- Lengthy-term Bitcoin holders have been promoting progressively, making a sluggish and managed decline slightly than a panic decline.

- Bitcoin has not too long ago underperformed gold and the S&P 500, irritating buyers who have been hoping for a seasonal rally.

- Regardless of the weak value motion, the decrease correlation with gold makes Bitcoin extra engaging for portfolio diversification.

As Bitcoin struggles to defend the essential $100,000 help degree, one query is dominating market evaluation. The query is, who’s promoting it?

Chris Kuiper, CFA and vp of analysis at Constancy Digital Belongings, says the reply is clearer than many assume, and the info helps it.

Kuiper defined that regardless of seen shopping for from ETFs, firms, and establishments, Bitcoin stays underneath persistent promoting strain. Specifically, the supply of this strain is Lengthy Time period Holders (LTH), a bunch generally referred to as probably the most affected person cohort out there.

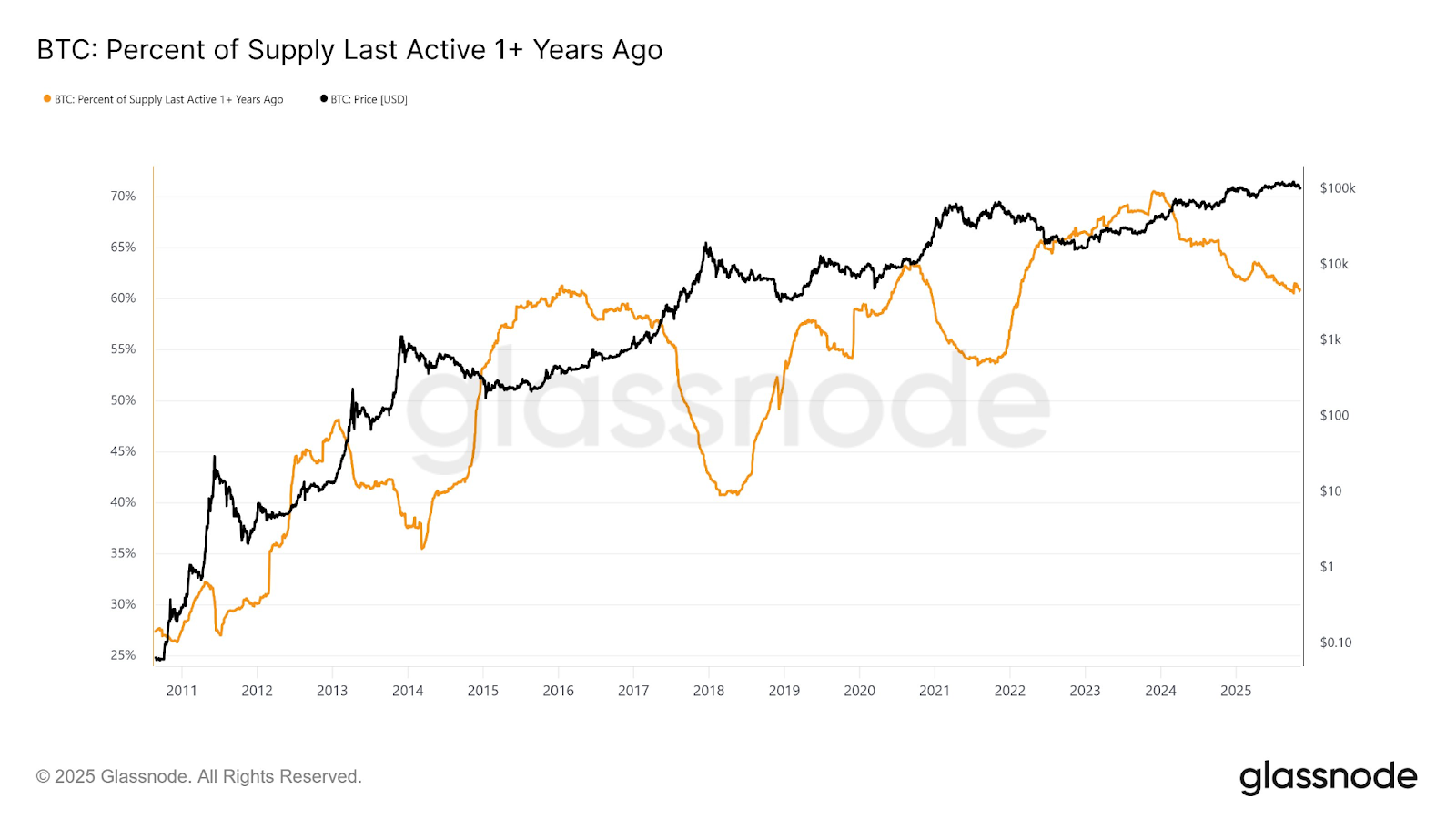

In keeping with Kuiper, probably the most apparent indicators is the share of Bitcoin that has remained inactive for a minimum of a yr. Traditionally, this indicator rises in bear markets when buyers endure losses, and falls sharply in bull markets when holders take earnings and these outdated cash find yourself shifting.

However this cycle is completely different.

Gradual and managed Bitcoin decline – no panic

Kuiper identified that the decline in inactive provide has been gradual and constant, slightly than the dramatic drop that occurred when Bitcoin hit all-time highs.

He described this as a “sluggish hemorrhage,” the place long-term holders proceed to scale back their positions because the market strikes sideways. That is in sharp distinction to previous cycles, the place profit-taking immediately surged through the euphoria.

Kuiper stated that from a psychological standpoint, buyers are merely drained. Bitcoin has underperformed gold and even the S&P 500 in latest months, disappointing many who have been hoping for sturdy seasonal features in October and November.

Because the yr attracts to an in depth, some long-term holders seem like locking in earnings for tax causes, portfolio changes, or just because the explosive rally they have been ready for hasn’t arrived.

Associated: Why are cryptocurrencies falling in the present day? $79 billion in LTH gross sales and $869 million in ETF outflows trigger $1 billion in liquidations

