- XRP maintains a key uptrend line close to $2.00 as ETF inflows return for the third consecutive internet constructive session.

- Open curiosity rose to $4.11 billion as choices publicity soared, indicating merchants are as soon as once more constructing lengthy positions.

- After weeks of downward strain, XRP is dealing with a heavy ceiling on the $2.36 EMA as bulls try to interrupt out of the draw back construction.

XRP worth is buying and selling round $2.22 in the present day, adhering to the long-term uptrend line that has supported the broader construction since early 2025. The rally is giving patrons the primary significant foothold after weeks of downward strain, as new ETF inflows and elevated open curiosity have helped offset current volatility.

ETF inflows present assist as markets reassess dangers

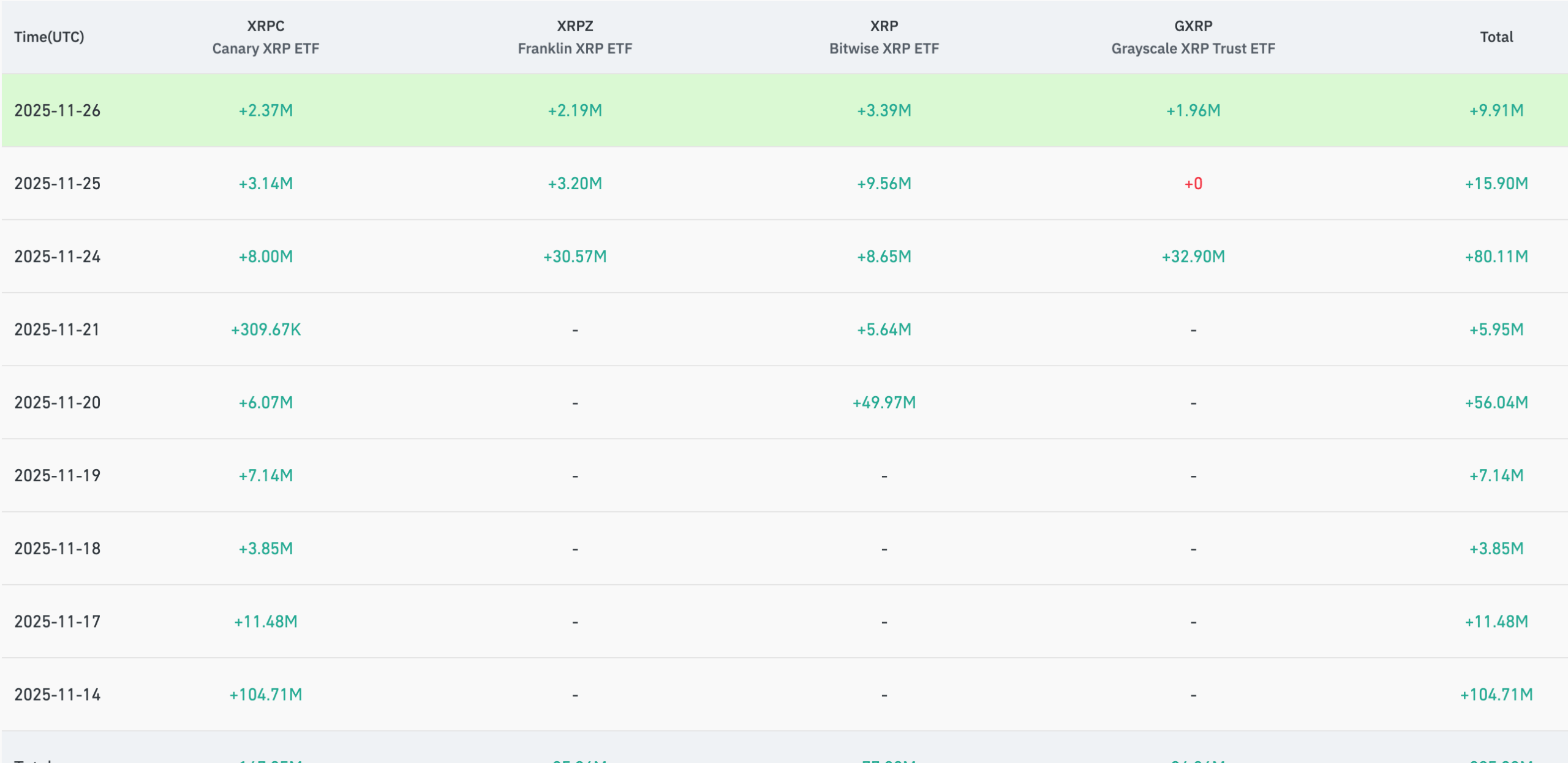

XRP continues to draw constant ETF inflows, and this pattern helps to stabilize sentiment. In keeping with the info, internet creation throughout Bitwise, Franklin, Canary and Grayscale merchandise was $9.91 million on November twenty sixth. This follows $15.9 million on November twenty fifth and $80.11 million on November twenty fourth.

The regular influx sample signifies institutional demand is returning after a tough first half of the month. An intensive article revealed by Franklin and Grayscale earlier this week reveals that fund managers should not withdrawing from their publicity, though spot costs stay compressed throughout the downtrend line.

Derivatives positioning reveals patrons are constructing long-term publicity

Futures indicators level to a restoration in confidence. Open curiosity elevated by 3.14% to $4.11 billion, indicating that merchants are including publicity quite than closing positions. Choices open curiosity surged by 52.73%, and complete choices OI rose to $126.33 million.

The long-to-short ratio confirms that merchants are taking positions for the upside. The long-short ratio of the Binance account is 2.56, with the highest merchants’ positions near 1.29. The OKX account displays 1.42 in favor of longs.

Associated: Kaspa Worth Prediction: Bulls Sharply Estimate Extended Downtrend

Liquidation knowledge can be trending constructively. Over the whole 24-hour interval, quick liquidations amounted to $2.53 million in comparison with lengthy liquidations of $1.93 million, indicating that sellers are more and more misinformed about intraday actions.

There aren’t any indicators of pressured deleveraging within the futures market. As an alternative, capital is returning as merchants anticipate a reversal try close to key Fibonacci or trendline ranges.

