- Ethereum is buying and selling close to $2,991, falling additional beneath the lengthy downtrend line as sellers defend any makes an attempt to maneuver increased.

- ETF outflows jumped to $37.4 million, with spot outflows inflicting one other $35.38 million to go away the change, whereas BlackRock alone reduce $24.6 million.

- The bearish momentum stays robust, with ETH caught beneath all main EMAs and liquidated derivatives knowledge, indicating continued strain.

Ethereum value is buying and selling round $2,991 at present, additional beneath the lengthy downtrend line that has dominated all beneficial properties since early October. The transfer provides sellers extra management as ETF outflows speed up and spot flows stay unfavourable throughout main exchanges.

The newest ETF knowledge reveals one other intense withdrawal cycle. In keeping with Ted Pillows, the Ethereum ETF recorded $37.4 million in outflows yesterday. BlackRock alone had gross sales of $24.6 million, making it one of many largest single-manager gross sales in November.

A number of issuers have been reducing allocations for greater than two weeks. The full flows for November 18th and nineteenth present an extended purple stripe, reflecting sustained threat discount by monetary establishments relatively than rotation.

Spot flows stay unfavourable as $35 million leaves the change

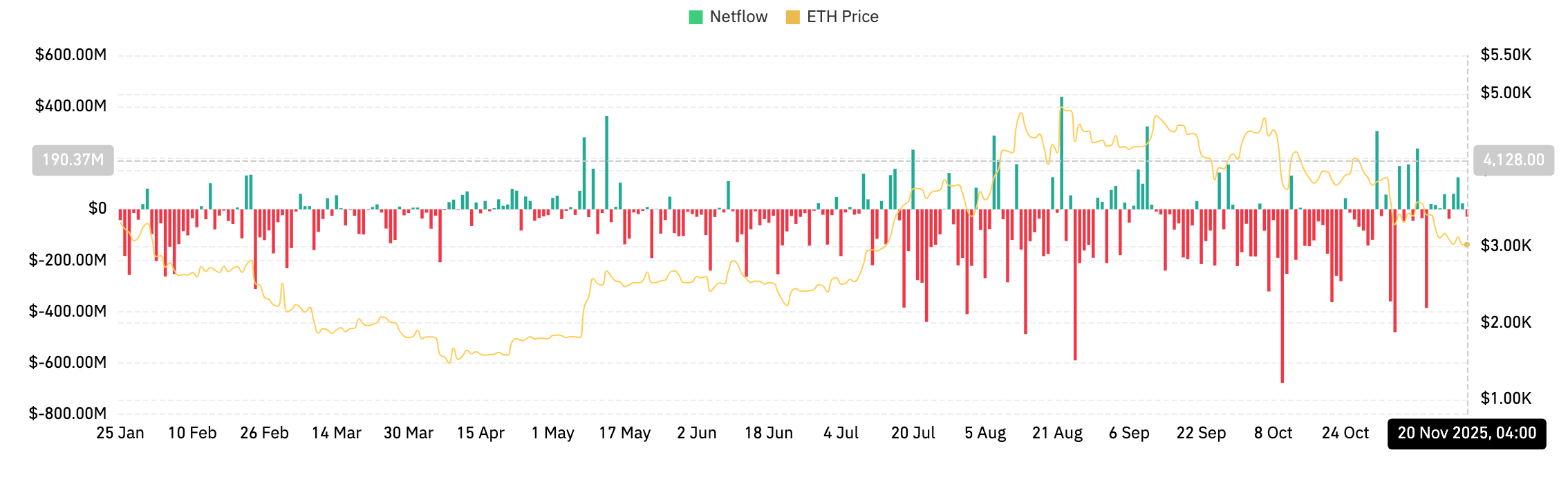

Coinglass knowledge helps the strain. Ethereum recorded internet spot outflows of $35.38 million on November twentieth. This continues the persistent purple bar sample that started in late September.

Associated: XRP Worth Prediction: XRP weakens as outflows improve, OI declines greater than ETFs per bit

The distribution is broad, with repeated unfavourable days throughout Binance, Coinbase, and Bitfinex. Sellers are constantly sending ETH again to exchanges, decreasing the prospect of a spontaneous reversal inside the present downtrend.

Open curiosity contracts put strain on derivatives markets

Ethereum derivatives knowledge reveals leveraged merchants have gotten extra cautious. Futures open curiosity decreased by 2.52% to $37.54 billion. This decline signifies that merchants are closing positions relatively than growing threat as value exams key helps.

Regardless of the contraction in OI, whole derivatives buying and selling quantity elevated by 21.64% to $111.23 billion, suggesting lively repositioning throughout volatility. Choices quantity surged 30.72%, exhibiting that merchants are actively hedging.

Lengthy and brief ratios stay lopsided. Binance reveals a robust lengthy bias, with a long-to-short ratio of two.57 for accounts and three.47 for high merchants. The same sample will be seen in OKX. With a lot leverage constructed up on the lengthy aspect, draw back breaks are typically stronger as liquidation cascades improve promoting strain.

Liquidation knowledge helps this. Prior to now 24 hours, the market noticed $195.7 million in liquidations, of which $174.56 million got here from lengthy positions. This imbalance signifies that consumers are leaning closely in the direction of the pattern line with out defensive positioning.

Momentum stays bearish with pattern line break

The day by day chart reveals that ETH is buying and selling properly beneath the downtrend line connecting the October and November swing highs. All makes an attempt to get it again have failed, together with the newest retest round $3,250 the place the worth was rejected cleanly.

Associated: Hyperliquid Worth Prediction: Symmetrical Triangle Squeeze Causes Breakout as Flows Stabilize

The 20-day EMA is $3,332, the 50-day EMA is $3,654, and the 100-day EMA is $3,753. All three are trending down and stacking above their present costs. This alignment displays a transparent bearish construction the place the rally instantly faces overhead strain.

Parabolic SAR stays above value, confirming that pattern momentum continues to favor sellers. The latest rejection close to the trendline coincided with SAR reversing to the draw back.

The main assist lies between $2,950 and $3,000, which is the horizontal zone highlighted by the shaded space on the chart. This space was held throughout two flushes earlier this month. If we escape of this, the following demand block will emerge round $2,780, adopted by a deeper summer time vary round $2,550 to $2,600.

outlook. Will Ethereum go up?

The following transfer will rely on whether or not consumers can defend the $2,950 to $3,000 zone. Though flows, derivatives positioning, and EMA construction stay bearish, ETH holds a major historic assist shelf.

- Bullish case: A restoration will solely start if Ethereum regains $3,332 and confidently breaks out of the downtrend line. A detailed above $3,654 would affirm momentum and pave the best way for $3,900.

- Bearish case: A day by day shut beneath $2,950 signifies a breakdown, exposing the following liquidity zone at $2,780 after which $2,600.

Associated: Zcash Worth Prediction: ZEC maintains bullish bias whereas Cypherpunk boosts holdings

Disclaimer: The knowledge contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any form. Coin Version shouldn’t be accountable for any losses incurred on account of using the content material, merchandise, or companies talked about. We encourage our readers to do their due diligence earlier than taking any motion associated to our firm.