- The collapse of the assist degree and sustained promoting strain created new draw back dangers, inflicting ZEC to weaken.

- As merchants cautiously exit, the drop in open curiosity suggests much less urge for food for leverage.

- Excessive web outflows and governance considerations are including additional pressure to ZEC’s already fragile sentiment.

Zcash is sliding in the direction of a key assist space as sellers keep sturdy management over key time frames. The token is buying and selling close to $363 after dropping the important thing zone that supported its early positive factors.

The current pullback exhibits the market is struggling to stabilize as momentum weakens, volatility returns and derivatives buying and selling exercise adjustments quickly. Because of this, merchants are actually centered on whether or not ZEC can maintain its present ranges or lengthen a broader decline.

Promoting strain will increase as main ranges break

ZEC continues to type highs and lows, which signifies regular weak point. Along with that, the value is buying and selling beneath the $406 EMA-9, whereas the $424 supertrend resistance is hampering any early restoration makes an attempt.

This configuration creates instant strain as each bounce faces a rejection close to short-term resistance. A break beneath the 0.236 Fibonacci degree at $424 added to the stress, sending ZEC again to multi-week lows.

The closest assist is close to $361, which exhibits the world the place patrons have reacted beforehand. Additional decline may expose the $320-$300 band. Furthermore, the structural flooring round $280 stays essential for medium-term stability. Failure in these areas may lengthen the correction that started after the transition from $760.

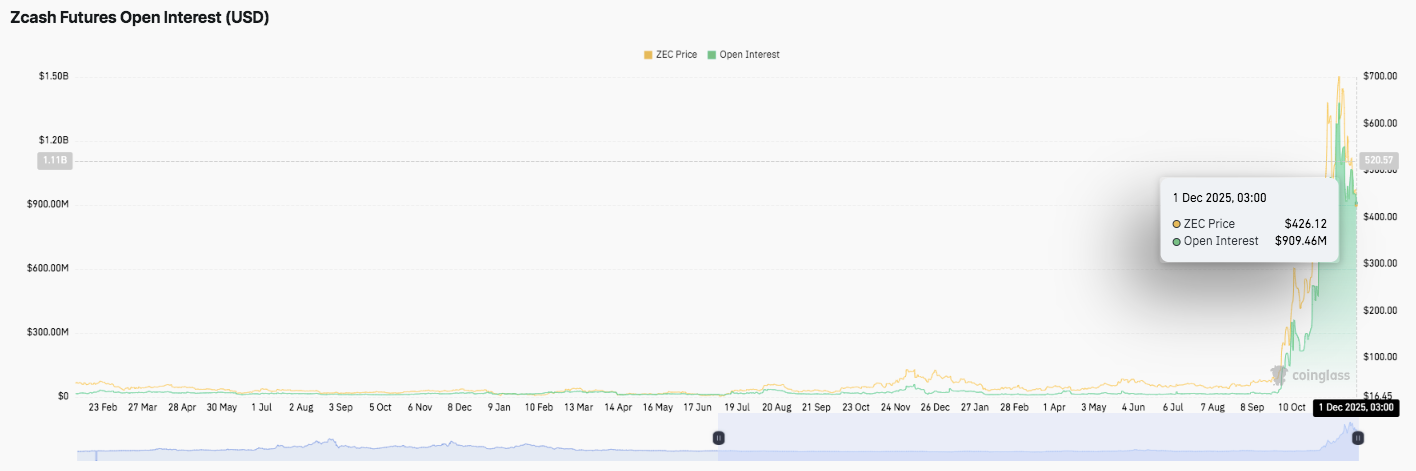

Derivatives exercise adjustments as open curiosity cools

Zcash futures buying and selling exercise has proven dramatic adjustments this quarter. Open curiosity remained quiet for a lot of the 12 months, however rose sharply from October to early December. The inventory value rose from lower than $100 million to greater than $900 million as merchants anticipated volatility and chased a fast rally towards $700. This era mirrored heightened hypothesis and aggressive leverage.

Nevertheless, the cooldown in the direction of $426 signifies a readjustment section. Many merchants diminished their publicity as value momentum weakened. Present open curiosity due to this fact displays a extra cautious market, with contributors ready for clearer indicators earlier than restructuring their positions.

