- Cryptocurrency analysts have recognized a “sturdy bullish divergence” on XRP’s 3-day chart.

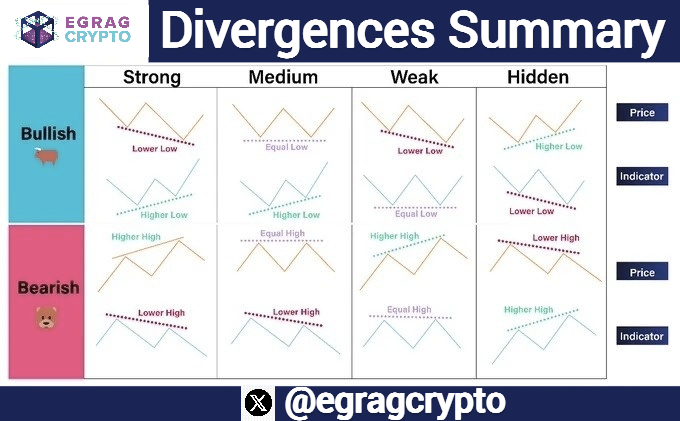

- The value is reducing decrease lows and the indicator is reducing greater lows, which is a typical reversal sign.

- XRP is buying and selling at $2.14, with quantity down 35%, suggesting vendor fatigue.

Egrag mentioned this divergence is likely one of the key alerts seen in XRP in current months, and comes because the asset exams key areas of assist. On the identical time, momentum indicators are reaching traditionally low values.

Associated: XRP Worth Ignores Franklin Templeton’s XRP ETF Debut, Drops Under Key Assist

Why the “3-day divergence” is an indication of an XRP bullish reversal

Inside this context, the present 3-Day setup locations XRP in a powerful bullish divergence zone, the place value information decrease lows whereas indicators kind greater lows. This habits is usually tracked for a potential upward reversal.

Further technical observations observe that XRP’s broader weekly construction continues to compress in the direction of its long-term assist band. Current weekly candlesticks are exhibiting a downtrend forming what analysts understand as a descending wedge. In line with the shared chart, this space is the decisive think about confirming the pattern.

Oversold Indicators: Stoch RSI and Final Oscillator

Nonetheless, the three upside reference zones labeled F, V, and G stay to be monitored as potential restoration ranges within the occasion of a confirmed pullback. These targets are in step with the historic loss and truthful worth hole left by greater timeframe candlesticks.

Associated:

Disclaimer: The data contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any variety. Coin Version isn’t accountable for any losses incurred because of the usage of the content material, merchandise, or providers talked about. We encourage our readers to do their due diligence earlier than taking any motion associated to our firm.