- WLFI has damaged a consolidation as increased lows and new momentum strengthen the pattern outlook.

- Elevated curiosity in futures and bettering spot flows counsel a shift to aggressive shopping for.

- Computerized purchases of strategic reserve wallets add secure demand throughout pattern enlargement.

World Liberty Monetary is receiving renewed consideration as its tokens start to get better after weeks of weak buying and selling. The asset is at the moment in a creating uptrend after breaking out of a protracted consolidation band.

The transfer comes as broader market exercise picks up, with WLFI recording stronger participation throughout spot and futures markets. Moreover, the mission’s strategic reserve pockets has launched an aggressive auto-accumulation program, including new demand at a vital time for value stability.

WLFI value shall be faraway from consolidation

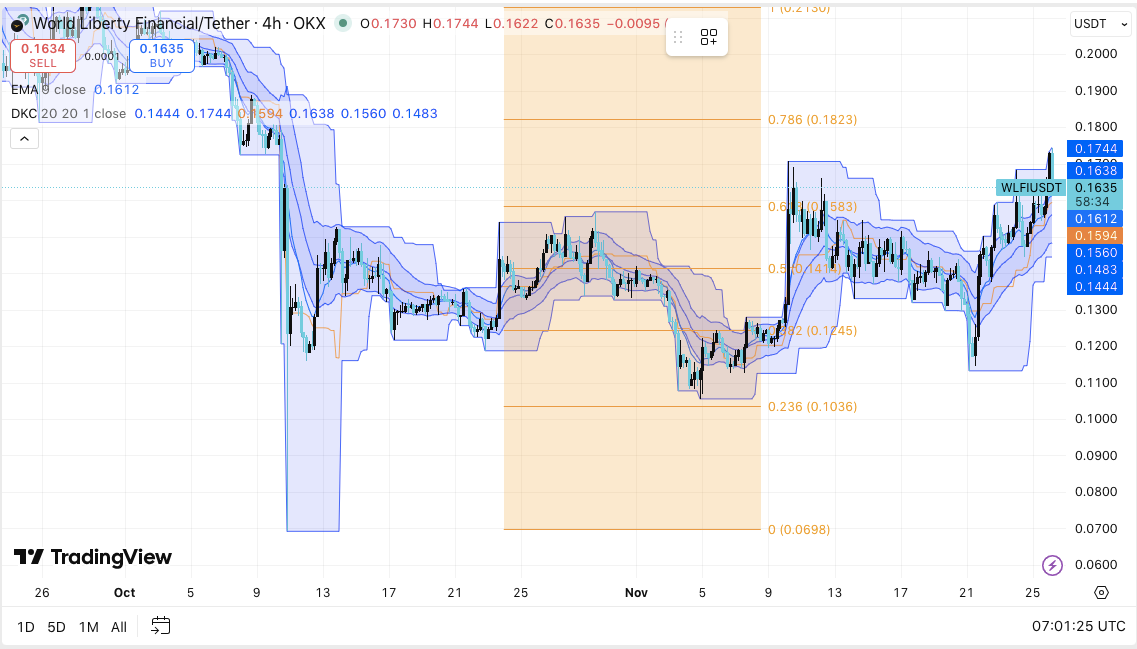

WLFI has lately damaged out of a good multi-week vary and shaped a constant sample of recent lows. The transfer gained momentum after the token broke above the midrange barrier round $0.158.

Patrons sustained the breakout and maintained value motion above the EMA line, indicating an early pattern extension. Moreover, the DKC channel tightened earlier than turning increased, indicating that momentum is bettering.

Help ranges stay strong at $0.148 and $0.156. Every stage was examined repeatedly throughout November as vendor stress eased. The value is at the moment buying and selling above $0.161 and approaching the $0.1635 breakout level. A detailed above this barrier will open the best way to $0.1744. Subsequently, merchants are intently monitoring pattern continuation indicators.

