- SHIB is buying and selling round $0.00000851 after being rejected once more on the prime of the descending channel.

- The EMA cluster stays bearish as sellers shield $0.00000880 to $0.00000954 every time they rebound.

- Spot outflows and weak inflows proceed to place strain on the pattern as help ranges at $0.00000820 and $0.0000072 come into play.

Shiba Inu value right this moment is buying and selling round $0.00000851, falling after being rejected once more on the prime of a multi-month descending channel. This transfer continues to place strain on patrons as spot outflows proceed and the EMA cluster strengthens its position as overhead resistance.

EMA cluster limits all bounces

SHIB stays locked throughout the descending channel that has guided the worth motion since January. All makes an attempt to interrupt out of the channel have failed, together with the latest check close to $0.0000090, forcing sellers to intervene and drive the worth again into the decrease half of the vary.

The each day EMA reinforces this construction. SHIB is buying and selling under the 20-day EMA of $0.00000880, the 50-day EMA of $0.00000954, the 100-day EMA of $0.00000969, and the 200-day EMA of $0.00001199. This correction retains the pattern decrease, indicating that patrons would not have the mandatory momentum to regain misplaced ranges.

Associated: Bitcoin Value Prediction: BTC faces robust restoration interval as key Fibonacci ranges restrict upside

The supertrend indicator is situated at $0.00000954, highlighting a powerful higher certain above the present value. This band stays pink for many of November and pattern management is on the vendor aspect till SHIB closes above it.

The broader channel suggests there’s room for a deeper transfer if the decrease certain close to $0.0000072 is examined once more. This space is performing as a serious demand zone and would be the subsequent key help if the decline continues.

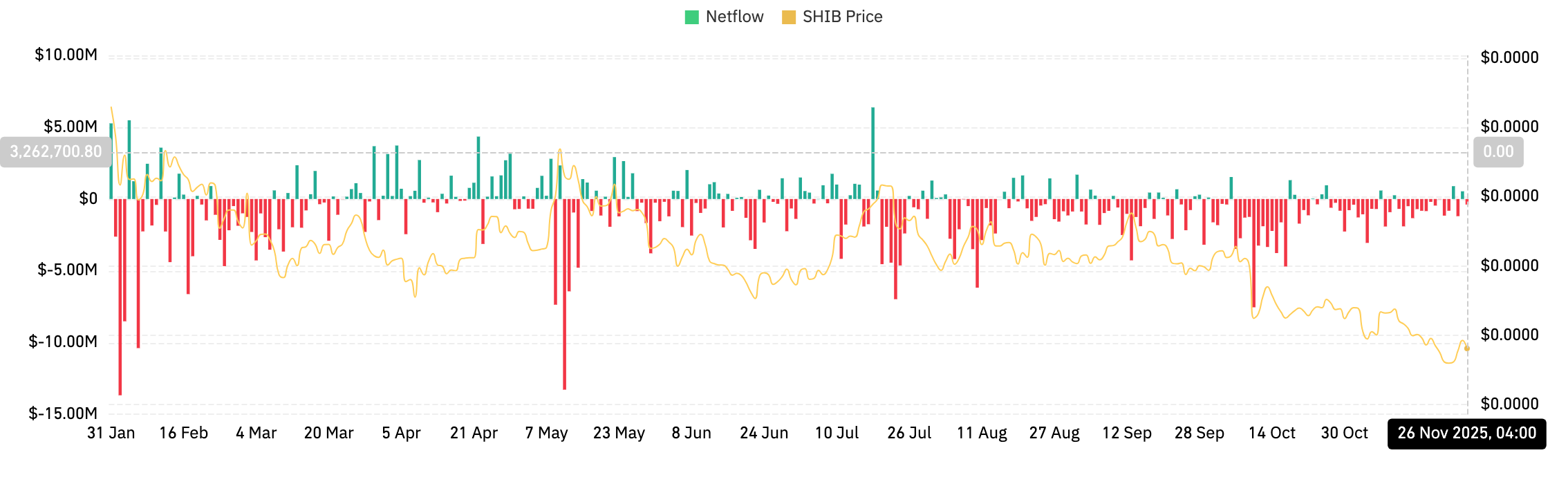

Spot spills point out continued distribution

Web outflows on November 26 had been $380,000, in response to Coinglass information. Though small in measurement in comparison with large-cap property, a constant sample is obvious. For the previous three months, SHIB’s flowcharts have been dominated by pink textual content.

Unfavorable web flows usually mirror distribution moderately than accumulation. Merchants ship their tokens again to the trade, rising the accessible provide and decreasing upward strain. This surroundings is contributing to a sustained downtrend, and SHIB is unable to show a short-term rally right into a sustained breakout.

Associated: XRP Value Prediction: XRP Makes an attempt to Reverse as Key Ranges Contract and Flows Stay Unfavorable

The dearth of sustained influx additionally explains why every EMA check results in fast rejection. Though patrons are intervening at help ranges, the broader market will not be circulating new capital into SHIB.

For sentiment to vary, the circulation must be optimistic. Till then, all pullbacks will probably be tactical moderately than pattern forming.

Intraday momentum makes an attempt to stabilize

On the 30-minute chart, we will see that SHIB has shaped an upward help line from the November low close to $0.0000076. This typically creates an intraday uptrend inside a broader downtrend, a construction that signifies non permanent stabilization. The worth reached $0.00000886 earlier right this moment and has since returned to present ranges.

The parabolic SAR dot remains to be above value, indicating that short-term momentum remains to be cooling off after the preliminary rally. The RSI is close to 41, indicating that the market will not be oversold and is dropping energy. This mixture means that SHIB is getting into a consolidation section moderately than forming a definitive breakout.

The rising intraday pattern line close to $0.00000820 is a crucial stage to look at. If there’s a rebound from this space, patrons may attempt to push additional in direction of the native resistance bands of $0.00000870 and $0.00000890. A breakdown under the pattern line brings momentum again towards the channel midpoint and will increase the chance of a retest of the important thing each day help space.

outlook. Will Shiba Inu rise?

The Shiba Inu at the moment faces two distinct eventualities.

- Bullish case: A each day shut above $0.00000890 signifies energy. A transfer above the 20-day EMA of $0.00000880 and the 50-day EMA of $0.00000954 will reverse short-term momentum. The confirmed energy will break above $0.00000990 and start a transfer in direction of $0.0000105 and the 200-day EMA.

- Bearish case: Dropping $0.00000820 exposes the primary intraday demand zone of $0.0000076. The breakdown under this stage is $0.0000072. An in depth under that help would point out a deeper correction in direction of $0.0000068.

Associated: Ethereum Value Prediction: Spot Outflows Collapse ETF Bid Assist, ETH Stalls Round $3,000

Disclaimer: The data contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any type. Coin Version will not be liable for any losses incurred on account of using the content material, merchandise, or companies talked about. We encourage our readers to do their due diligence earlier than taking any motion associated to our firm.