abstract

The asset is buying and selling barely under its short-term common, in step with broader market tendencies. weak authorities On the each day chart. The momentum is gradual, the RSI is across the midrange, and the MACD is just barely damaging. It’s not panic promoting, it’s pattern weak point.. Moreover, Bollinger Bands and ATR reveals include volatility, suggesting a managed atmosphere quite than explosive actions. The scenario will enhance through the day. Hourly and 15 minute tendencies are sloped. constructively bullishrevealed aggressive market shopping for. In the meantime, whereas the broader crypto market is rising modestly and remains to be closely dominated by Bitcoin, Sentiment Gauge reveals: excessive concern. This mixture reveals that the market is cautious and selective, but keen to take dangers on distinct technical settings.

Market scenario and course

If we zoom out, the market capitalization of cryptocurrencies is sort of $3.1 trillion. 1.1% within the final 24 hours. This rally reveals that consumers are nervous however not capitulating. Nevertheless, Bitcoin instructions are roughly 56% benefitThis highlights that the market nonetheless prefers the security of benchmark cash over aggressive various publicity. In distinction, altcoins like this pair are inclined to lag every time their dominance turns into this excessive, as their liquidity gravitates in the direction of BTC.

On the sentiment facet, the Concern and Greed Index is 15 (excessive concern)a degree sometimes related to defensive positioning and decrease leverage. Nevertheless, such pessimism typically coincides with the later levels of a downtrend or the early levels of base development. For this pair, the mixture of each day bearish background and really scary sentiment suggests a cautious atmosphere. The draw back could also be restricted, however the upside nonetheless must be confirmed..

