Hedera value is buying and selling round $0.148 at the moment after rebounding sharply from the $0.125 demand zone. Whereas the restoration has elevated near-term momentum, the general construction stays bearish as HBAR stays under the important thing downtrend line that has capped the rally since September.

Resurgent bounce faces strong trendline wall

HBAR’s 20-day EMA close to $0.155 is the primary degree of block progress. Every time the worth approaches this line, the worth continues to fall, indicating that short-term management has not modified. The 50-day and 100-day EMAs are reinforcing tops close to $0.174 and $0.189, in step with the broader downtrend. HBAR has not recovered a single main EMA this cycle and the chart continues to make new highs.

The supertrend stays crimson, confirming that the development on the upper time-frame has not modified. Even with the pullback from $0.125, the candlesticks point out compression under the trendline reasonably than energy passing via it. All rallies since September have stalled at this similar confluence level, and this transfer is indicative of an identical dynamic.

A decisive break above $0.155 is required for the trendline to weaken. With out that, HBAR stays weak to a decline to $0.140 and presumably an additional take a look at of the $0.125 demand zone.

Construct a basis under a weak chart with ETF purchases

A key growth this week was the resurgence in inflows from institutional traders. Canary Capital’s HBR Hedera ETF has elevated its holdings once more as of November 23, in accordance with knowledge from FinancialPress. The ETF presently holds 421,473,721 HBAR, price roughly $54.86 million, representing roughly 0.84% of its complete provide.

The regular improve in ETF holdings demonstrates long-term confidence in Hedera’s position in enterprise and controlled digital infrastructure. Accumulations of this magnitude throughout downtrends are uncommon and help the macro backdrop.

Three consecutive inflows will take a look at the vendor’s benefit

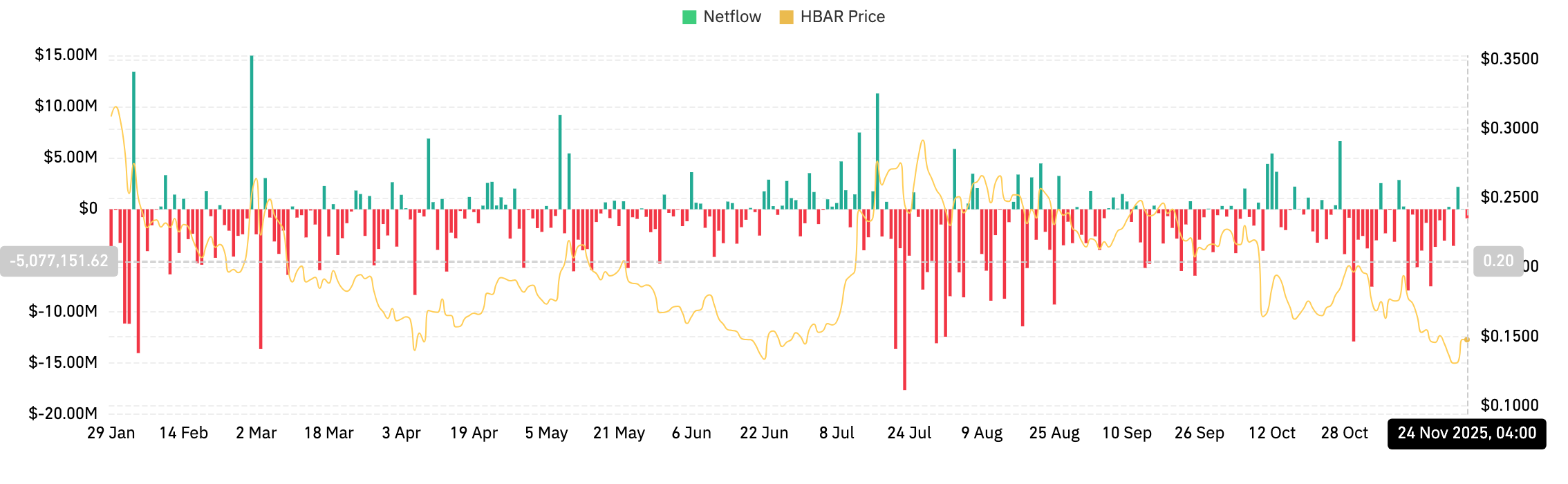

HBAR spot stream was meaningfully enhanced over the previous three classes. Coinglass knowledge confirms a transparent continuation of steady inflows, together with the latest influx of $71,000 on November twenty fourth. That is the primary sustained inexperienced streak in a number of weeks and is in sharp distinction to the heavy distribution that dominated a lot of the quarter.

This modification signifies that sellers not have full management over liquidity. The constant inflows point out that capital is returning to belongings after the November selloff, decreasing draw back stress and serving to to stabilize the restoration from the $0.125 zone.

Brief-term momentum is strong, however resistance stays sturdy

The two-hour chart exhibits a transparent restoration from the $0.125 zone the place the Bollinger Bands widened and created a volatility squeeze breakout to the upside. This rally pushed HBAR in direction of the higher band round $0.156, however the transfer is beginning to subside.

The RSI is hovering round 66 after reaching overbought circumstances early within the session. This degree signifies early fatigue, and the worth is presently consolidating round $0.149 as intraday merchants e book earnings.

Though short-term construction is bettering, the restoration will happen inside a broader downtrend. Intraday momentum requires sustained energy above $0.156 to forestall additional rollover into the $0.140 midband.

Will Hedera rise?

HBAR’s subsequent transfer will rely upon whether or not patrons are in a position to get away of the downtrend line and reclaim the EMA cluster.

- Bullish case: An in depth above $0.155 confirms energy and paves the best way for the 50-day EMA close to $0.174. If the worth breaks above $0.174, the momentum will reverse and the worth will goal $0.189, the place the 100-day EMA exists.

- Bearish case: Failure on the trendline will ship HBAR again in direction of $0.140. A break under $0.128 will reveal the $0.110 liquidity zone and resume the broader downtrend.

The construction will solely enhance if HBAR regains the trendline and 20-day EMA with acceptable quantity. Staying under $0.155 maintains bias protection heading into December.

Disclaimer: The knowledge contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any variety. Coin Version will not be accountable for any losses incurred on account of using the content material, merchandise, or companies talked about. We encourage our readers to do their due diligence earlier than taking any motion associated to our firm.