Within the newest Solana cryptocurrency information state of affairs, the SOL and USDT mixture is at a susceptible level the place sentiment, liquidity, and pattern construction are clearly below stress. However the identical stress holding costs down may be setting the stage for the subsequent decisive transfer as merchants reassess dangers in opposition to a difficult macro and on-chain backdrop.

abstract

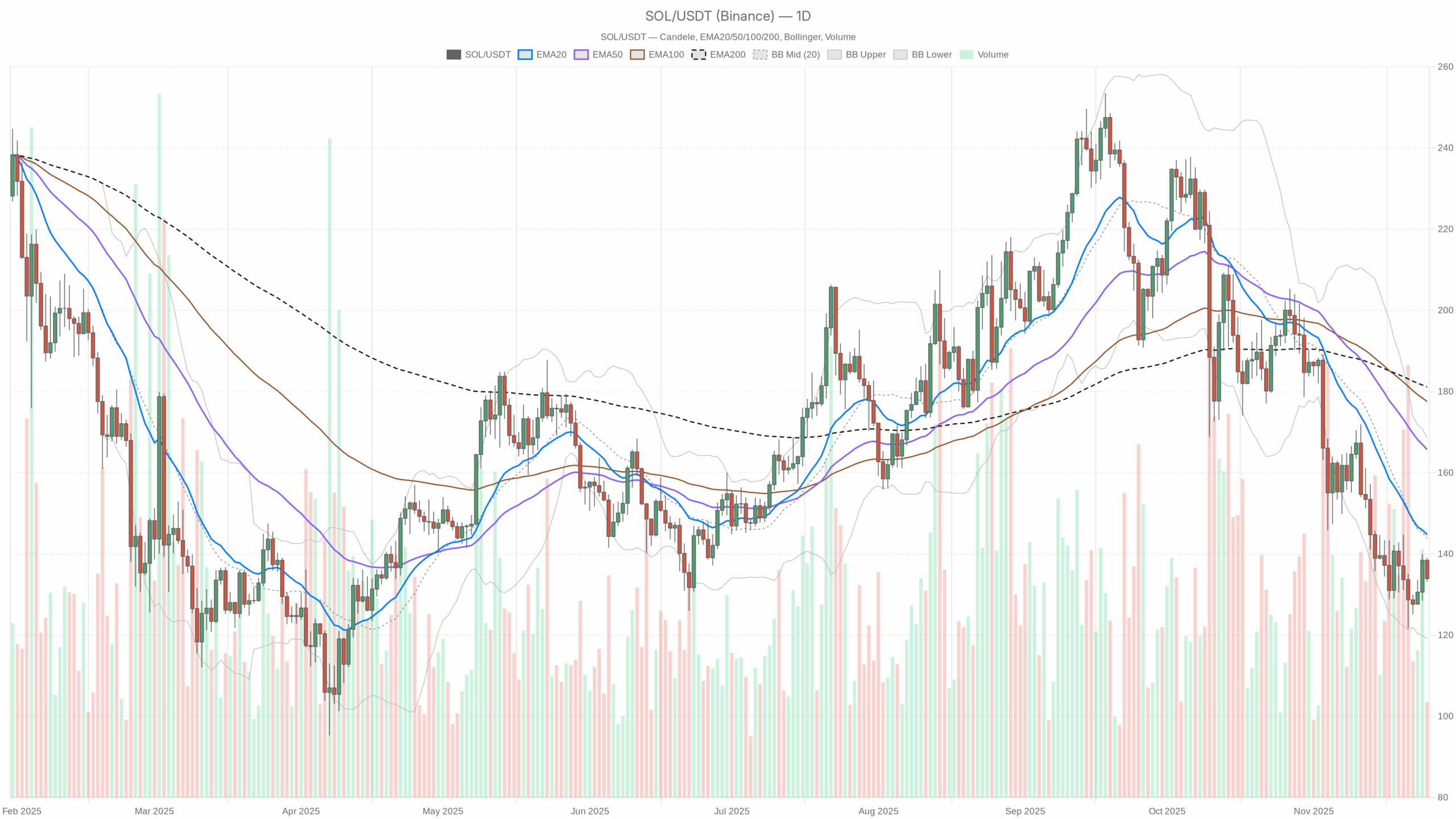

On the day by day chart, SOL is buying and selling round 133.9 USDT, nicely under the medium- to long-term transferring common. In depth bear market regime. Momentum indicators are trending unfavourable, however not capitulating, indicating extra of a pointy decline and consolidation than an entire flush. Furthermore, the volatility on the day by day timeframe is reasonable and the common true vary is shut. 10.44 USDTleaving room for vital fluctuations across the present worth. Intraday circumstances are moderately gentle, with the hourly and 15-minute timeframes being categorized as impartial moderately than outright bearish. Nonetheless, the benefits of Bitcoin talked about above 56% And the acute worry within the Crypto Concern and Greed Index means that capital is cautious and favors majors over high-beta tokens. Total, short-term merchants are on the lookout for a tactical pullback, whereas long-term members nonetheless face a broken however doubtlessly stabilizing pattern.

Solana Cryptocurrency Information: Market Background and Route

The broader market context stays comparatively constructive total, with complete crypto property remaining at round $3.5 trillion and a gradual improve over 24 hours. However that optimistic floor hides a eager desire for security. Bitcoin has over 56% market share, and traditionally there’s much less room for lively rotation of altcoins. In distinction, SOL represents solely a small piece of the worldwide pie, highlighting the present hierarchical construction the place liquidity favors the most important corporations.

