- Entice: Bitcoin is buying and selling at $86,000, properly beneath its latest purchaser price foundation of $113,000.

- Flash: $20 billion lower in open curiosity signifies a large reset of leverage.

- Danger: Heavy overhead provide cap will increase till BTC recovers $89,000.

Bitcoin (BTC) has entered a crucial part of structural restore, stabilizing round $86,470 after a pointy rebound from the $92,000 resistance band. Though the asset has paused its decline, on-chain information reveals a extreme “cost-based lure” that would restrict upward momentum for weeks.

The pullback erased earlier positive aspects and pushed Bitcoin again towards ranges that merchants see as key to the market’s path heading into December.

Market charts present that Bitcoin’s decline accelerated after being rejected on the $92,000 stage, a degree at which sellers have intervened repeatedly all through the quarter. This pullback pushed the asset into the $81,000 to $84,000 vary, a zone that has served as a serious demand ground in latest months. Patrons have been energetic on this band, capping the decline and permitting the value to rebound in the direction of $86,000.

Analysts say Bitcoin must regain the $88,000 to $89,000 space to keep away from retesting the November lows. Above $90,000, the asset will transfer again throughout the $94,000 to $96,000 resistance cluster. Chart predictions point out that provide stays excessive round $102,000, however a break by way of this barrier might pave the way in which to the $100,000 stage.

Quick-term holders face huge losses

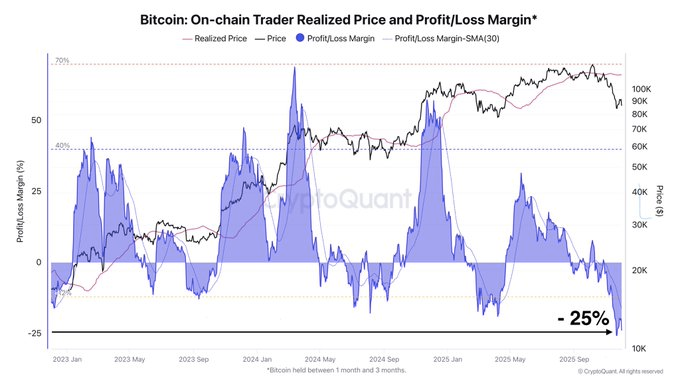

On-chain information reported by cryptocurrency analyst Darkforest offers an in depth view of market tensions. The realized value for 1-3 month holders has fallen to $113,692, with common unrealized losses within the 20-25% vary. Analysts monitoring this phase say this is likely one of the strongest capitulation phases since early 2023.

CryptoQuant’s chart reveals that the revenue margin has fallen into unfavorable territory, reflecting the continued strain on new market entrants. In earlier cycles, we’ve seen comparable declines happen close to native bottoms when most of those merchants cease promoting or altering positions. Nevertheless, present measurements present that whereas spot costs are removed from latest highs, realized costs proceed to fall.

Darkforest additionally famous that leveraged positions proceed to be unwound by way of compelled liquidations and voluntary closures as merchants turn out to be extra cautious. He famous that the present setting has solidified a risk-off method, leading to a discount in Bitcoin’s derivatives publicity.

In accordance with his information, BTC open curiosity has fallen by about $20 billion since October 6, making it the biggest decline this cycle and probably the most extreme within the historical past of the Bitcoin derivatives market.

Market information reveals extreme liquidation strain

Bitcoin fell greater than 5% up to now 24 hours, buying and selling round $86,473, in keeping with CoinMarketCap statistics. Market capitalization decreased to roughly $1.72 trillion as buying and selling quantity elevated by 70% to greater than $63 billion.

The surge in quantity displays a powerful repositioning after Bitcoin fell from over $91,000 to beneath $87,000 in steady in a single day buying and selling.

Disclaimer: The data contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any form. Coin Version isn’t chargeable for any losses incurred on account of using the content material, merchandise, or providers talked about. We encourage our readers to conduct due diligence earlier than taking any motion associated to our firm.