: President Trump predicts $20 trillion financial surge: Might easing insurance policies gasoline Bitcoin’s large rally?

Disclaimer: The data contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any form. Coin Version shouldn’t be answerable for any losses incurred because of the usage of the content material, merchandise, or providers talked about. We encourage our readers to do their due diligence earlier than taking any motion associated to our firm.