- Ethereum has stalled round $2,914 as new ETF inflows of $78.6 million have been unable to offset spot outflows of $129.2 million.

- ETH continues to fall sharply, with all main EMAs trending bearishly above $3,115.

- A tightening intraday triangle indicators a decisive transfer as assist at $2,900 and resistance at $3,000 converge.

Ethereum value is buying and selling round $2,914 right now, remaining simply above short-term assist after one other failed try to interrupt the downtrend that has capped any good points since early September. Rejections will proceed to place stress on patrons as spot flows stay unfavorable and the EMA cluster continues to behave as a ceiling.

ETF purchases present assist however fail to vary momentum

$ETH Yesterday’s ETF influx was $78.6 million 🟢.

BlackRock bought $46.1 million in Ethereum. pic.twitter.com/Ww7wsXt7Y3

— Ted (@TedPillows) November 26, 2025

The most recent ETF information yesterday confirmed uncommon constructive inflows. The fund added $78.6 million in internet Ethereum publicity, led by a $46.1 million buy from BlackRock. This influx offers some aid after two weeks of losses for many issuers. It additionally exhibits that institutional desks are selectively including publicity at decrease costs.

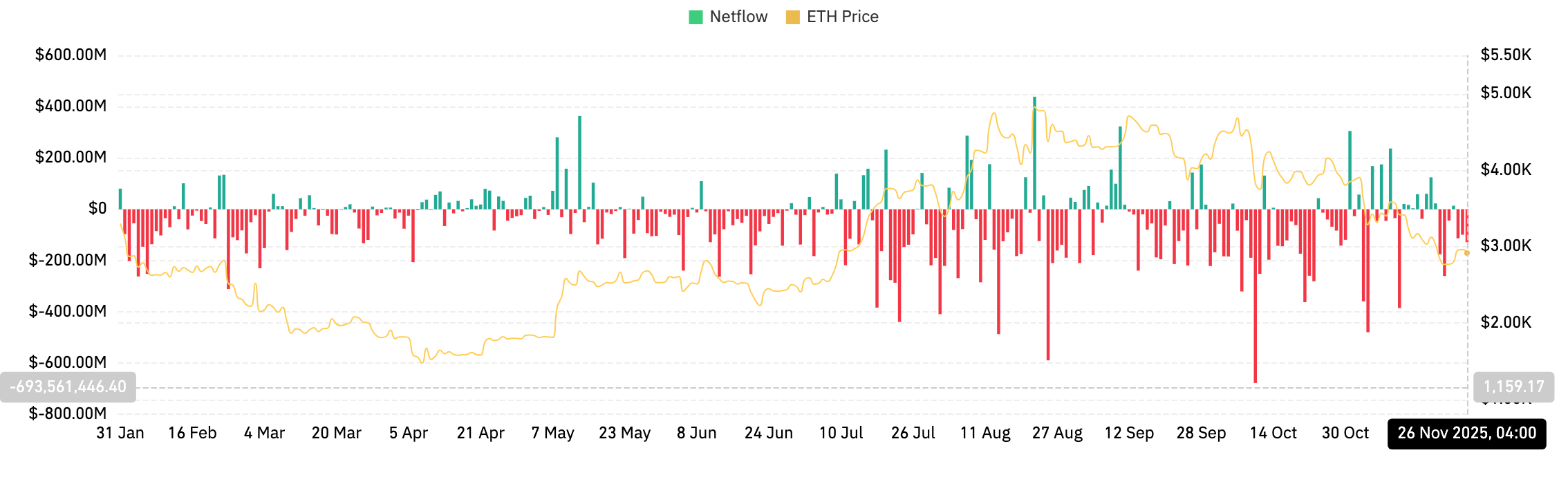

Nevertheless, spot circulation is a unique story. Coinglass recorded $129.2 million in outflows on November twenty sixth. This continues the multi-session sample of unfavorable internet inflows that lasted via a lot of November. When ETF inflows collide with continued spot promoting, costs typically stall with out forming a pattern. This pressure explains why Ethereum is unable to interrupt out of the downtrend line regardless of bettering institutional bids.

The downtrend is maintained because the EMA is aligned in a bearish course.

The every day chart exhibits Ethereum buying and selling firmly beneath its 20-day EMA of $3,115, 50-day EMA of $3,481, 100-day EMA of $3,649, and 200-day EMA of $3,512. This adjustment retains the pattern decrease and extra biased. The entire rebounds over the previous three weeks have weakened as the value touched the decrease aspect of the 20-day EMA.

A downtrend line from the September excessive strengthens this barrier. The most recent check close to $3,000 failed spectacularly, pushing ETH again into the midrange. Sellers will proceed to defend this line and the market will stay in a correction construction till ETH information a every day shut above that line.

The every day supertrend is at $3,434, properly above the present value. This indicator has remained firmly within the purple since its breakdown earlier this month. An in depth above this band is required to substantiate a change in directional management.

Associated: Pi Worth Prediction: Pi Breakout Approaches Amid Scams, Hypothesis, and Utilities

The long-term uptrend line from April is close to $2,750. This space serves as a multi-month benchmark and represents the subsequent main demand zone if downward stress continues. If ETH fails to carry the $2,900 space, the potential for a retest of this stage stays.

The diurnal construction is compressed right into a symmetrical triangle

The 30-minute chart exhibits that ETH is buying and selling inside a tightening triangle with intraday merchants forming a low above $2,860, whereas the higher restrict is beneath $2,965. This compression displays indecision after the current trendline rejection.

The parabolic SAR dot remains to be above value, indicating that sellers are nonetheless accountable for short-term momentum. The RSI is hovering round 42, indicating a light bearish bias relatively than oversold. This mix means that ETH is ready for an opportunity to interrupt out of the intraday vary.

A breakout of $2,965 would give patrons one other probability to place stress on the $3,000 zone. A break beneath $2,860 exposes $2,820 and will increase the chance of an additional pullback in direction of the long-term trendline.

For now, intraday fluctuations stay reactive relatively than directional. Merchants are utilizing the triangle border for short-term setups whereas ready for broader flows to settle.

outlook. Will Ethereum go up?

Ethereum faces a transparent technological path.

- Bullish case: An in depth above $3,115 would sign step one towards restoration. Energy above the downtrend line close to $3,000 confirms the breakout and a retracement of the 50-day EMA close to $3,481 units the stage for a transfer in direction of $3,650.

- Bearish case: Failure to maintain $2,900 opens the door to $2,820 and $2,750, the long-term trendlines which have supported the market since April. A break beneath $2,750 will set off a deeper correction in direction of $2,600.

Ethereum’s subsequent large transfer will depend upon whether or not patrons can escape of the trendline and reverse the important thing EMA. Energy above $3,115 modifications the narrative. For those who lose $2,750, full management passes to the vendor.

Associated: World Liberty Monetary Worth Forecast: Strategic purchases and inflows gas new uptrend

Disclaimer: The knowledge contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any sort. Coin Version will not be accountable for any losses incurred because of the usage of the content material, merchandise, or providers talked about. We encourage our readers to conduct due diligence earlier than taking any motion associated to our firm.