- Shiba Inu worth in the present day is buying and selling round $0.00001005, rebounding from demand zone help as consumers defend the ground.

- The EMA resistance cluster between $0.00001068 and $0.00001257 continues to reject any breakout makes an attempt.

- A breakout above the 20-day EMA will verify a change in momentum, however a failure dangers a return to help at $0.00000980.

The Shiba Inu worth is buying and selling round $0.00001005 in the present day, rebounding from final week’s lows and stabilizing. Consumers intervened within the low demand zone and compelled an intraday restoration above the short-term pattern channel. Nevertheless, the broader construction stays managed by sellers, as SHIB is buying and selling under a long-term downtrend line that has rejected all breakout makes an attempt since August.

Sellers nonetheless management increased timeframe buildings

The day by day chart exhibits that SHIB is anchored under a downtrend line extending from the highs originally of the 12 months. Every rally try was capped by that pattern line and was not pushed again into the vary.

The key shifting averages reinforce the ceiling.

- 20-day EMA: $0.00001068

- 50-day EMA: $0.00001146

- 100 days EMA: $0.00001200

- 200 days EMA: $0.00001257

All 4 EMAs are stacked above the present worth. The construction will stay corrective till the Shiba Inu closes above the EMA for at the very least 20 days. The supertrend indicator additionally stays purple, indicating that sellers nonetheless have management over the course.

This cluster of EMAs acts as a thick resistance zone. Any pullback into the area has been met with promoting, and SHIB has been pushed again to decrease liquidity ranges.

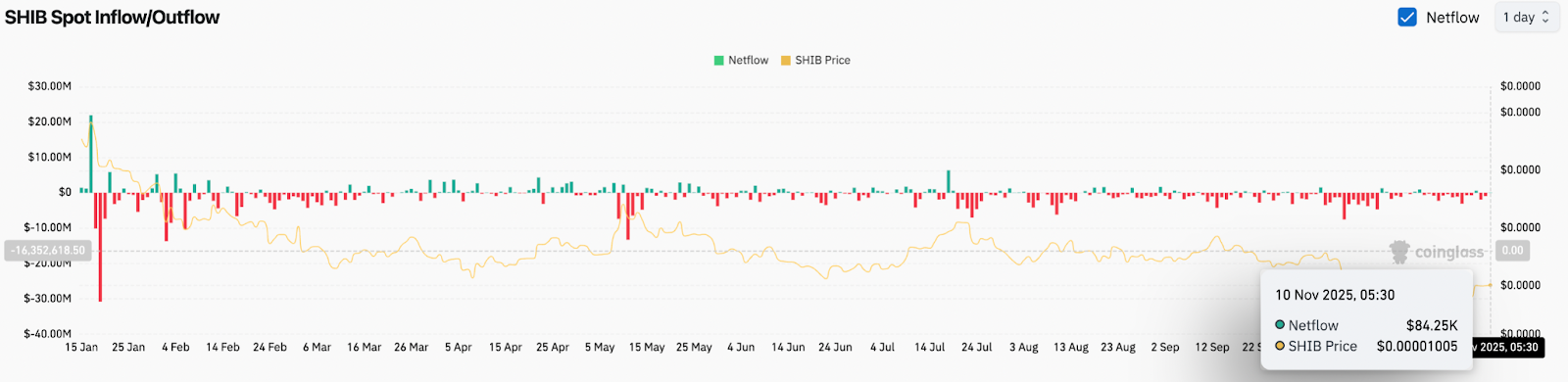

Spot flows are exhibiting stability as consumers defend the ground.

In line with Netflow information, SHIB recorded a small influx of $84.25,000 in the present day. Though modest, it marks a shift after a number of rounds of constant capital outflows. Optimistic web flows recommend some accrued curiosity will return, particularly round key help ranges.

This influx coincides with worth holding above $0.00000980, a zone the place consumers have intervened quite a few occasions over the previous month. So long as SHIB stays above that space, the draw back stays restricted.

Nevertheless, the stream will not be but sturdy sufficient to help a breakout. As the worth strikes in the direction of the EMA cluster, SHIB will want inflows and elevated buying and selling quantity for sustained upside.

Intraday momentum will increase however not confirmed but

On the 30-minute chart, SHIB broke out of a short-term descending channel and regained the VWAP line, an early signal that consumers are regaining momentum. This transfer exhibits that short-term merchants are actively defending the decline relatively than permitting it to proceed.

- RSI is round 52, simply above impartial.

- The value is above the short-term help of the mid-channel zone.

- The primary intraday resistance is close to $0.00001020.

This construction exhibits early power, however consumers will want a follow-through push to substantiate a change in pattern.

A clear break above $0.00001020 will shift intraday momentum in favor of the bulls.

outlook. Will Shiba Inu rise?

The Shiba Inu is exhibiting indicators of stabilization, however an entire reversal has not been confirmed. The overhead of trendlines and EMA clusters stays a serious barrier.

- Bullish case: If SHIB closes above $0.00001068 (20-day EMA) and is subsequently pushed via $0.00001146 to $0.00001200, momentum will change to bullish. A break above the 200-day EMA at $0.00001257 will verify a pattern reversal and open the way in which to $0.00001400.

- Bearish case: If the worth fails to interrupt out of the EMA, the worth will return to $0.00000980, and if the sell-off returns, a deeper draw back in the direction of $0.00000900 is anticipated.

Disclaimer: The knowledge contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any sort. Coin Version will not be liable for any losses incurred on account of the usage of the content material, merchandise, or companies talked about. We encourage our readers to do their due diligence earlier than taking any motion associated to our firm.