- The Pi maintains essential Fibonacci ranges as the value coils inside a good consolidation vary.

- Future token unlocks will steadily increase provide, rising the danger of short-term volatility.

- App Studio upgrades enhance flexibility for builders and foster continued progress of the ecosystem.

The Pi community is making an attempt to stabilize after a robust rally firstly of the month, with value motion presently inside a slim vary that’s being carefully monitored by merchants. The asset has retreated from its current peak and is presently hovering across the mid-range round $0.227. Though the general market stays unsure, Pi continues to guard the essential Fibonacci degree from its earlier rally.

Value maintains essential Fibonacci vary

Pi trades between two distinct boundaries, making a tense consolidation construction. The assist at $0.216 coincides with the 0.618 Fibonacci degree, which stays the strongest ground. The client visited this zone a number of occasions and persistently protected it.

Nonetheless, the resistance degree at $0.237, which coincides with the 0.382 Fibonacci marker, limits any upward motion. Your complete chart displays the decline in volatility because the Bollinger Bands proceed to slim.

Moreover, the value has regained the 9-day EMA and Bollinger midband. This exhibits early power, however a breakout is but to be decided. A transfer above $0.237 might entice momentum in direction of the $0.26 space. The broader goal stays the $0.297 excessive that set the tone for the earlier bull market. Conversely, a lack of $0.216 might create strain in direction of $0.20.

Provide shapes short-term outlook

The community distribution cycle provides one other dimension to the evaluation. Greater than 5.03 billion Pi tokens stay locked, price roughly $1.14 billion.

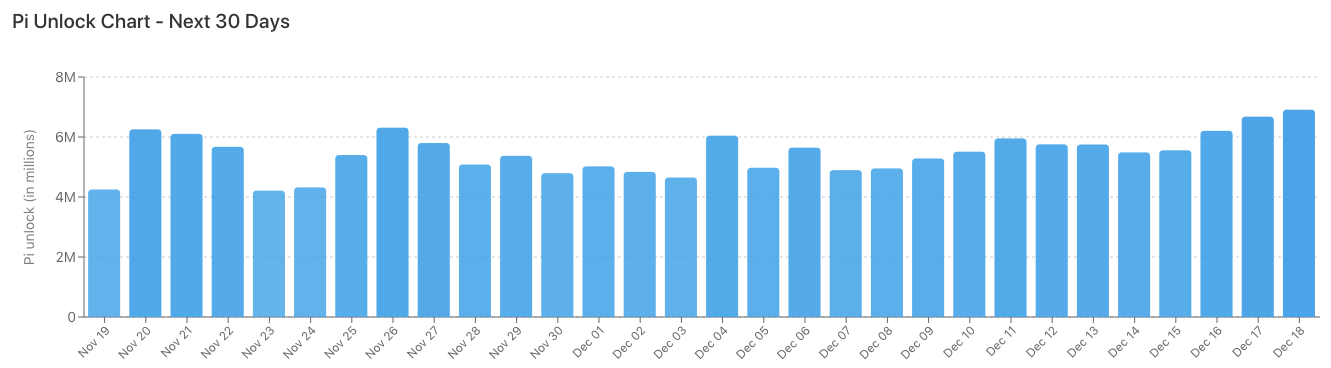

Moreover, the community expects roughly 163.65 million Pi to be unlocked over the subsequent 30 days. This represents roughly 3.25% of the locked provide. Each day unlocks common 5.45 million Pi, equal to roughly $1.24 million.

Consequently, the most important deliberate launch will probably be December 18th, with over 6.9 million Pis obtainable. These unlocking patterns form short-term sentiment, as increasing provide typically influences intraday volatility.

Help future improvement with App Studio upgrades

Pi Community additionally rolled out upgrades to Pi App Studio. The platform now permits authors to obtain present app code and add revised variations.

Due to this fact, authors have extra flexibility and builders can easily construct superior prototypes. The adjustments additionally embody improved challenge administration, new sorting instruments, and a broader app creation restrict of as much as 100 tasks.

Associated: Starknet Value Prediction: STRK Stays in Breakout Zone as Consumers React to $3M Spot Influx

Moreover, these updates strengthen the Pi ecosystem by facilitating quicker experimentation. The platform continues to pursue options that make improvement extra intuitive and has the potential to assist long-term implementation as your exercise grows.

Technical outlook for Pi (PI) value

The important thing ranges stay clear for the subsequent buying and selling section, with Pi sustaining a good consolidation zone.

Upside ranges are seen at $0.237, $0.266, and $0.297, posing a direct hurdle for any near-term breakout try. A transfer above these zones might lengthen in direction of the $0.26-$0.27 cluster the place the earlier rejection level stays lively.

Draw back ranges embody assist on the 0.618 Fibonacci zone at $0.216, adopted by $0.195 and a structural low at $0.167. The $0.237 space, which coincides with the primary main retracement barrier, serves because the higher restrict of resistance that Pi must reverse to determine medium-term bullish momentum.

The technical state of affairs means that Pi is compressed between the boundaries of $0.216 and $0.237, forming a contracting equilibrium. A decisive breakout above the higher band may cause elevated volatility, particularly if quantity strengthens. Conversely, a break beneath $0.216 dangers shifting management to the sellers and exposing deeper assist round $0.20 and $0.195.

Outlook: Will Pi rise?

The near-term course of the pie will depend upon whether or not consumers can defend $0.216, which has repeatedly served because the anchor for the present construction. Holding this ground will increase the probability of a retest of the $0.237-$0.266 cluster, permitting the breakout to regain bullish momentum and paving the way in which for a swing excessive at $0.297.

Nonetheless, dropping $0.216 might erode market confidence and expose Pi to a decrease retracement zone. For now, Pi stays in a pivotal zone the place compression, previous conduct, and upcoming unlock cycles all level to elevated volatility going ahead. The following leg will depend upon the circulate of convictions and whether or not a breach of both line is confirmed.

Associated: Web Laptop Value Prediction: ICP holds $5 assist as futures leverage soars

Disclaimer: The data contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any sort. Coin Version shouldn’t be accountable for any losses incurred on account of the usage of the content material, merchandise, or companies talked about. We encourage our readers to do their due diligence earlier than taking any motion associated to our firm.