abstract

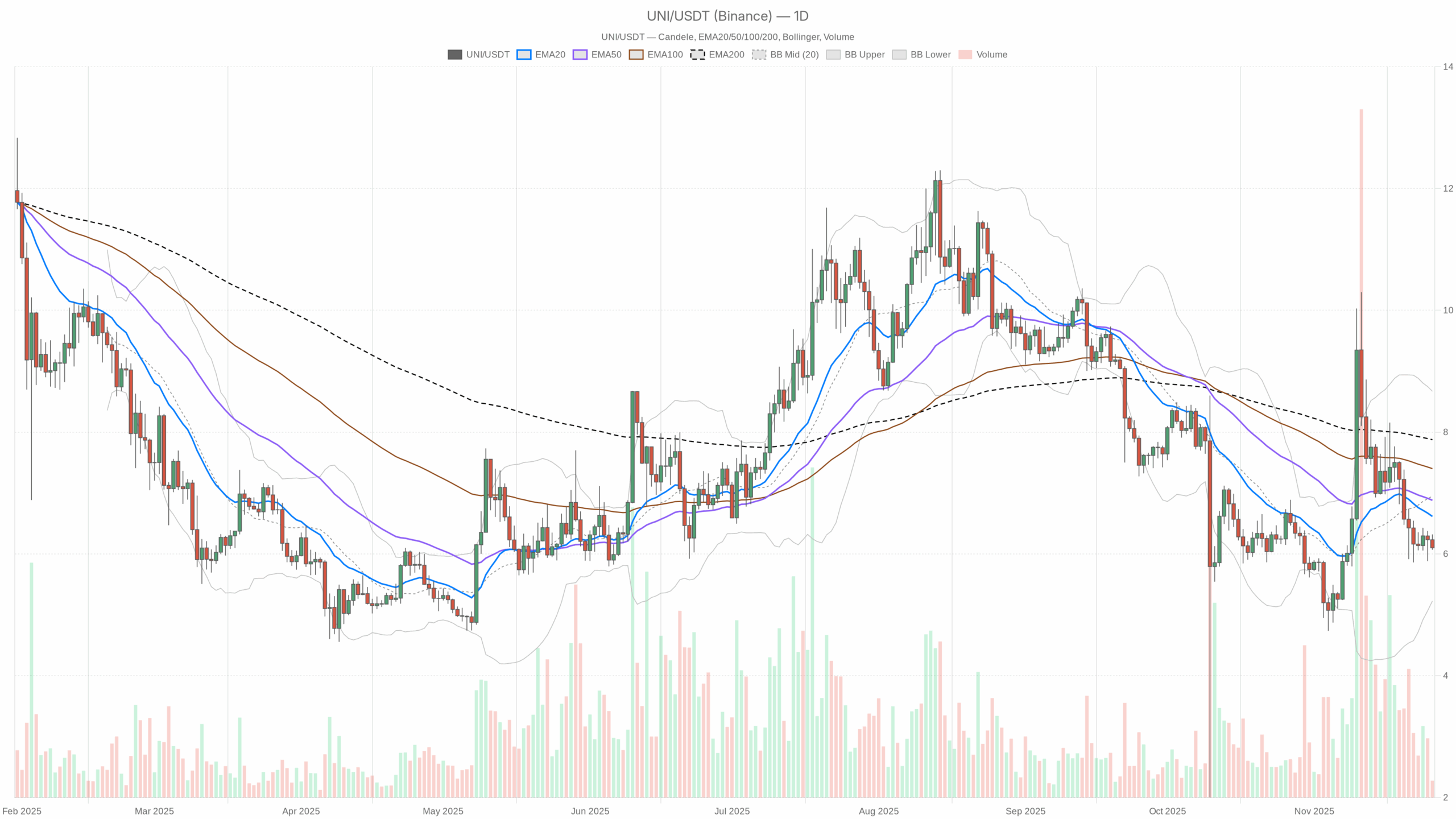

UNI is altering arms and altering merchandise. 6.1 USDTbeneath all main every day shifting averages, which widespread weak spot In the next time-frame. Momentum is detrimental however not capitulating, with the every day RSI hovering within the low 40s, suggesting cautious promoting fairly than panic. Furthermore, the MACD remains to be beneath the sign line, indicating that the bulls haven’t but regained management of the medium-term course. Volatility on the every day chart is average, however intraday measurements present a narrower vary, indicating a consolidation section after the current decline. On the identical time, whereas total liquidity within the crypto market stays robust, threat urge for food has slowed as merchants prioritize capital preservation. General, UNI is in a correction surroundings and any pullback nonetheless requires robust affirmation earlier than being handled as a everlasting pattern change.

Uniswap Cryptocurrency Information: Market Background and Path

There are numerous backgrounds behind the widespread use of digital currencies, and the entire market capitalization has remained nearly flat. $3.8 trillionwhich has decreased barely over the previous 24 hours. Having stated that, Bitcoin has a bonus of over 56% signifies that capital is concentrated within the largest property, which is a typical sample throughout unsure instances for altcoins. This dynamic usually makes tokens like UNI extra weak to rebound and slower to get better when markets change into unstable.

