- Bitcoin worth right now is buying and selling round $106,239 and is making an attempt to reclaim the 20-day and 50-day EMA after defending the $100,000 to $98,500 demand zone.

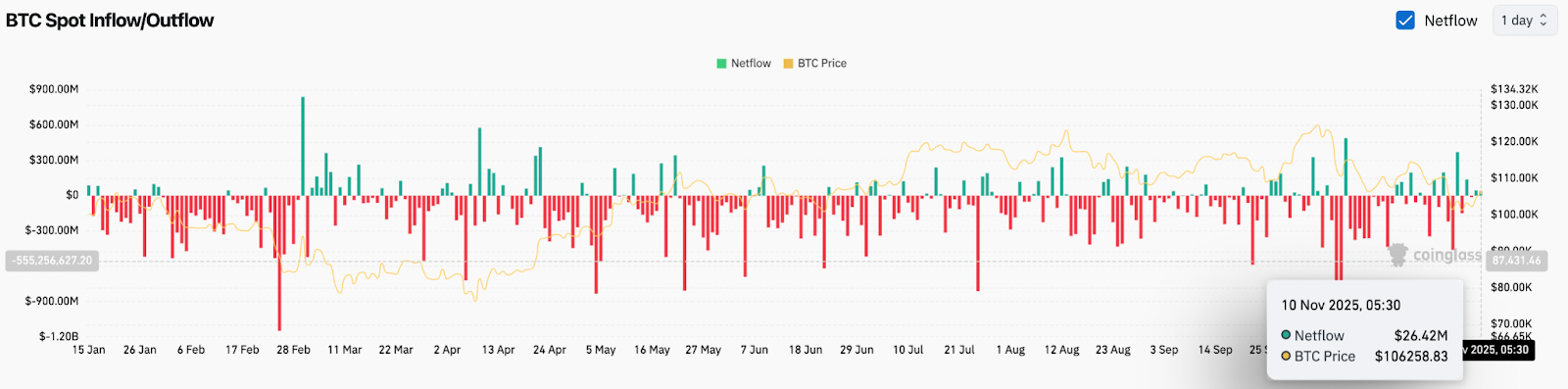

- Spot flows confirmed internet inflows of $26.42 million, the primary optimistic change in current days, and open curiosity in derivatives rose 4.15% as merchants re-entered the market.

- An in depth above $111,177-116,289 would verify a development restoration towards $124,000, whereas a break beneath $100,000 may result in $92,000.

Bitcoin worth is buying and selling round $106,239 right now, recovering from final week’s breakdown beneath the multi-month uptrend line that supported progress all through 2025. Sellers pushed costs into the $100,000 to $98,500 demand zone, and patrons aggressively defended that stage. Danger sentiment improved following President Donald Trump’s current feedback suggesting the US authorities shutdown may finish quickly.

Purchaser makes an attempt to get well misplaced EMA

On the day by day chart, Bitcoin is trying to shut above the 20-day and 50-day EMAs of $107,180 and $110,262. These shifting averages now kind an overhead resistance zone that rejects any makes an attempt to maneuver larger since late October.

The breaking of the development line was the important thing change. For nearly seven months, the worth revered the rising help line. Shedding it confirmed sellers in management and compelled Bitcoin into its first main structural take a look at for the reason that August rally.

Principal day by day ranges:

- Resistance Zone: $107,180 to $111,177

- Breakout set off: $116,289

- Assist vary: $100,000 to $98,500

The present pullback is constructive, however the worth must clear the EMA cluster for management to return to patrons. Till then, the near-term restoration will stay reactive somewhat than trend-setting.

Spot circulation stabilizes after mass distribution

In accordance with spot circulation knowledge from Coinglass, Bitcoin recorded internet inflows of $26.42 million on November 10, the primary optimistic quantity in current days. Transitions from outflows to inflows traditionally coincide with bottoms forming on larger time frames.

The market will stay defensive till spot flows return to a persistently optimistic place. Merchants are ready for affirmation that the present rally is being supported by actual demand somewhat than brief protecting.