Futures charges and spot flows get better

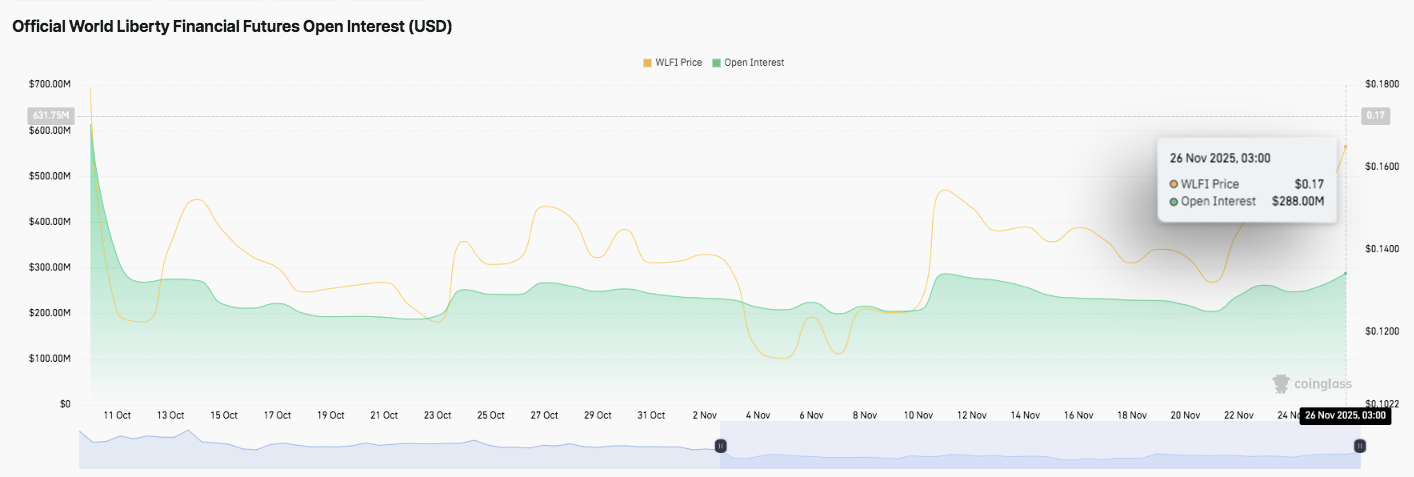

WLFI futures open curiosity has proven a protracted cycle of unwinding from its peak in early October. Buying and selling fell sharply as volatility elevated and merchants averted massive positions.

Nevertheless, curiosity started to rise once more in late November. On November 26, open curiosity approached $288 million, indicating a return to confidence. This gradual restoration indicators a shift from defensive positioning to extra proactive risk-taking.

The spot move additionally modified its tempo. Promoting dominated the market, and steady capital outflows have been recorded from September to October. There was regular enchancment in November. WLFI recorded inflows of $1.51 million on November 26, with the worth hovering round $0.163. Subsequently, this transformation suggests a rest of stress and a stronger need to build up.

Speed up your buying program with strategic wallets

World Liberty’s Strategic Reserve Pockets gained market consideration after it launched an $11 million auto-purchase program on CowSwap. This pockets has already bought roughly $1.2 million value of WLFI.

The system runs roughly $131,000 each 5 minutes. The remaining allocation continues so as to add new demand as costs search to construct increased constructions. Moreover, this system demonstrates inner confidence and introduces a gentle move of liquidity throughout main pattern transitions.

World Liberty Monetary (WLFI) Technical Outlook

Key ranges stay nicely outlined as WLFI builds a developmental uptrend into December.

High stage: The quick resistance zones are $0.1635, $0.1744, and $0.1823. A break above $0.1635 may pave the best way to the native swing zone at $0.1744 after which the 0.786 Fibonacci marker at $0.1823.

Lower cost stage: EMA help at $0.1612, adopted by main help at $0.1560, and $0.1483 as the first demand flooring. A lack of $0.1560 would weaken the short-term momentum and expose the decrease finish of the buildup band.

Development construction: WLFI is coming off an prolonged decline and is at the moment making new lows throughout a number of time frames. This construction suggests an early pattern extension because the candlestick is above the EMA baseline and the DKC midline. The volatility bands are narrowing, indicating compression earlier than the following directional transfer.

Will WLFI proceed to rise?

WLFI’s December trajectory will rely on whether or not patrons can keep energy above $0.1612 and safe a sustained breakout above $0.1635. Technical compression, bettering spot move, and elevated open curiosity all level to growing momentum. If inflows are sturdy and costs keep the EMA help, WLFI may try a transfer in the direction of $0.1744 and presumably $0.1823.

Nevertheless, if $0.1560 can’t be defended, there’s a danger that the latest high-low construction will collapse and the worth will return to the buildup zone at $0.1483.

Disclaimer: The knowledge contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any type. Coin Version is just not chargeable for any losses incurred on account of using the content material, merchandise, or companies talked about. We encourage our readers to conduct due diligence earlier than taking any motion associated to our firm.