- Bitcoin value is buying and selling round $104,100 as we speak, struggling under the short-term EMA cluster amid weak makes an attempt at restoration.

- Spot outflows of $56.25 million counsel modest distributions, however open curiosity rose 0.52% as futures buying and selling quantity declined.

- Danger sentiment stays fragile because the Fed’s stance on a December fee minimize is split, with key help seen between $102,900 and $100,000.

Bitcoin value is buying and selling round $104,100 as we speak, struggling to regain momentum following repeated rejections from the short-term EMA cluster and mid-range Fibonacci zone. Regardless of the modest restoration, threat sentiment stays fragile resulting from uncertainty over a possible Federal Reserve fee minimize in December, and technical and move knowledge point out continued bearish strain.

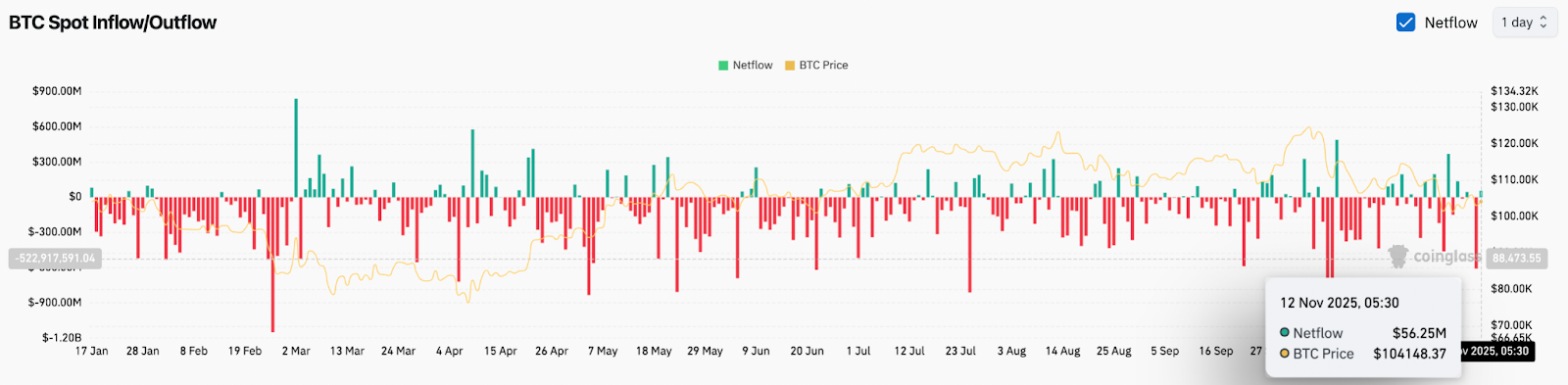

Spot outflows affirm weak threat urge for food

In response to knowledge from Coinglass, web inflows to the trade on November 12 had been $56.25 million, suggesting a modest distribution as merchants put Bitcoin again into circulation relatively than accumulation.

This continues the broad pattern of alternating web outflows and small inflows in current weeks, indicating that market confidence stays weak.