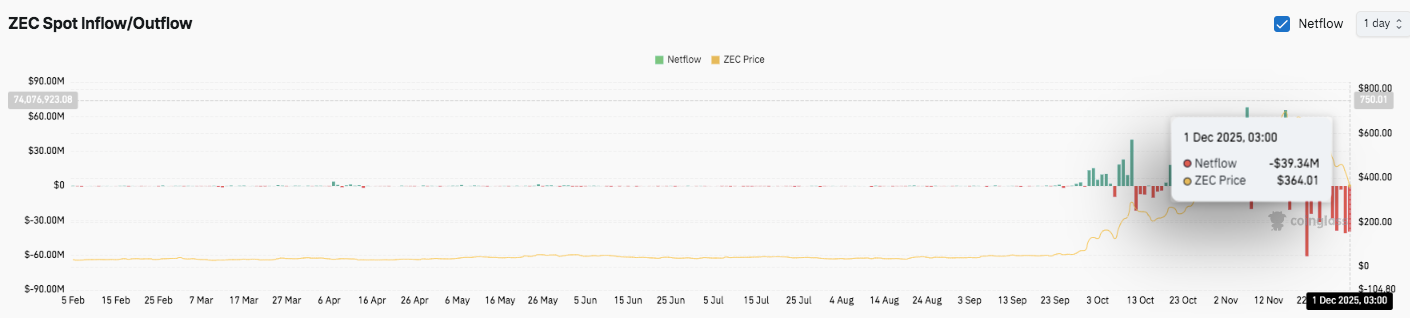

Netflows suggests aggressive distribution

We’re additionally seeing main adjustments within the move of on-chain exchanges. Web flows remained virtually impartial from February to late September. Exercise elevated in October, with remoted inflows and huge outflows in November.

The most recent readings present a notable web outflow of $39.34 million as ZEC trades round $364. This sample signifies distribution strain as merchants are taking earnings after an prolonged bull market.

Governance considerations add new layer

Moreover, discussions about governance have resurfaced throughout the group. Vitalik Buterin raised considerations about token-based governance and warned of long-term dangers associated to privateness.

His feedback reignited an earlier debate about how governance fashions will affect the event of privacy-focused networks. Because of this, market watchers now see governance stability as one other issue that would affect ZEC sentiment within the coming months.

Associated: Zcash Worth Prediction: ZEC maintains bullish bias whereas Cypherpunk boosts holdings

Technical outlook for Zcash value

Key ranges stay well-defined as Zcash trades in a strain construction close to multi-week lows.

The upside degree consists of instant hurdles at $406, $424, and $480. A break above these layers may pave the best way for a broader midrange restoration zone round $569 and the 0.5 Fibonacci degree.

Draw back ranges embrace near-term trendline assist at $361 to $360, adopted by the $320 to $300 demand space. A extra extreme failure may expose $280, however that is nonetheless the first structural decrease sure on the excessive timeframe chart.

The $424 resistance ceiling and 0.236 fib, which coincide with the supertrend, function key ranges to reverse for medium-term momentum to alter. Costs proceed to compress between draw back resistance and horizontal assist, forming a tightening construction that means extra volatility is on the horizon.

Will Zcash get better?

Zcash’s subsequent transfer will depend upon whether or not patrons can maintain on to $361-$360 lengthy sufficient to push in the direction of $406 and $424. A robust restoration of the $424 cluster would weaken the bearish construction and permit ZEC to focus on $480 and even $569 if inflows strengthen.

Nevertheless, failure to carry $361 dangers breaking the present accumulation shelf, exposing ZEC to $320-$300, and even $280.

For now, ZEC stays in pivotal territory. Whereas the current cooling in derivatives buying and selling and sustained capital outflows spotlight waning confidence, technical compression suggests a decisive transfer is on the horizon. A change in move or a robust response at assist may decide the following significant leg for ZEC.

Associated: Zcash Whale loses $2.4 million as account capital disappears in leveraged flash

Disclaimer: The knowledge contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any form. Coin Version just isn’t answerable for any losses incurred because of using the content material, merchandise, or providers talked about. We encourage our readers to conduct due diligence earlier than taking any motion associated to our firm.