- Ethereum worth is buying and selling round $3,613 as we speak, regaining momentum above a serious demand zone.

- Stablecoin inflows into Ethereum surged by $84.9 billion, indicating an inflow of latest liquidity into the ecosystem.

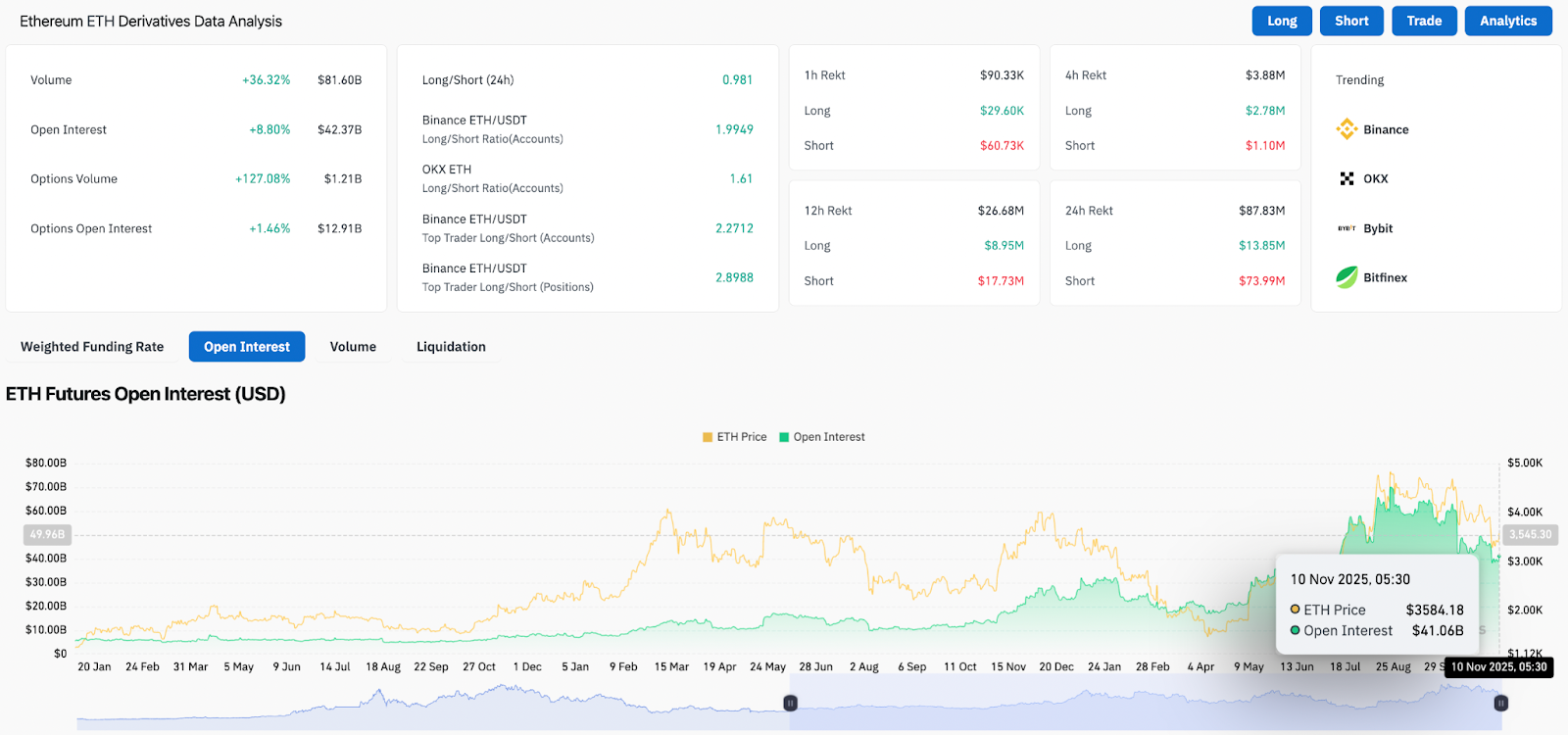

- Open curiosity rose 8.80%, indicating that merchants are including publicity somewhat than unwinding positions.

Ethereum worth as we speak is buying and selling close to $3,613 and is attempting to increase the rebound from the demand zone between $3,300 and $3,450. The rally comes as the newest derivatives information exhibits elevated open curiosity and improved positioning amongst merchants.

Patrons shield key demand zones

Ethereum worth as we speak stabilized after tagging into a requirement zone that lasted from August to September. This area close to $3,300 to $3,450 is simply above the 200-day EMA of $3,596, which has absorbed important promoting strain in latest periods.

The every day chart exhibits the value trying to retake the 20-day and 50-day EMAs. Speedy resistance lies at $3,694 after which $3,887, the place the 50-day and 100-day EMAs are concentrated. Above that, the downtrend line from year-to-date highs reaches a worth close to $4,001. The construction will stay mounted till patrons shut above that trendline.