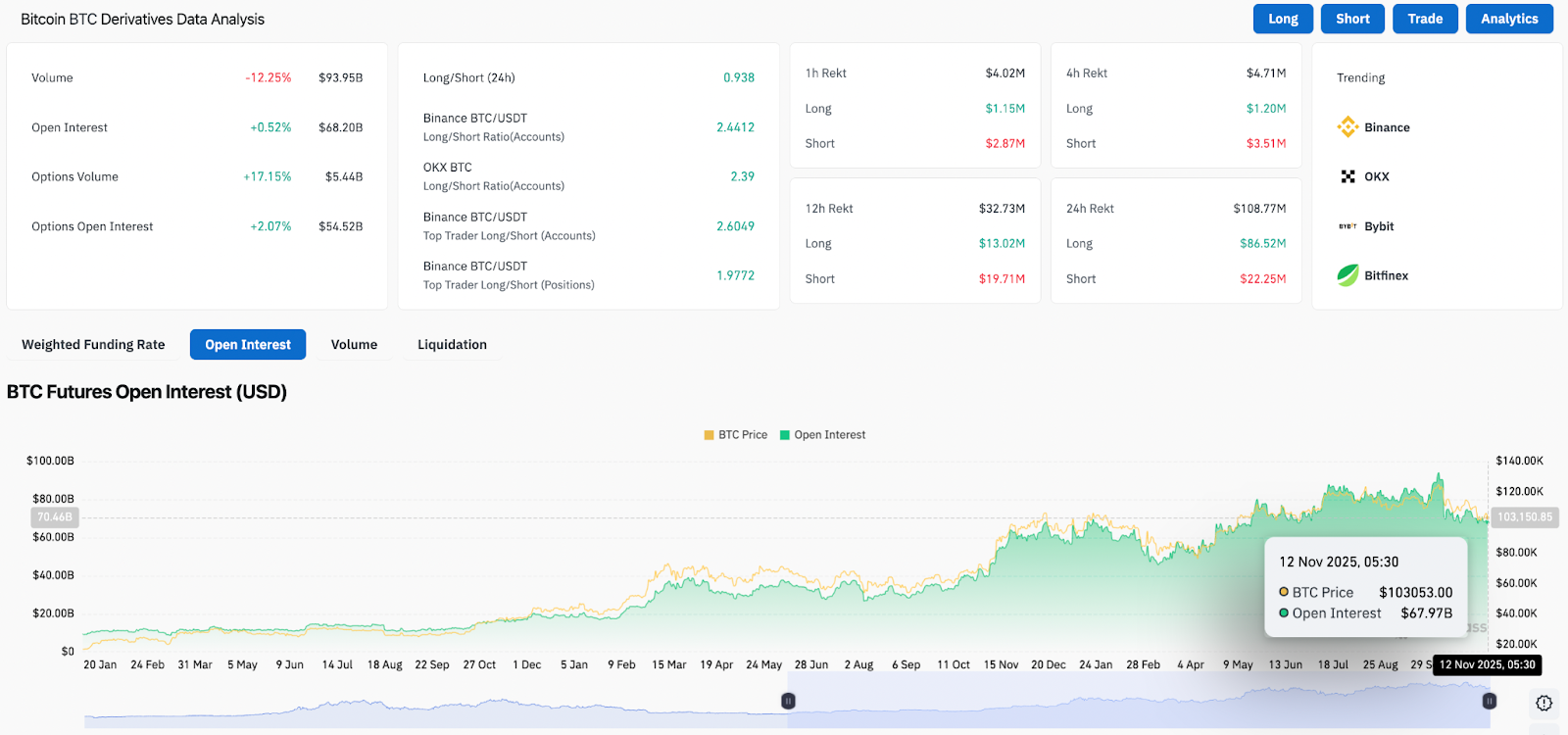

Open curiosity will increase as futures buying and selling quantity decreases

Derivatives knowledge highlights refined however significant adjustments in dealer conduct. Whole open curiosity elevated by 0.52% to $68.2 billion, whereas futures buying and selling quantity decreased by 12.25% to $93.95 billion.

This divergence means that new positions are being opened with low confidence, maybe representing a defensive hedge relatively than an outright lengthy.

The lengthy/brief ratio of main exchanges resembling Binance and OKX remains to be above 2.3, indicating a continued bullish bias. Nevertheless, with 24-hour liquidations exceeding $108 million, most of that are lengthy positions, leverage accumulation stays weak if the value falls under short-term help.

If this imbalance continues, a brand new wave of pressured liquidations might speed up the downward momentum in the direction of the subsequent seen demand zone.

Bitcoin faces EMA rejection and channel resistance

On the 4-hour chart, Bitcoin stays trapped in a transparent descending channel that has guided value actions since early October.

Costs are at present buying and selling within the $104,000 to $108,500 vary, slightly below the 20, 50, 100, and 200 EMA clusters.

Every current rally into this zone has confronted rejection, confirming it to be a robust ceiling that have to be cleared as a way to change the short-term construction.

Fibonacci retracement ranges help this view. Bitcoin’s rejection close to the 0.382 stage ($105,449) and repeated failures close to the 0.5 zone ($107,490) point out that sellers are precisely defending.

Rapid help lies at $102,924 (0.236 retracement), adopted by a psychological $100,000, however deeper demand might emerge close to the decrease finish of the descending channel at $98,850.

The RSI is within the impartial zone reflecting indecision, however momentum stays flat. This setup favors consolidation or retesting of decrease help ranges till a breakout happens above $107,500.

Macro pressures: limits on fee minimize differentials are pointing upwards

The Federal Reserve’s disagreement over December’s rate of interest minimize has created new uncertainty in threat markets.

Merchants now anticipate a 66.9% likelihood of a fee minimize on the December 9-10 assembly, decrease than earlier expectations that it was nearly sure, in accordance with the CME FedWatch instrument.

Optimism was additional tempered by Federal Reserve Chairman Jerome Powell’s current assertion that the speed minimize was “not a achieved deal.”

Analysts like Presto Analysis’s Min Jeong warning that even when a fee minimize is confirmed, a lot of the optimism “might already be priced in,” suggesting that short-term upside for Bitcoin is proscribed until liquidity circumstances enhance meaningfully.

outlook. Will Bitcoin go up?

Bitcoin stays at a crossroads.

- Bullish case: On the again of elevated quantity and improved spot flows, a definitive shut above $107,500 might set off a transfer in the direction of $110,000-$112,400, in keeping with the higher Fibonacci and channel resistance zone.

- Bearish case: Failure to carry between $102,900 and $104,000 might push the value in the direction of $98,800, the place the subsequent pocket of demand coincides with the channel’s decrease boundary.

Disclaimer: The knowledge contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any type. Coin Version is just not liable for any losses incurred on account of the usage of the content material, merchandise, or companies talked about. We encourage our readers to do their due diligence earlier than taking any motion associated to our firm.