Day by day chart maintains long-term pattern line however faces vital resistance at EMA

XRP continues to commerce inside a big descending triangle, however its long-term upside base stays intact close to the $1.95 to $2.00 zone. The current rally confirms that patrons are defending that assist.

Worth is under all main EMAs.

- 20-day EMA: $2.208

- 50-day EMA: $2.369

- 100-day EMA: $2.516

- 200-day EMA: $2.521

This cluster will kind a heavy ceiling above $2.36, limiting upside momentum. The 0.382 Fibonacci degree at $2.49 strengthens the identical provide zone.

The subsequent key check lies on the 0.5 Fib retracement at $2.71, however XRP should first shut above the EMA group to interrupt out of the upper goal.

On the draw back, the uptrend line and the $2.17 0.236 Fib proceed to function the principle axes. A detailed under $2.17 would expose the structural decrease bounds round $2.00 and $1.90.

Intraday chart reveals compression inside a descending channel

The 30-minute chart reveals that XRP is buying and selling inside a short-term descending channel. The parabolic SAR stays above costs, indicating that downward strain has not fully eased. The RSI sits between 47 and 52, reflecting balanced however cautious momentum.

Above $2.24, SAR might reverse and problem the higher certain of the channel. If rejected on the present band, there’s a danger of retesting $2.15, the place patrons intervened earlier.

Intraday momentum has improved in comparison with earlier periods, however we’d like elevated quantity and a clear shut above $2.24 to verify.

outlook. Will XRP go up?

The subsequent transfer will depend upon XRP’s skill to interrupt by means of the EMA cluster and regain the mid-Fibonacci band.

- Bullish case: As soon as the worth closes above $2.36, it’ll begin transferring in the direction of $2.49 after which in the direction of $2.71. Rising ETF inflows and stronger open curiosity are supporting this path. A breakout above $2.71 would deliver the broader construction again into an uptrend and expose $2.93.

- Bearish case: For those who fail to carry $2.17, XRP will transfer again towards $2.00. A detailed under $1.95 would break the long-term upside base and shift the bias totally to bearish with a goal of $1.77.

Disclaimer: The data contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any type. Coin Version isn’t answerable for any losses incurred because of using the content material, merchandise, or providers talked about. We encourage our readers to do their due diligence earlier than taking any motion associated to our firm.