- XRP weak spot continues because it trades close to decrease help and struggles to reclaim key resistance ranges.

- Leverage has cooled sharply, however total dealer curiosity stays above the place it was initially of the 12 months.

- The brand new Bitwise XRP ETF may change sentiment if liquidity strengthens throughout market stabilization.

XRP stays beneath sustained downward stress, despite the fact that market curiosity stays robust and new institutional merchandise are starting to emerge. The token has been buying and selling close to the decrease finish of its current vary, with merchants monitoring a number of technical zones for indicators of stabilization.

Technical construction exhibits persistent weaknesses

XRP continues to fall on the 4-hour chart. Worth stays under the short-term EMA and the mid-Bollinger Bands. This construction helps sustainable gross sales energy.

Latest makes an attempt to regain the $2.20 space have failed, indicating weak purchaser confidence. The 0.382 Fibonacci stage at $2.16 stays the primary main resistance. Moreover, XRP has struggled to recuperate this space a number of occasions.

Present help is $2.05 to $2.06. Dropping this zone exposes the 0.236 Fibonacci stage at $1.94. The world under that at $1.58 represents the right retracement space.

Upside resistance lies at $2.34 and $2.52. These ranges kind a heavier provide zone that suppresses a few of the rise. A breakout of this space may ship the worth in direction of the $2.70 space. Nevertheless, development stress will stay in place until value returns strongly to $2.16.

Leverage and liquidity tendencies carry combined alerts

Open curiosity rose late within the first quarter and into the second quarter as merchants constructed giant leveraged positions. The index peaked at over $8 billion throughout the mass rally, marking intense hypothesis.

Associated: Hyperliquid Worth Prediction: Symmetrical Triangle Squeeze Causes Breakout as Flows Stabilize

Nevertheless, it has now cooled down to almost $3.79 billion. This decline signifies that the place will decline as the worth returns to the $2.10 space. Regardless of the backlash, engagement stays above ranges initially of the 12 months. Due to this fact, merchants might re-enter if XRP holds main help.

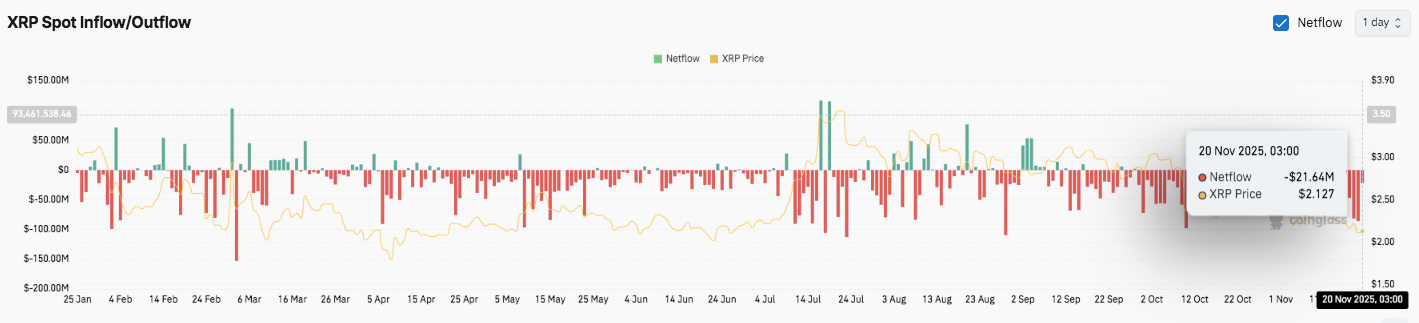

Spot flows present constant runoff all year long. Some classes have distributed greater than $100 million. Moreover, on November twentieth, it recorded one other $21.64 million exit as the worth hovered round $2.12. These flows emphasize defensive sentiment and cautious positioning.

New ETF presents a recent story

Bitwise has confirmed the launch of its Spot XRP ETF on the New York Inventory Trade. The fund has a 0.34% price, however the first month is free for the primary $500 million in property.

Moreover, this launch provides a brand new institutional gateway for XRP publicity. This improvement may influence sentiment as soon as liquidity improves and market situations stabilize.

Technical outlook for XRP value

As XRP enters its subsequent buying and selling section, key ranges stay well-defined. The upside ranges are $2.16, $2.34, and $2.52, which signify fast hurdles that the bulls have to recuperate to vary short-term momentum. A clear breakout of $2.52 may prolong the upside in direction of $2.70 and $2.77, the place the upper timeframe resistance coincides with the 0.786 Fibonacci zone.

Draw back ranges embody $2.05, which acts as trendline help on the decrease timeframe. A break under this space exposes the following structural stage at $1.94. If promoting stress intensifies, the chart has room to maneuver deeper in direction of $1.58, which represents an ideal retracement of the earlier impulse.

Technical photos present that XRP is compressing under the 0.382 Fibonacci stage, forming a tightening construction that always precedes a robust enlargement. A decisive restoration at $2.16 would sign a return to momentum, however failure to clear it’s going to depart the development weak.

Will XRP regain momentum?

XRP’s near-term path will rely upon whether or not patrons defend the $2.05 help lengthy sufficient to retest the $2.34-$2.52 resistance cluster. Compression, decreased leverage, and sustained outflows point out a decline in confidence, however historic tendencies present that volatility typically rises when costs take a look at key Fibonacci bases.

If inflows strengthen and the worth sustains above $2.05, XRP may rebound in direction of $2.34 and acquire momentum in direction of $2.52 and $2.70. Nevertheless, failure to defend the present help dangers re-opening the trail to $1.94, with additional declines doubtless under that stage.

Associated: Zcash Worth Prediction: ZEC maintains bullish bias whereas Cypherpunk boosts holdings

For now, XRP is buying and selling in a pivotal zone. Future classes are more likely to rely upon liquidity flows, construction affirmation, and market response across the $2.16 restoration stage, which would be the figuring out issue for the following huge transfer.

Disclaimer: The knowledge contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any sort. Coin Version shouldn’t be chargeable for any losses incurred on account of the usage of the content material, merchandise, or providers talked about. We encourage our readers to do their due diligence earlier than taking any motion associated to our firm.