- Surge: Cryptocurrency hacks soared 10x in November, with losses totaling $172 million.

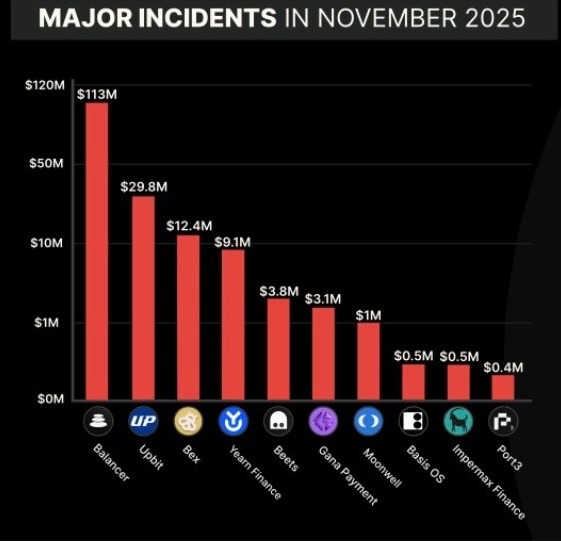

- Victims: Balancer ($113 million) and Upbit ($30 million) lead the listing of exploited entities.

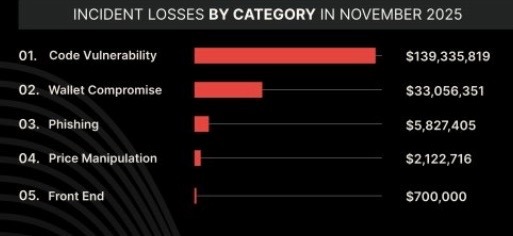

- Trigger: A flaw in good contract code has changed phishing because the primary assault vector.

The cryptocurrency sector suffered a devastating safety setback in November, with complete losses from exploits and hacks hovering practically 1,000% month-on-month.

In line with a forensic report from blockchain safety agency CertiK, the business has misplaced a complete of $127 million on account of vulnerabilities in good contracts, not phishing, which has regained its place because the main assault vector.

A better have a look at the highest crypto exploits for November 2025

Throughout a four-week interval in November 2025, CertiK Alert recorded greater than 10 large-scale assaults. The most important cryptocurrency assaults in November concerned Balancer and Upbit, leading to losses of $113 million and $29 million, respectively.

Bex and Yearn Finance recorded internet losses of roughly $12.4 million and roughly $9.1 million on account of system abuse. PeckShieldAlert reported earlier on Monday that Yarn Finance had siphoned off greater than $9 million and that attackers had exploited its good contract capabilities to mint an virtually infinite quantity of yETH tokens.

Late: Hackers earn $3.1 million by exploiting GANA funds on BSC Chain

DeFi attackers exploiting code vulnerabilities had been a serious contributor to the fund listing in November. Poorly designed bridges and different security measures have confirmed pricey for the DeFi area. Moreover, losses of over $33 million had been recorded in November on account of cryptocurrency pockets breaches.

Authorities-backed North Korean hackers had been accused in November of stealing a big quantity of the stolen funds. Superior assault strategies and the usage of crypto mixers comparable to Twister Money remained the principle movement of stolen funds final month.

Market Influence and Attainable Options to Cryptocurrency Exploit Threats

A 10x enhance in crypto exploits in November in comparison with the earlier month is contributing to the current debacle. Moreover, the lack of funds has lowered institutional buyers’ confidence within the potential of DeFi protocols to safe trillions of {dollars}.

On the time of writing, the entire worth locked (TVL) of the DeFi ecosystem was roughly $114 billion, and the stablecoin market capitalization was roughly $306 billion. The core builders of Ethereum (ETH), led by Vitalik Buterin, have been advocating for elevated privateness, decentralization, and safety within the cryptocurrency and blockchain area to strengthen mainstream adoption of the digital asset.

In line with Buterin, cryptocurrency customers shouldn’t belief Web3 builders who search to centralize methods within the identify of service enhancement. Mainly, Buterin believes that builders want to scale back centralization to eradicate danger factors.

Associated: StakeWise recovers $20.7 million from Balancer exploit, distributed professional rata to customers

Disclaimer: The knowledge contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any variety. Coin Version is just not liable for any losses incurred on account of the usage of the content material, merchandise, or companies talked about. We encourage our readers to conduct due diligence earlier than taking any motion associated to our firm.