abstract

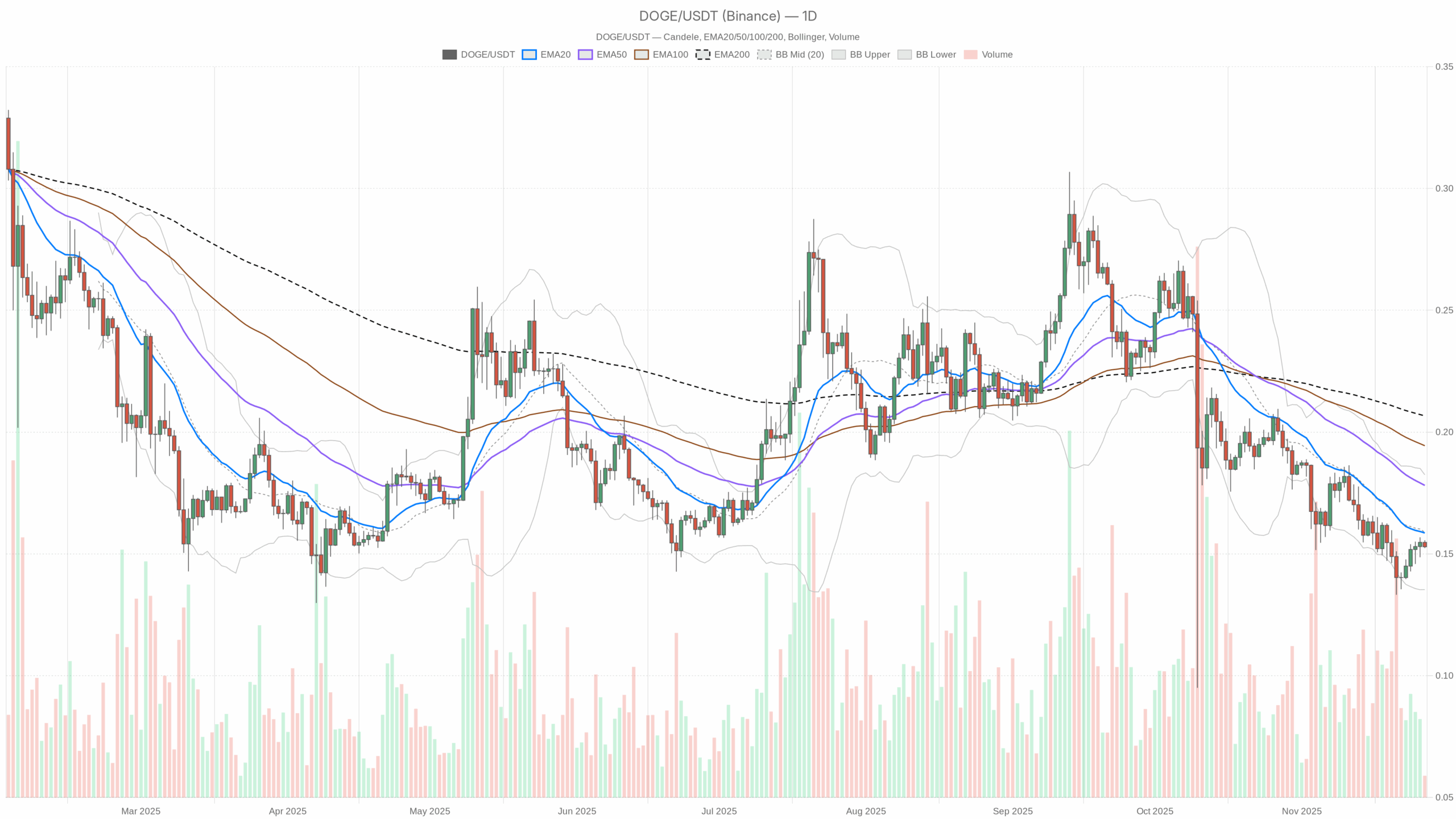

On the every day chart, the asset is buying and selling round 0.15 USDT, beneath all main shifting averages. dominant bearish authorities. Momentum indicators are gentle however not capitulating, suggesting fatigue slightly than panic promoting. Moreover, volatility is subdued, with every day ATR near 0.01. Consolidation part after earlier decline. The intraday timeframe reveals a flatter construction, indicating that short-term merchants are searching for course slightly than extending the decline. In the meantime, Bitcoin’s dominance of round 57% confirms that the market stays centered on the majors, placing memecoins on the defensive. Total, general crypto sentiment is fragile because the Worry & Greed Index sits in excessive concern territory and threat urge for food is subdued.