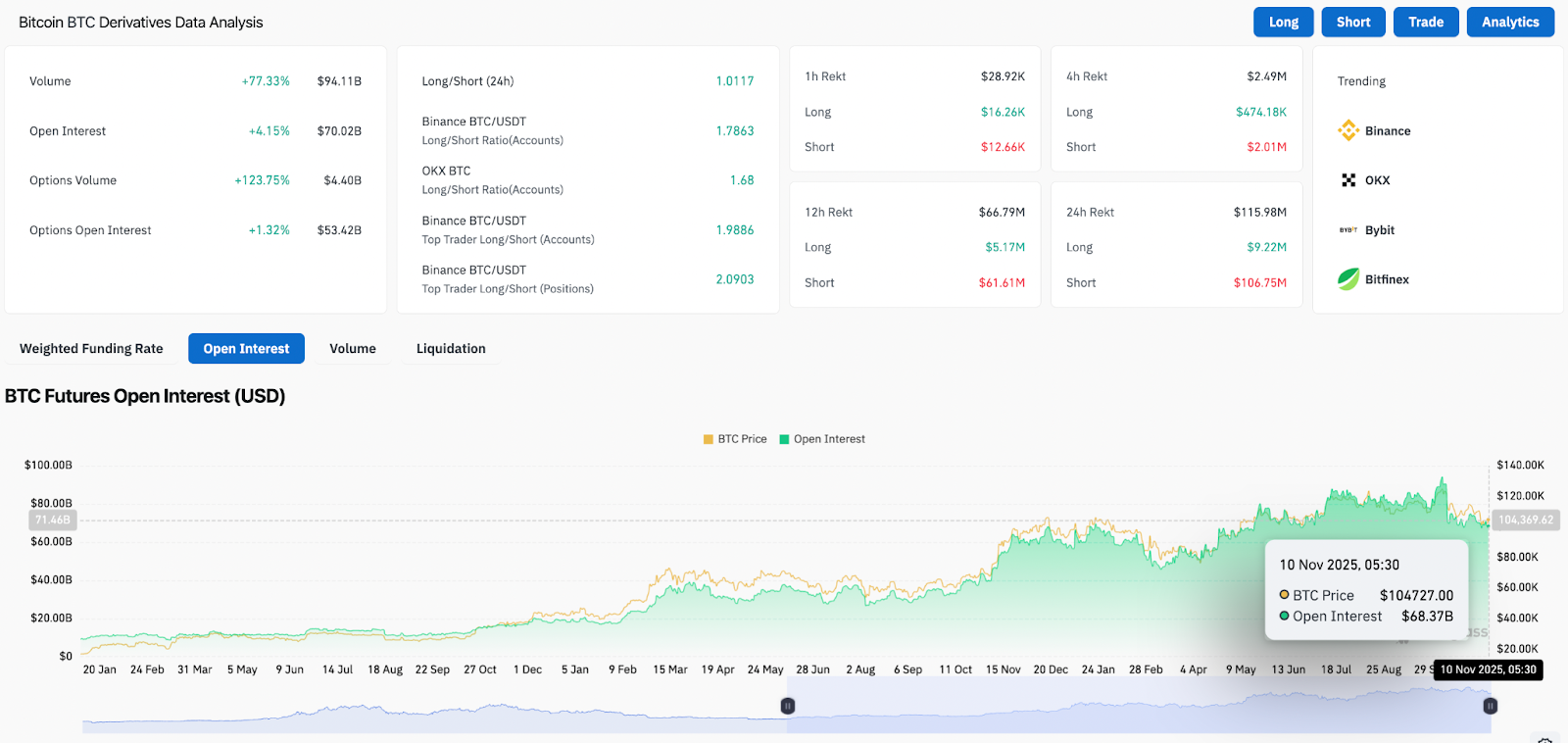

Open curiosity rises as merchants take positions forward of macro catalysts

Bitcoin derivatives knowledge reveals merchants are returning to the market. In accordance with Coinglass,

- Quantity surge: +77.33%

- Open curiosity enhance: +4.15% to $70.02 billion

- Non-obligatory quantity enhance: +123.75 %

A rise in open curiosity signifies that new positions are being opened somewhat than closed. The long-short ratio at present favors the bulls, with Binance’s high merchants holding 2.09 lengthy positions for each brief place. This positioning suggests merchants are betting on a sustained restoration somewhat than anticipating additional drawdowns.

A retest of the development line is in progress

Worth is at present retesting the decrease aspect of the damaged development line. If patrons are unable to get well it, a retest can be validation of a brand new downtrend.

Key studying on construction:

- EMA begins to give attention to help above $111,177

- $116,289+: Confirms development resumption in the direction of $124,000

- Below $100,000: Extra room in the direction of $92,000

The supertrend stays crimson on the day by day chart, indicating that the short-term construction favors sellers so long as the worth doesn’t exceed $111,000.

outlook. Will Bitcoin go up?

Bitcoin is at a decisive level. The help zone between $100,000 and $98,500 continues to be in place, and derivatives merchants are searching for upside. A reversal in spot flows provides early affirmation that promoting stress could also be easing.

- Bullish case: An in depth above $111,177 adjustments momentum, and a clearing of $116,289 confirms the breakout. That might open the way in which to $124,000, the place sellers had beforehand capped the rally.

Bearish case: If the EMA fails to get well, Bitcoin will stay beneath the damaged development line. If the day by day closing worth falls beneath $100,000, the following liquidity block of $92,000 is uncovered.

Disclaimer: The data contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any sort. Coin Version isn’t answerable for any losses incurred on account of the usage of the content material, merchandise, or companies talked about. We encourage our readers to do their due diligence earlier than taking any motion associated to our firm.