abstract

The asset is hovering round 1.39 USDT, clearly beneath the important thing each day transferring common. Predominant bearish pattern In a better time-frame. Momentum on the each day chart is weak, the RSI is oversold, and the MACD has a destructive backdrop, indicating that sellers are nonetheless in management. Nonetheless, volatility as measured by ATR stays average, suggesting a managed promote fairly than a chaotic promote. On the similar time, the hourly and 15-minute charts look extra balanced, suggesting a short-term rally fairly than one other fast collapse. Throughout the market, the risk-off conduct weighing on altcoins is clear, with Bitcoin’s dominance reaching almost 57% and the Concern and Greed Index in excessive concern. Total, this market is extra about endurance and selective entry than chasing fast good points.

SUI Crypto Information: Market Background and Path

The worldwide cryptocurrency market capitalization is roughly $3.4 trillion, up roughly 0.6% up to now 24 hours. Regardless of this sluggish progress, Bitcoin nonetheless holds roughly 56.9% market energy, which is Threat-averse market system Right here capital prefers the relative security of the benchmark over smaller tokens. Moreover, the Concern & Greed Index is at 19, utterly within the class of maximum concern, displaying how reluctant merchants nonetheless are so as to add publicity general.

In such a scenario, it isn’t shocking that belongings weaken in comparison with historic ranges. Whereas the broader market capitalization has been progressively rising, the token has fallen into bearish settings every day, indicating underperformance in comparison with the broader market. That mentioned, decentralized exchanges within the Sui ecosystem similar to Cetus CLMM and Bluefin Spot proceed to generate important cumulative charges, indicating that the underlying community exercise has not disappeared regardless of value struggles. Because of this, primary utilization context might assist restrict structural harm if sentiment finally normalizes.