CryptoQuant confirms the development

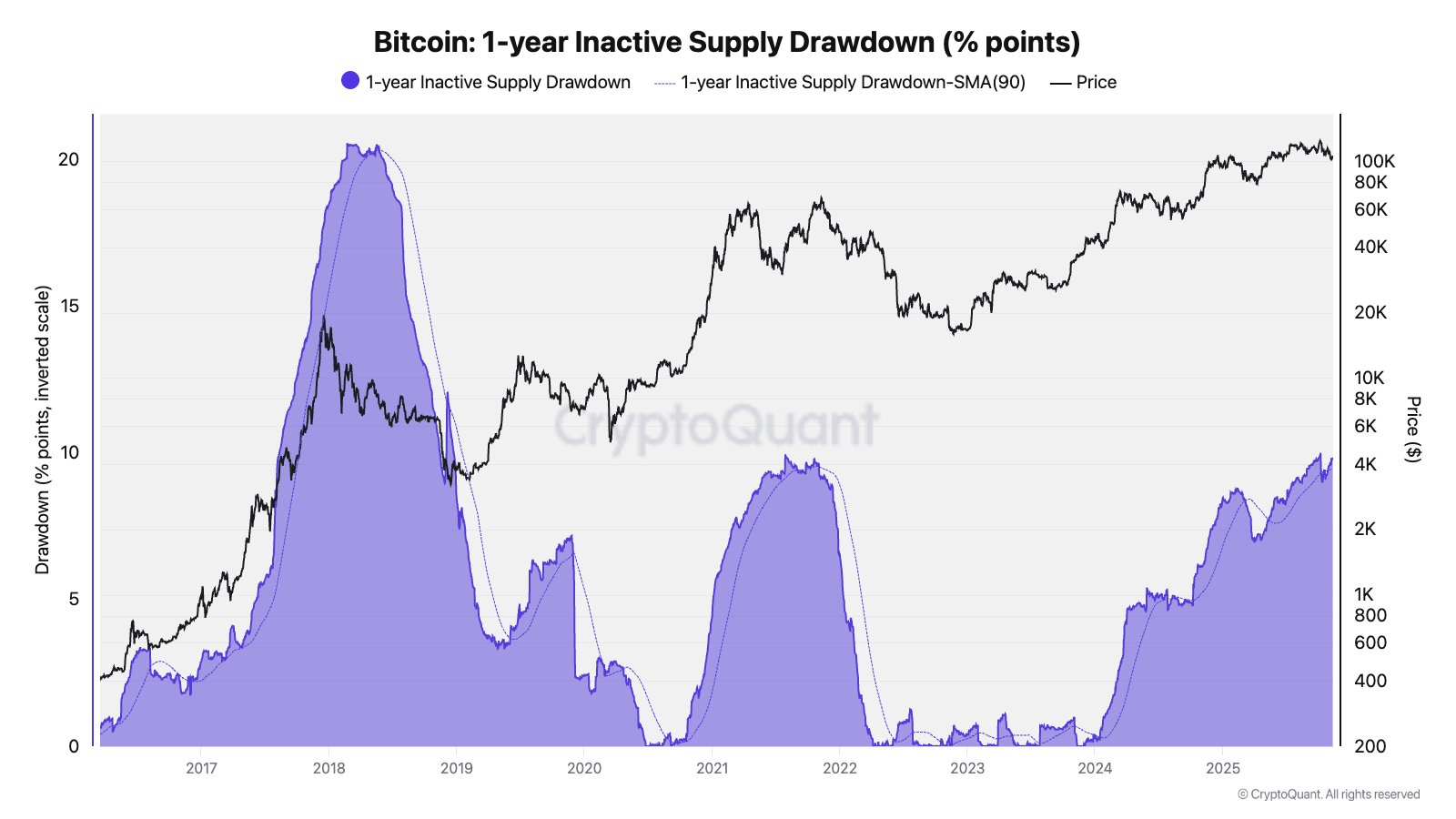

CryptoQuant analyst Julio Moreno expanded on Kuiper’s observations. By measuring the drawdown of inactive provide over a one-year interval, he confirmed that this cycle’s decline is definitely similar to earlier declines.

- 2017-2018: 20% level lower

- 2021: 10 proportion level decline

- 2024-2025: 10 proportion level decline

Moreno’s chart (with the size reversed) helps the concept that the present cycle is following a well-recognized sample, solely at a slower tempo and extra dispersed.

