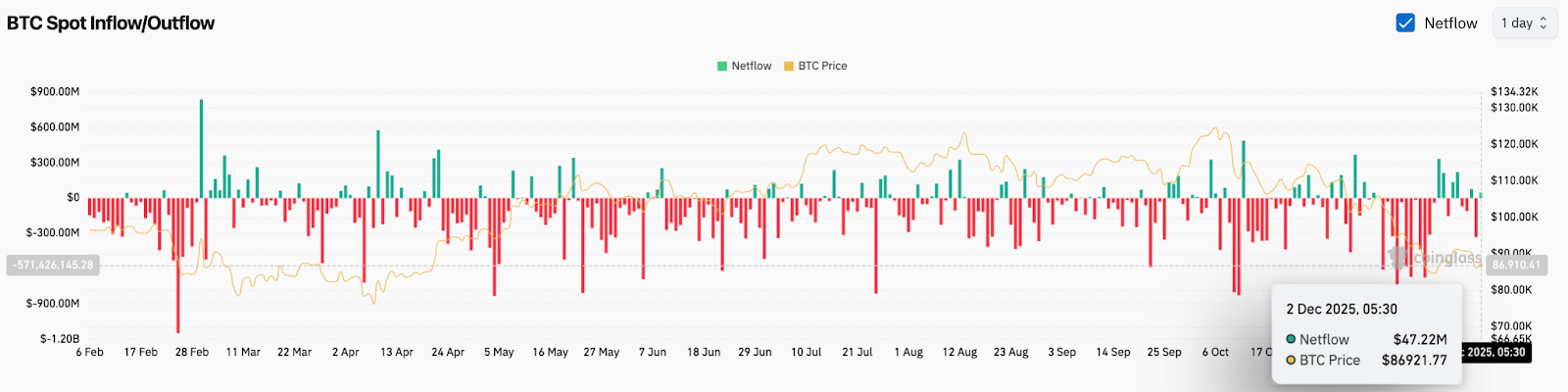

- Bitcoin recorded inflows of $47.2 million, however stays under the $90,000 to $92,000 rejection zone.

- The worth is buying and selling under the 20-day, 50-day, 100-day, and 200-day EMAs, confirming a sustained downtrend on longer time frames.

- With help between $84,000 and $82,000, the cryptocurrency’s concern and greed index drops to 22, reflecting the chance of capitulation.

Bitcoin value is buying and selling round $86,900 at this time after a pointy intraday rebound that took it under the $90,000 space. The transfer displays a brief restoration after final week’s selloff, however consumers stay weighed down by a falling trendline and extreme unfavourable sentiment throughout the market.

Sellers stay in management as Bitcoin dips under key day by day EMA

The day by day chart reveals that Bitcoin stays in a descending wedge after a three-week decline that noticed it break under a number of help ranges. Value stays under the 20-day, 50-day, 100-day, and 200-day EMAs centered between $91,500 and $103,900. The coincidence of those transferring averages strengthens the broader downtrend and makes restoration makes an attempt troublesome.

The downtrend line from the mid-October excessive continues to restrict any upside, with repeated failures round $90,000 to $92,000. Every rejection lowered the excessive and shifted momentum again into the wedge construction. Sellers preserve their benefit till Bitcoin closes above the pattern line.

The parabolic SAR indicator stays above costs, confirming continued downward strain. This indicator has not reversed to bullish since early October, and the present positioning signifies that sellers proceed to dominate the medium-term construction.

Assist stays concentrated between $84,000 and $82,000, and volatility has diminished over the past week resulting in the present rebound. Value is making an attempt to determine the next low inside this zone, however a sustained follow-through above the resistance is required to verify it.

Spot outflow is gradual, however the pattern stays unfavourable

Bitcoin recorded web inflows of $47.2 million at this time, in accordance with knowledge from Coinglass. This marks a reversal from the deep crimson print seen in November, however the broader sample reveals a constant distribution over the previous six weeks. Main unfavourable scores have been recorded in most periods as market individuals diminished threat throughout the spike in volatility.

For flows to help a pattern reversal, a constant constructive studying should emerge together with an enchancment in value motion. At this stage, the information reveals defensive positioning somewhat than accumulation.

Intraday chart reveals an try at stabilization under $90,000

Charts on shorter time frames present that Bitcoin is about to consolidate after final week’s sharp decline. Value has regained VWAP on the 2-hour timeframe and is at present testing the underside of the damaged pattern line, creating a possible retest zone.

Momentum indicators point out early stabilization. The RSI has recovered from its oversold ranges and is at present buying and selling round 43, indicating much less promoting strain. Nevertheless, the rebound stays shallow, with costs persevering with to maneuver under the resistance ranges which have supported the continuation of the pattern.

A detailed above $88,500 would point out a slight change, whereas a break above $90,000 would affirm the primary excessive for the reason that break. Intraday actions will stay corrective till these ranges recuperate.

Sentiment turns defensive when concern index reaches excessive ranges

Based on Coinglass knowledge, the crypto concern and greed index is 22, indicating deep concern. Sentiment rapidly deteriorated after Bitcoin was above $110,000 in the beginning of the quarter. Comparable ranges of concern have coincided with rebound makes an attempt in previous cycles, however they haven’t essentially signaled sustained bottoms.

Bitcoin’s seasonality gives a delicate backdrop. Traditionally, October and November are likely to have robust constructive efficiency, with common month-to-month good points of 19.92% in October and 41.12% in November, in accordance with Coinglass knowledge.

Each months this 12 months have recorded unfavourable returns, indicating that the latest decline is opposite to seasonal norms.

December has traditionally carried out positively with a median achieve of 4.11%, however outcomes range broadly from 12 months to 12 months. Previous cycles have seen each robust recoveries and sharp declines, relying on market circumstances.

Given the present downtrend and risk-off sentiment, seasonality alone doesn’t present clear route. Merchants aren’t positioning primarily based on previous patterns, and the market reacts extra to liquidity and sentiment than to calendar results.

outlook. Will Bitcoin go up?

A bullish breakout would require a day by day shut above $92,000, supported by elevated quantity and bettering flows. That may sign a shift from reactive shopping for to pattern formation.

The bearish continuation begins with a detailed under $82,000, which confirms a deeper correction in direction of $78,000 and doubtlessly even decrease ranges if sentiment stays subdued.

Till a decisive transfer happens, Bitcoin will stay trapped in a wedge, with sellers holding a bonus under resistance and consumers defending key help in opposition to a backdrop of hostile sentiment.

Disclaimer: The knowledge contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any variety. Coin Version shouldn’t be answerable for any losses incurred on account of using the content material, merchandise, or providers talked about. We encourage our readers to conduct due diligence earlier than taking any motion associated to our firm.