Sentiment information reinforces this defensive posture. The Worry and Greed Index is: 15, labeled as excessive concernThis means that buyers are usually threat averse and shortly cut back publicity throughout upswings. Furthermore, when concern is so excessive, even technically engaging setups can take a very long time to execute as contemporary capital is on standby. For UNI, this implies any makes an attempt at upside might initially run right into a wall of provide from short-term merchants desperate to get out of break-even positions.

Technical Perspective: Learn the general setup

On the every day time-frame, UNI is buying and selling round 6.1 USDT, clearly beneath the US greenback. 20-day EMA is 6.62, 50-day EMA is 6.88 and 200 day EMA is 7.88. This placement of the shifting common above the spot worth is typical. mature downtrendrallies are sometimes pitched fairly than prolonged. Till the value is ready to regain a minimum of the 20-day EMA, any pullback ought to be thought of a countertrend transfer.

every day RSI 43.48 Test this picture. Though it’s beneath the impartial mark of fifty, it means that it’s removed from oversold territory. Sustained however managed promoting strain. In different phrases, the bears are nonetheless in management, however there may be nonetheless room for the oscillator to spin increased with out overriding the broader correction construction.

The MACD line is positioned at: -0.11beneath the sign line 0.02detrimental histogram -0.13. This configuration exhibits that The downward momentum has not been fully resolved but.Even when the tempo of decline has not accelerated dramatically. A bullish crossover of the MACD above that sign sooner or later shall be one of many first indicators that the market is about to return to accumulation.

The midline of the Bollinger Bands on the every day chart is 6.95, the higher band is round 8.67, and the decrease band is round 5.23. Costs are at present buying and selling within the decrease half of this envelope, Nonetheless biased to the draw back throughout the broad volatility channel. Nonetheless, the dearth of touches or breaks within the decrease bands means that the sell-off is stable however has not reached its peak but.

The every day ATR(14) is 0.67indicating that every day fluctuations are average in comparison with costs. Such a volatility profile is commonly Managed fixes as an alternative of chaotic flashesleaving room for each a gradual continuation of the decline or a gradual and uneven reversal.

Intraday outlook and UNIUSDT token momentum

Zooming in on the intraday chart, the hourly time-frame tells the same however extra nuanced story. The primary half closed at round 6.11 USDT, barely decrease. 20 hour EMA of 6.16 and 50 hour EMA as of 6.19,alternatively, 200 hour EMA (6.52) keep far above, Quick-term downtrend nested inside a broader bearish construction. Alternatively, this clustering of EMAs shut to cost signifies that the market is in a consolidation pocket after the current decline.

The hourly RSI is 43.84, reflecting a every day sign that favors sellers however doesn’t point out depletion. Because of this, a short-term pullback might emerge, however a sell-off is probably going till momentum constantly regains the 50-55 space. The MACD for H1 is barely detrimental and nearly flat, which means that: daytime momentum declines And a market ready for brand new catalysts.

The 15-minute chart stays cautious. Value is buying and selling round 6.1 USDT, barely beneath the 20-period and 50-period EMAs, and in addition beneath the 200-period EMA at 6.19. RSI is 39.14; Delicate short-term oversupplyhowever there was no spike that signaled give up. The Bollinger Bands for this timeframe are fairly tight, in step with the ATR(14) round 0.03, which usually displays this mix. Volatility compressed earlier than a transfer within the subsequent course.

Key ranges and market reactions

Day by day pivot ranges present merchants with a helpful roadmap. The central pivot level is close by 6.16 USDTbarely above the present worth, making this zone a right away battleground. If consumers are in a position to push this space increased and maintain, consideration will probably shift to the primary surrounding resistance band. 6.26 USDTshort-term sellers might attempt to reassert management. A decisive escape of this pocket and consolidation would improve the probability of a extra significant quick squeeze in direction of the 20-day EMA.

The draw back is that the preliminary help space nonetheless stays. 6.01 USDT. A transparent lack of this decrease certain, particularly on robust quantity, would point out that the bears are searching for a deeper extension in direction of the decrease Bollinger Band area close to 5.23. Nonetheless, if the value repeats the take a look at and stays close to 6.0, it may mark an early stage of base and put together the bottom for a medium-term reversal.

Future eventualities and funding outlook

General, the technical state of affairs favors a cautious stance, with main bearish situation Early indicators of stabilization begin to seem on decrease time frames however are nonetheless prevailing. Conservative contributors might desire to attend for clear proof of a pattern Reversal affirmationevery day closing costs above the 20-day EMA, mixed with an enhancing RSI and a bullish MACD crossover. In distinction, extra lively merchants might search to keep up tight threat administration in a market that also trades below the shadow of utmost concern and benefit from the intraday vary outlined between 6.0 and 6.26. How the value behaves round these pivot zones within the coming classes may decide whether or not this section develops into a protracted decline or the primary chapter of UNI’s restoration story.

This evaluation is for informational functions solely and doesn’t represent monetary recommendation.

Readers ought to conduct their very own analysis earlier than making any funding selections.