Parabolic SAR has damaged under worth for the primary time in latest weeks, displaying early energy. The present battle is about management. An in depth above $3,694 will verify step one within the pattern restoration. A lack of $3,450 will reinstate draw back strain.

Stablecoin development suggests capital will return to Ethereum

Ethereum dominated stablecoin provide development this yr, including $84.9 billion, in response to Artemis information. No different chain can match this. Tron and Solana are a distant second and third on the charts.

A rise in stablecoin provide usually indicators an inflow of latest liquidity into the ecosystem. Stablecoins function dry powder for buying and selling, market making, lending, and staking. As the bottom of a stablecoin will increase, the chance of future inflows into ETH or ETH-based belongings will increase.

Derivatives information exhibits re-leveraging to rebound

Derivatives positioning confirms adjustments in market conduct. Coinglass information displays:

- Buying and selling quantity elevated by 36.32% to $81.6 billion

- Open curiosity elevated by 8.80% to $42.37 billion

- Choices buying and selling quantity elevated by 127.08% to $1.21 billion

A spike in open curiosity signifies that merchants are including publicity somewhat than unwinding. The long-to-short ratio signifies bullish conduct.

- Binance long-to-short ratio: 1.99

- Binance Prime Dealer Lengthy Bias for Positions: 2.89

- OKX Lengthy to Brief Ratio: 1.61

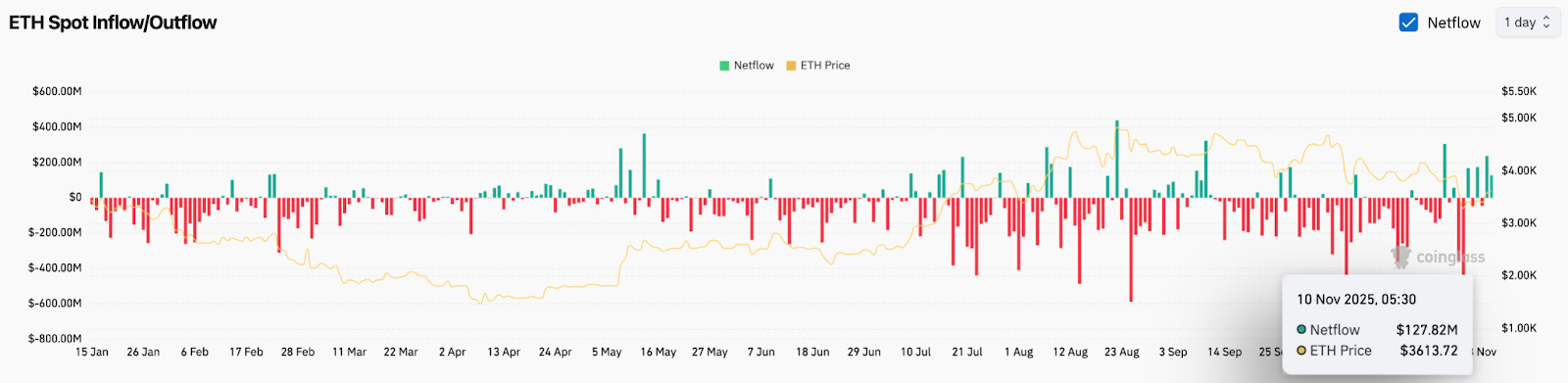

Spot flows present capital is returning after weeks of outflows

From most of October to early November, Ethereum confronted spot outflows, which have been an indication of circulation. That has modified as we speak.

The newest Coinglass information exhibits:

- Spot internet inflows on November 10 have been $127.82 million

The reversal in spot flows helps the concept that buyers are returning to Ethereum after key demand zones maintain. This is sensible as a result of spot patrons are sometimes taking long-term positions somewhat than short-term speculative trades.

outlook. Will Ethereum go up?

The setup has modified from being reactive to being constructive. The growth of stablecoins means that liquidity is being constructed on high of Ethereum. Derivatives positioning exhibits that merchants are gaining confidence somewhat than retreating. Spot inflows verify that capital is circulating again into the ecosystem somewhat than leaving it.

- Bullish case: A every day shut above $3,694 after which $3,887 would verify a pattern restoration and set targets at $4,300 and $4,500.

- Bearish case: If the every day shut worth falls under $3,450, the rebound is void and $3,250 and $3,000 could also be uncovered.

If Ethereum holds the 200-day EMA and clears $3,887, the pattern will return to larger highs. Dropping the demand zone turns the motion right into a deeper correction.

Disclaimer: The knowledge contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any form. Coin Version isn’t chargeable for any losses incurred on account of the usage of the content material, merchandise, or providers talked about. We encourage our readers to do their due diligence earlier than taking any motion associated to our firm.