Technical Perspective: Learn the general setup

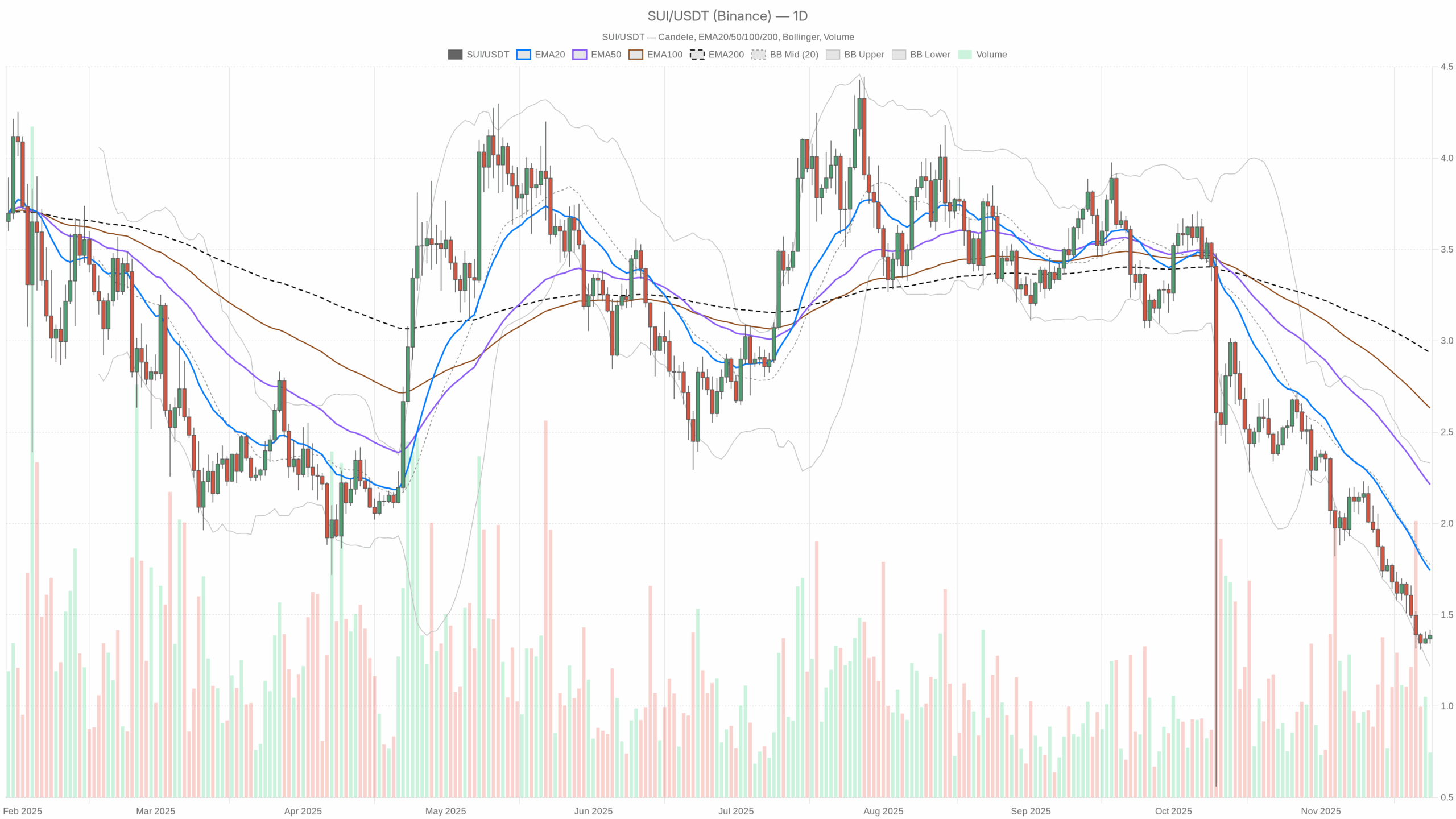

On the each day time-frame, the value is 1.39, nicely beneath the 20-day exponential transferring common of 1.74, the 50-day exponential transferring common of two.21, and the 200-day exponential transferring common of round 2.94. This huge hole between the spot EMA and the primary EMA is Sustained downward strain And it is not a shallow decline, however a mature downtrend. Every of those transferring averages probably acts as dynamic overhead resistance, suggesting {that a} pullback will reply to produce alongside the best way.

The each day RSI is round 25.2, which places the token firmly in oversold territory. Traditionally, this low typically precedes a minimum of a correctional pullback as aggressive sellers start to expire of gasoline. Nonetheless, the RSI can turn out to be oversold in sturdy bearish conditions, so this setup signifies that: Threat of exhaustion in a downtrend Nonetheless, no reversal has been confirmed but. Merchants typically search for bullish divergences or recoveries above the 30-35 zone to strengthen the rationale for the underside.

The each day MACD can also be negatively sloping, with a line round -0.27 and a sign of -0.26, however the histogram is barely barely beneath zero. This configuration means that draw back momentum could also be beginning to degree out, despite the fact that it’s already sturdy. Histogram discount is mirrored weakening of bearish momentumsuggesting that the tempo of decline is slowing, though the course has not modified but.

On the each day chart, Bollinger Bands place the center band at 1.77, the higher band at 2.33, and the decrease band at 1.22. The worth is presently hovering simply above the decrease band, indicating that current candlesticks have pushed into statistically prolonged territory. Such positioning typically precedes both a sideways consolidation or a volatility snapback. Potential improve in volatility It might emerge if costs begin to imply revert in direction of the intermediate band.

The 14-day ATR is round 0.15, which is comparatively modest contemplating absolutely the value degree. This exhibits that regardless of the downward pattern, the each day fluctuations the market is experiencing should not excessive. managed volatility Not a panicked give up. For place merchants, this surroundings favors scaled entries and exits fairly than all-or-nothing bets.

Intraday outlook and SUIUSDT token momentum

However, the intraday construction paints a extra impartial image. On the hourly chart, the value close to 1.39 is nearly precisely in keeping with the 20-period and 50-period EMAs round 1.38, however above the 200-period EMA at about 1.53. This configuration signifies that the short-term value pattern has shifted to the next scenario: Consolidation after a downtrendbulls and bears are nonetheless briefly balanced beneath the prevailing long-term resistance line.

The hourly RSI close to 53 signifies a impartial momentum regime, neither overbought nor oversold, in line with the market taking a breather. The hourly MACD line and sign are almost flat close to zero, supporting the concept that confidence within the fast course is restricted. On the 15-minute chart, the EMA is clustered round 1.38-1.39 and the RSI is situated round 49, once more highlighting short-term equilibrium. Because of this, scalpers might discover vary buying and selling setups extra engaging than trend-following methods till a clearer breakout develops.

Key ranges and market reactions

Each day pivot ranges add helpful context. The important thing pivot level is close to 1.38, which is successfully the place the value is presently gravitating. Holding this space above will go away the door open to a technical bounce, whereas a definitive shut beneath will verify continued weak spot. Just under is the primary assist zone round 1.35, the place patrons might attempt to shield in opposition to additional declines. A agency response there will probably be supported. Brief-term trial.

On the upside, the closest resistance band seems round 1.42, the primary each day pivot resistance. A transfer by means of that space with growing quantity may very well be step one in a broader correction in direction of the 20-day EMA of 1.74. Nonetheless, a cluster of upper EMAs as much as the 200-day line round 2.94 signifies that a medium-term restoration will face difficulties. Layered resistance overheadand a fast V-shaped reversal is statistically unlikely.

Future eventualities and funding outlook

Total, the dominant situation stays bearish on the each day chart, with the asset entrenched beneath all main EMAs and sentiment weighed down by excessive concern and excessive Bitcoin dominance. Nonetheless, a number of alerts, from an oversold each day RSI to flattening MACD and impartial intraday momentum, level to the following part. Downward momentum might weaken. This mix typically results in an preliminary sideways consolidation, adopted by a corrective rebound if macro situations cooperate.

Subsequently, traders and merchants might think about a two-step method. Brief-term individuals will give attention to the intraday vary across the 1.35-1.42 hall, whereas long-term individuals will await stronger affirmation, such because the RSI retaking the 30-40 zone or value retaking the 20-day EMA. On this fragile context, strict danger administration, staggered orders, and practical expectations concerning the velocity of restoration are crucial whereas the market weathers the present extremes.

This evaluation is for informational functions solely and doesn’t represent monetary recommendation.

Readers ought to conduct their very own analysis earlier than making any funding choices.