- XRP consolidates above key EMAs, displaying early indicators of accelerating bullish momentum

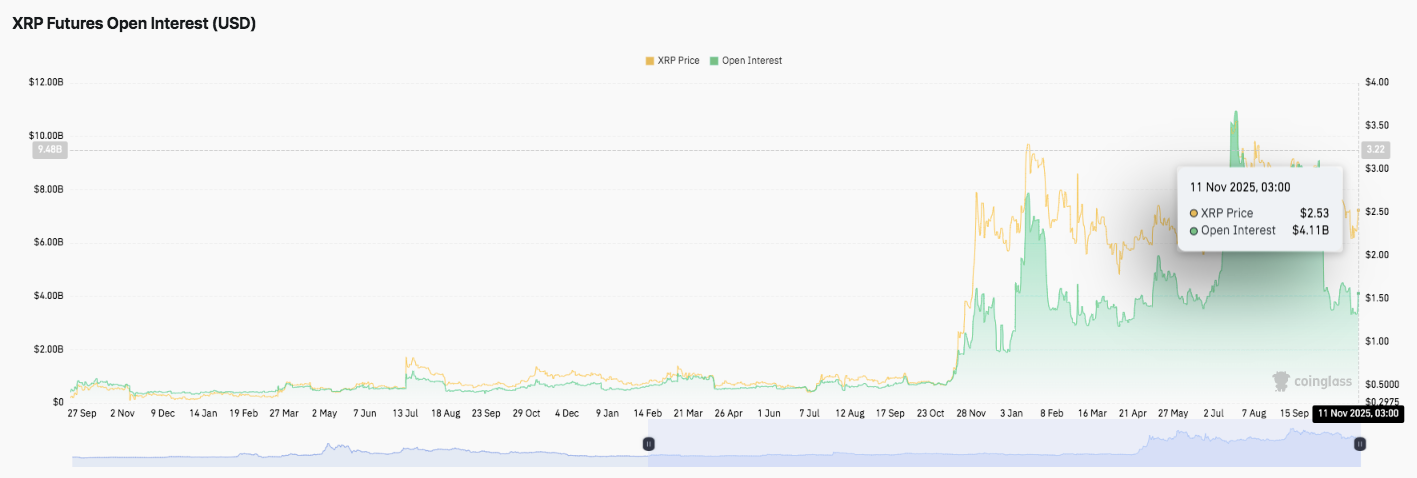

- Open curiosity rose to $4.11 billion, highlighting merchants’ rising confidence in XRP’s upside.

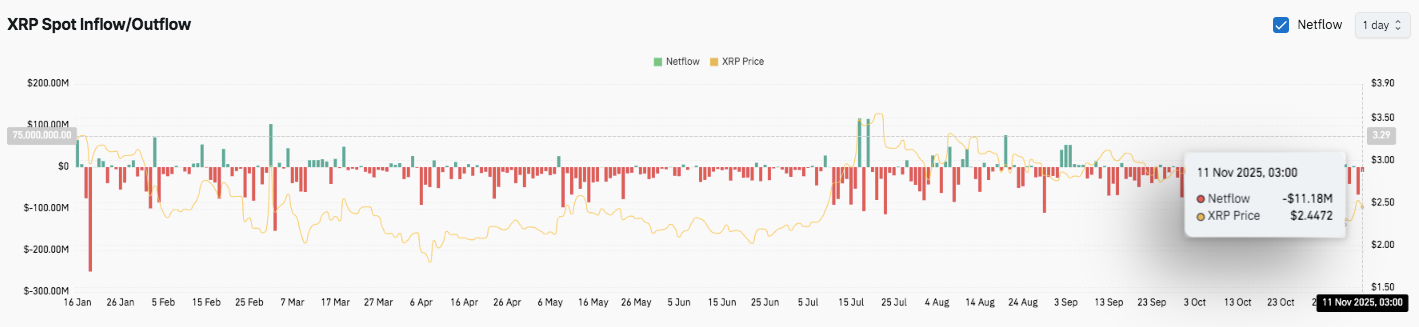

- Spot outflows of almost $11 million sign short-term warning regardless of bettering market construction