Dogecoin value: market standing and course

Zooming out, the broader market stays giant, with whole capitalization exceeding $3.19 trillion, up about 3.9% previously 24 hours. Regardless of this pullback, Bitcoin nonetheless controls roughly 57% of the market. Danger-off market system If capital favors large-cap shares. In such conditions, speculative property like this one usually underperform or are sluggish to recuperate.

The emotional knowledge additionally displays this warning, with a price of twenty-two on the Worry and Greed Index, classifying it as Excessive Worry. This background sometimes matches: Low leverage and hesitance to purchase in the marketplace. Nevertheless, extreme pessimism usually compresses expectations and may also create a basis for future contrarian alternatives. That stated, the present dominant situation stays closely biased to the draw back, or at greatest sideways, because the every day pattern continues to be categorised as bearish by the system’s regime filter.

Technical Perspective: Learn the general setup

The every day pattern construction is clearly weak. A value of 0.15 is beneath the 20-day exponential shifting common of about 0.16, the 50-day exponential shifting common of about 0.18, and the 200-day exponential shifting common of about 0.21. A full stack of EMAs above this spot degree is typical proof of: Affirm pattern to lower cost. Which means these rebounds to the imply are prone to be met with provide till the construction modifications meaningfully.

The 14-day RSI is close to 42, barely beneath the midpoint, however not oversold but. this means Draw back momentum weakens with out full washout. Sellers are nonetheless in management, however the transfer has not expanded sufficient to pressure a direct technical rebound. This matches the MACD, with each the road and sign situated at round -0.01, and the histogram flat. Truly, that configuration sign is Momentum exhaustion slightly than a vigorous new bearish impulseusually precedes the mixing scope.

The Bollinger bands on the every day chart are centered round 0.16, with the higher band close to 0.18 and the decrease band close to 0.14. Costs round 0.15 are beneath the center band, however comfortably above the decrease band. Bearish bias inside suppressed volatility. There are not any indicators of a major enhance in volatility but. The ATR of roughly 0.01 helps this evaluation. Current every day candlestick value ranges have been modest, in keeping with decreased volatility following preliminary promoting stress. Taken collectively, these measurements point out that the market has moved away from extreme stress and right into a cautious, low-energy part.

Intraday outlook and DOGEUSDT token momentum

On the timeframe, the token trades at 0.15, roughly caught on the 20, 50, and 200 interval EMAs, all clustered on the identical value. This shut collaboration will short-term equilibrium between consumers and sellers. The hourly RSI could be very near impartial at round 47, whereas the MACD is flat at zero, confirming the absence of a transparent intraday pattern.

In the meantime, a 15-minute view tells the same story. Worth is as soon as once more pegged on the brief, medium and long run EMA at 0.15, with the RSI barely decrease round 39. This reveals that: No pattern acceleration, intraday momentum is barely bearish. The Bollinger Bands and ATR for each intraday timeframes are very slender, which means volatility is compressed. In consequence, a breakout from this slender vary may proceed sooner than ordinary as soon as a catalyst emerges, even when the course just isn’t but decided.

Key ranges and market reactions

The pivots on the every day, hourly, and 15-minute charts are tightly converged round 0.15, and the assist and resistance clusters are basically on the identical degree. This uncommon compression round a single zone highlights 0.15. A vital battleground for motion within the subsequent course. If the worth sustains above this equilibrium space and begins to maneuver again above the every day midpoint of the Bollinger Bands round 0.16, it might point out that consumers are regularly regaining management.

Conversely, a sustained break beneath the decrease band area of roughly 0.14, particularly with a rise in ATR, New volatility expands downwards. In that case, intraday merchants are probably to make use of that space as a brand new resistance ceiling and pivot to promoting the pullback between 0.15 and 0.16. Till such a transfer happens, the market appears content material to maneuver in a slender hall with liquidity piling up across the pivot.

Future eventualities and funding outlook

Total, the present regime favors a cautious stance. The every day state of affairs is bearish, with the EMA clearly tilted to the draw back and the most important oscillators exhibiting solely a brief stabilization slightly than a confirmed reversal. For swing merchants, this insists on respecting the final downtrend in favor of a extra outlined pattern. pattern reversal sign earlier than adopting a extra optimistic stance.

Extra speculative individuals might observe volatility falling out of the 0.14 to 0.16 vary. A decisive transfer above the shorter EMA because of improved RSI and optimistic MACD would strengthen the case for a extra constructive part. Till then, place sizing and threat administration stay important, as sentiment throughout the crypto advanced stays fragile regardless of its huge market capitalization.

This evaluation is for informational functions solely and doesn’t represent monetary recommendation.

Readers ought to conduct their very own analysis earlier than making any funding choices.