bitcoin vs gold

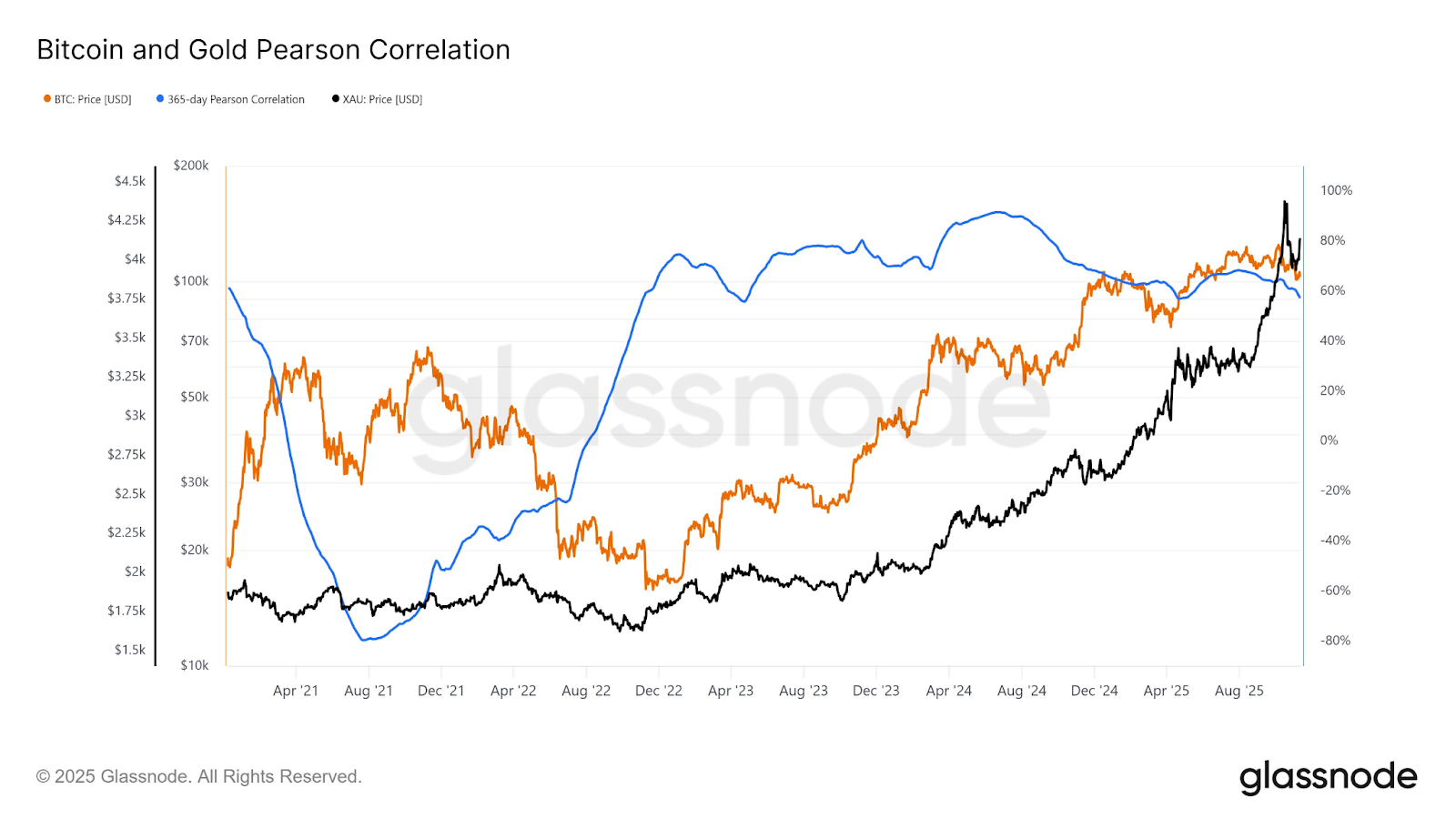

In a separate remark, Kuiper addressed the rising disappointment over Bitcoin’s latest poor efficiency in comparison with gold.

Nonetheless, he argued that there’s a silver lining in the truth that the correlation between Bitcoin and gold continues to say no. This can be precisely what institutional buyers are on the lookout for.

For an asset to enhance the risk-adjusted return of a portfolio, it should behave in a different way than what’s already in it. If Bitcoin merely moved with leverage like gold, monetary establishments would have little incentive to allocate it. They might doubtlessly recreate the publicity by taking leveraged positions elsewhere.

Basically, decrease correlation means Bitcoin can supply true diversification and enhance its long-term enchantment.

Associated: Gold breakout is a “harbinger” of DXY collapse and Bitcoin rise – Analyst

Nonetheless, the disconnect between Bitcoin’s sturdy fundamentals and lackluster value efficiency stays one of many defining options of this cycle.

Disclaimer: The knowledge contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any type. Coin Version just isn’t answerable for any losses incurred on account of using the content material, merchandise, or providers talked about. We encourage our readers to do their due diligence earlier than taking any motion associated to our firm.