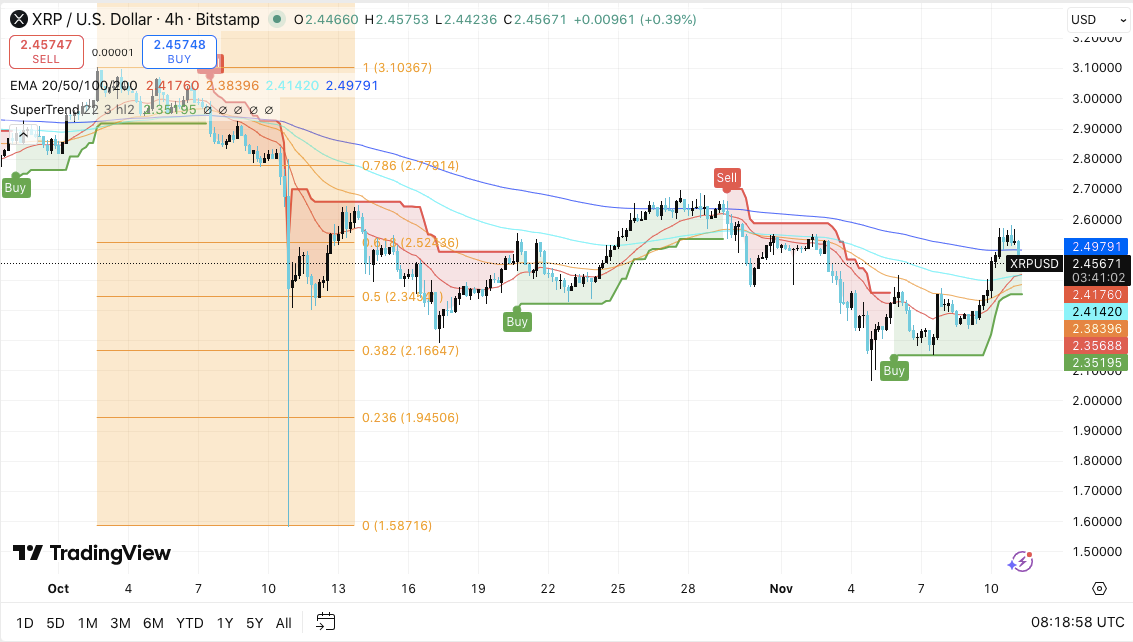

XRP is displaying renewed power because it makes an attempt to regain momentum above $2.45. The most recent worth actions of the token replicate the expansion of the restoration section that started after the rebound from the $2.35 assist zone.

Present buying and selling close to $2.47 signifies growing shopping for stress, with the 200-EMA resistance at $2.497 appearing as a key short-term barrier. In consequence, the market is carefully monitoring whether or not XRP can keep its upward trajectory and ensure a change in development momentum.

Strengthening restoration and technical programs

The 4-hour XRP/USD chart highlights a consolidation interval the place the asset is constructing assist above the $2.41 degree. This space coincides with the 50-EMA and supplies the premise for a doable bullish continuation.

If consumers keep on with this zone, the following upside worth goal will likely be across the Fibonacci 0.5 degree at $2.52. A sustained transfer past this level might pave the way in which to $2.79, which corresponds to the 0.786 Fib extension.

Moreover, technical indicators point out an enchancment in market sentiment. The supertrend not too long ago turned bullish after months of correction, suggesting that momentum is step by step shifting in consumers’ favor.

Convergence of the 20, 50, and 100-EMA traces additionally signifies a doable cross and is commonly related to an preliminary development reversal. Subsequently, sustaining above the $2.47-$2.50 vary might validate the following leg of XRP’s uptrend.

Derivatives knowledge exhibits rising confidence

Market exercise within the XRP futures market has expanded considerably. Open curiosity soared to $4.11 billion on November 11, the best degree since mid-year.

This enhance displays an obvious enhance in leveraged buying and selling positions, which frequently precede giant worth actions. Moreover, the rise in open curiosity together with steady worth power suggests that there’s a sense of confidence amongst merchants who count on continued upside potential.

Earlier this 12 months, XRP derivatives exercise was comparatively subdued, remaining at lower than $2 billion via August. The sharp enhance since September signifies new liquidity and speculative investor participation. Such a rise in open curiosity sometimes enhances short-term volatility and reactivity of worth actions.

Influx is required to keep up sentiment

Regardless of the bullish technical construction, on-chain knowledge exhibits continued web outflows from the XRP spot market. On November eleventh, with the value hovering round $2.44, outflows of over $11.18 million have been recorded.

This sample signifies investor profit-taking and short-term warning. Sustained capital inflows will likely be important to stabilize sentiment and ensure the continuation of financial restoration.

Technical outlook for XRP worth

Key ranges stay nicely outlined heading into mid-November. On the upside, XRP faces short-term hurdles at $2.47, $2.52, and $2.79. If the value sustains the shut above the Fibonacci 0.5 degree at $2.52, new bullish momentum might be confirmed and the following goal might be $2.79.

The draw back degree is equally essential. Quick assist lies at $2.41 (50-EMA), adopted by $2.35, the place shopping for stress has not too long ago appeared. If this vary fails to carry, the value might be uncovered to $2.16, and additional decline might check the 0.236 Fib retracement at $1.94.

At the moment, XRP is buying and selling inside a slim restoration channel between $2.35 and $2.50. The technical construction exhibits that the SuperTrend indicator is popping bullish, whereas the converging transferring averages (20/50/100) point out a doable upcoming crossover. This compression section often precedes a rise in volatility and alerts {that a} decisive transfer is imminent.

Will XRP proceed to get better?

XRP’s short-term trajectory will rely on whether or not consumers can maintain out the $2.35-$2.41 assist cluster lengthy sufficient to problem the resistance at $2.52. If the bullish momentum continues with stronger inflows and elevated open curiosity, the value might rise in the direction of $2.79 and probably retest the $3.00 zone.

Nonetheless, continued outflows and weak spot demand might restrict any upside makes an attempt. If the value breaks beneath $2.35, management will seemingly return to the sellers and the trail to sub-$2.16 will seemingly open once more. For now, XRP stays in a pivotal zone, and upcoming classes will decide whether or not its restoration develops right into a broader development reversal.

Associated: Are XRP bulls dishonest the rising market? A $2 drop might be subsequent

Disclaimer: The data contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any sort. Coin Version isn’t chargeable for any losses incurred on account of the usage of the content material, merchandise, or companies talked about. We encourage our readers to do their due diligence earlier than taking any motion associated to our firm.