The emotional facet of the equation is much more eloquent. The Concern & Greed Index is at 20, firmly in excessive worry territory, confirming that buyers stay very defensive. This background tends to suppress Energy of uptrend It additionally will increase the chance of a pointy however short-lived bailout rebound for altcoins. Moreover, DeFi exercise in Solana’s ecosystem is exhibiting blended indicators, as seen from Raydium, Orca, and different DEX charges. Though long-term price accumulation stays giant, the latest decline within the month-to-month common price signifies a cooling within the hypothesis cycle. That stated, the continuing acquisition saga surrounding Solana infrastructure, resembling Coinbase’s transfer in direction of a local buying and selling platform, reminds the market that structural curiosity within the ecosystem persists past day-to-day worth noise.

Technical Perspective: Learn the general setup

On the day by day chart, SOL is buying and selling at 133.9 USDT, clearly under the 20-day exponential transferring common of 144.74, 50-day index of 165.68, and 200-day index of 181.13. This stacked configuration of EMAs are all nicely above spot; A mature downtrend that doesn’t reverse shortly.. Every of those transferring averages acts as a dynamic overhead stress, suggesting {that a} pullback towards them might meet promoting curiosity from trapped longs or systematic methods.

The relative energy index of 37.72 confirms that state of affairs. Though under the impartial 50 mark, it’s nonetheless above basic oversold territory, suggesting this. Bearish momentum that’s not utterly exhausted. In follow, because of this sellers are in management, however there’s nonetheless room for additional declines earlier than a statistically sturdy imply reversion turns into extra possible.

The day by day body MACD tells a barely extra nuanced story. The -12.31 line remains to be under zero, confirming unfavourable momentum, however barely above the -13.25 sign, and the histogram is reasonably optimistic at 0.95. This delicate crossover suggests potential Momentum deceleration inside a broader downtrendusually portends a sideways consolidation or countertrend upswing moderately than a right away and sustained reversal.

Bollinger bands add additional context. The midline is at 143.85, the higher band is at 168.55, and the decrease band is at 119.15. Costs round 133.9 stay within the decrease half of this volatility envelope, which implies There’s a downward bias, however it’s not an excessive improve in volatility.. The asset just isn’t trying on the decrease bands positively, suggesting that stress is current however not but at panic stage.

Lastly, the common true vary is 10.44 factors, moderating the day by day volatility. For merchants, because of this a number of greenback strikes through the day are fully potential, however it’s not a state of affairs the place the market goes to blow out or capitulate. In consequence, threat administration should nonetheless respect potential. A pointy response to the final pattern.

Intraday outlook and SOLUSDT token momentum

In the meantime, the intraday construction is softer than the day by day downtrend would counsel. On the hourly chart, SOL is buying and selling round 133.97 USDT, very near the pivot at 134.08, a regime labeled as Impartial. The 20 interval EMA is presently barely above the worth at 135.92, whereas the 50 EMA and 200 EMA converge between 134.44 and 135.03, forming a slim vary. This clustering is Ongoing integration sectionright here neither the bulls nor the bears have definitive management through the day.

The hourly RSI round 40.68 is subdued however not excessive, suggesting delicate draw back stress. Nonetheless, the 0.23 MACD line is under the 0.84 sign and the unfavourable histogram is at -0.61, suggesting that the latest try at a rebound is fading. In consequence, intraday merchants might even see risky actions with a slight bearish tilt, particularly if costs fluctuate across the hourly pivot.

On the 15-minute chart, the state of affairs turns into extra tactical. The worth of 133.97 is under the 20 and 50 interval EMAs (135.62 and 136.25) however near the 200 EMA of 134.21. The short-term RSI stands at 30.9, indicating close to oversold standing. Distortion of momentum over very quick horizons. The MACD line at -0.61 stays under the -0.4 sign with a unfavourable histogram, confirming that the microstructure nonetheless favors sellers, however being near oversold territory will increase the chance of a fast technical rebound.

Key ranges and market reactions

For the day by day pivot evaluation, the central reference level is positioned simply above the spot, round 135.34 USDT. Staying under this space will hold the short-term bias unfavourable. Quick resistance seems within the zone round 137.5 USDT, which coincides with the primary pivot resistance on each the day by day and day by day timeframes. If the push to that band is denied, it’ll most likely be confirmed Steady distribution at conferences And that might push the worth again in direction of Bollinger’s sub-region.

On the draw back, assist first seems within the 131.7 USDT space in keeping with the primary day by day assist degree after which close to the decrease certain of the day by day Bollinger Band round 119.1. A full break under 131.7 and subsequent acceptance in direction of 120 would strengthen the present state of affairs. bearish continuation setup. Conversely, a rally between 137 and 145 could be an early sign that sellers are dropping management, particularly if the day by day shut begins to maneuver above the 20-day EMA of 144.74.

Future eventualities and funding outlook

Total, the chart represents a market the place the dominant pattern remains to be pointing down, however there are early indicators of momentum stabilizing. Swing merchants might favor to attend for affirmation by way of a decisive breakdown under a serious assist for one more bar draw back, or by way of a sequence of lows supported by a restoration above RSI 50. Alternatively, intraday members can make the most of motion throughout the present vary, however provided that they use tight threat parameters in opposition to a backdrop of maximum worry.

Lengthy-term buyers might view the present construction as a creating base moderately than a confirmed backside, because the EMA stays bearishly stacked and volatility might nonetheless widen. A affected person technique that scales in solely when costs begin to regain key transferring averages and the market’s total threat urge for food improves from at the moment’s depressed ranges seems to be extra prudent than aggressive bull-buying. On this sense, the newest Solana cryptocurrency information headlines are extra necessary than whether or not the worth can flip the present stress into everlasting fluctuations. market system.

This evaluation is for informational functions solely and doesn’t represent monetary recommendation.

Readers ought to conduct their very own analysis earlier than making any funding selections.