Technical Perspective: Learn the general setup

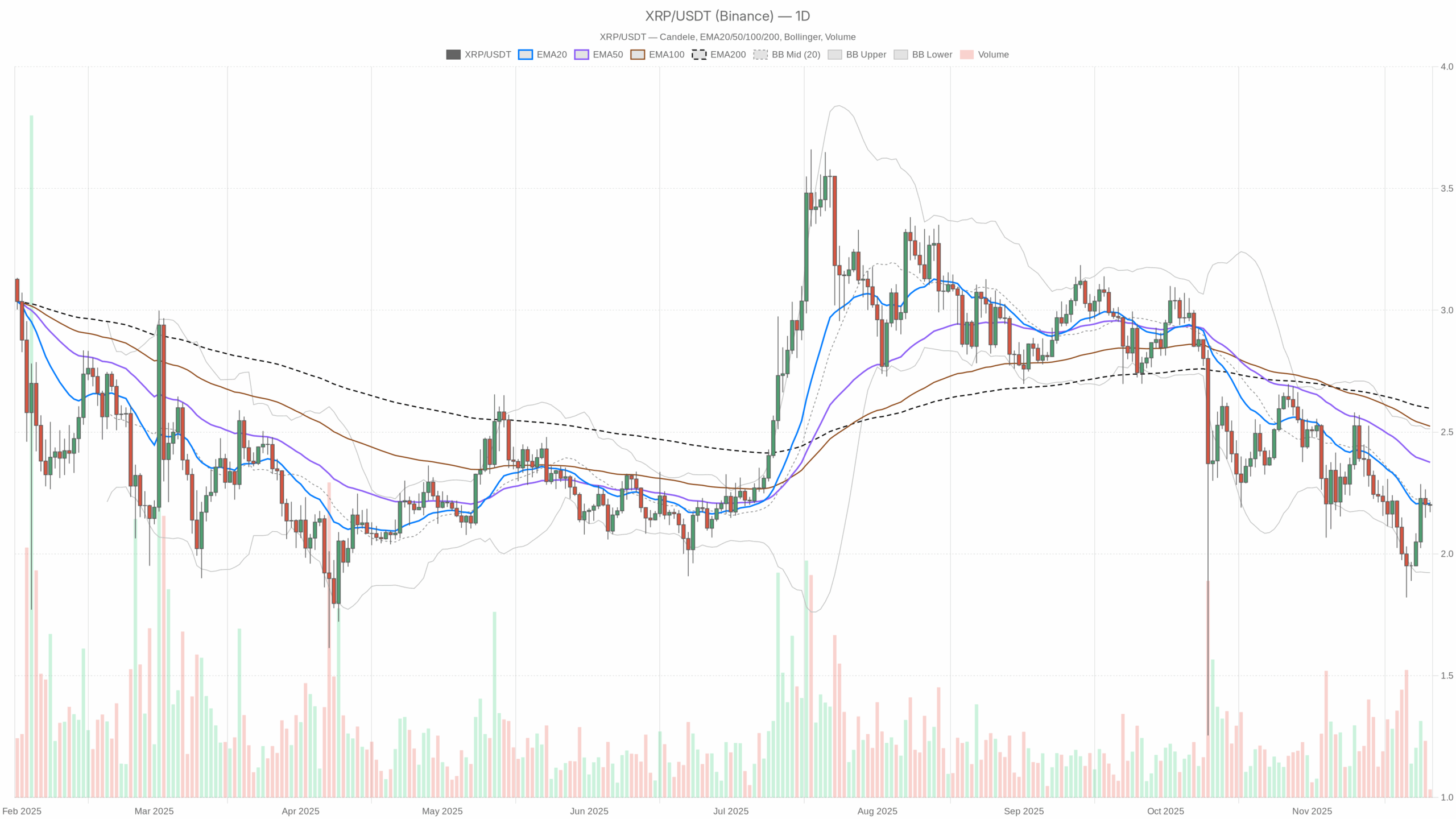

On the each day timeframe, the value is near 2.2, barely under the 20-day EMA close to 2.21, however extra clearly under the 50-day EMA close to 2.38 and the 200-day EMA at 2.6. This shifting common alignment maintains key situations. Bearishness, rebound is more likely to be seen as a promoting alternative Till value can a minimum of regain the 20-day and 50-day traces with confidence.

The each day RSI of round 47 helps the concept that the market is caught between fatigue and restoration. Neither oversold nor overbought. This implies there isn’t a sturdy momentum sign. As an alternative, it describes as A variety-like scenario inside an overarching downtrend. In consequence, merchants might anticipate uneven swings quite than a clear directional push, a minimum of within the brief time period.

The each day MACD provides nuance. The road is barely damaging at -0.08, however above the sign line at -0.1, producing a small optimistic histogram. On this configuration, typically Try and capitalize on early momentum turns inside broader weak pattern. If the histogram continues to widen and the MACD line returns to optimistic territory, a extra sustained restoration will grow to be extra probably. If not, it could merely fade as one other bounce failure.

The Bollinger bands on the each day chart present that the center band is round 2.22, the higher band is round 2.51, and the decrease band is round 1.92. means that value is hovering just under the median Lack of directional benefitas a result of neither the customer nor the vendor has full management over it. Furthermore, the gap between the bands is average quite than huge, which along with the ATR near 0.15 confirms the next scenario. Decreased volatility. Such an atmosphere typically happens earlier than a bigger transfer, with the present degree turning into a staging space for a attainable breakout or deeper slide.

Intraday outlook and XRPUSDT token momentum

Intraday charts inform a extra optimistic story. On the timeframe, the asset is buying and selling simply above its 20-period EMA of two.19, barely above its 50-period EMA of two.17, and nicely above its 200-period EMA of two.12. A piece of help under this value, Brief-term bullish constructionin sharp distinction to the each day downward pattern.

In the meantime, the hourly RSI is simply above 52 and has risen to round 53 on the 15-minute chart. These measurements point out average optimistic momentum, not exuberance. The MACD for each intraday frames is basically flat round zero; impartial momentum baseline Right here, course could be rapidly fashioned by the incoming circulate. In consequence, short-term merchants seem like leaning lengthy, however there isn’t a aggressive build-up that screams euphoria.

The Bollinger Bands on the 1-hour and 15-minute charts are slender and the value is caught within the center and high. This construction, mixed with the low intraday ATR (about 0.02 within the first half and about 0.01 in M15), signifies that: Compressed volatility that may escalate quickly. If the general market maintains an upward bias, such an enlargement may gasoline the rally. A risk-off swing may very well speed up the return to the each day help zone.

Key ranges and market reactions

The each day pivot ranges are at present clustered across the value, with the central pivot at 2.19. The primary space of resistance seems round 2.22, primarily overlapping the each day Bollinger midband and the 20-day EMA. A transparent closing value above this band is Purchaser stress lastly overwhelms short-term providewhich opens the door to a problem with a 50-day common of round 2.38.

On the draw back, in response to the pivot construction, the speedy help is round 2.18, with a wider cushion extending in the direction of the decrease band round 1.92. If the sellers handle to interrupt decisively under the two.18 zone, the prevailing bearish regime might be strengthened and the danger of a good deeper retracement will enhance. Nevertheless, given the intraday power, consumers might attempt to aggressively defend these ranges.

Future eventualities and funding outlook

General, the important thing situation stays cautiously bearish on the each day time-frame, with the asset nonetheless buying and selling under key medium- and long-term averages. Nevertheless, the development in intraday construction and short-term MACD reversal point out that: The downward momentum is dropping momentum. In an atmosphere of rising market capitalization regardless of excessive concern, if it might probably outperform the close by help cluster and reclaim the two.22-2.38 space, the asset could possibly be quietly constructing the foundations for a extra significant rebound.

For buyers and lively merchants, the trail ahead will probably rely upon how costs transfer round overlapping resistance and help zones. A continued rally together with elevated quantity and widening volatility would help a transfer to a extra constructive stance, whereas repeated failures close to resistance or a decline under 2.18 would help sustaining a defensive stance. Till an answer emerges, a deal with disciplined danger administration and clear affirmation alerts stays important.

This evaluation is for informational functions solely and doesn’t represent monetary recommendation.

Readers ought to conduct their very own analysis earlier than making any funding selections.