- Bitcoin’s sharp decline harm market confidence and slowed the momentum towards a full-fledged alt season.

- The ISM PMI is at 48.2, indicating weak spot in manufacturing, hampering sturdy progress in cryptocurrency liquidity.

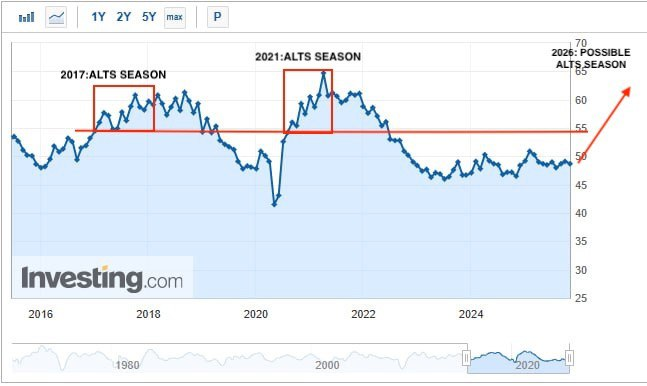

- Earlier alt seasons solely began when ISM was above 55.

The elusive Altseason. The interval of parabolic progress of non-Bitcoin property has been successfully halted by US trade for the rest of 2025. New financial knowledge launched on Monday reveals that the macroeconomic liquidity wanted to gas such a rally simply is not there.

Analysts say there are a number of elements behind this decline. Issues a couple of return to regular costs after months of beneficial properties, document gold costs, a quiet however tense inventory market, and a limiteless provide of competing crypto property.

Amid such uncertainty, consultants have give you a solution as to why the 2025 ortho season has been postponed, primarily based on new financial knowledge.

Associated: Bitcoin falls under key ranges as short-term holders face heavy losses

Indicators that predicted all previous alt seasons

New evaluation reveals that the US ISM Manufacturing PMI is among the most dependable indicators of the upcoming orthoseason. The newest studying for November was 48.2, decrease than anticipated and confirming a contraction within the manufacturing sector.

The numbers mirror responses from greater than 400 firms concerning new order standing, manufacturing exercise, employment developments, stock ranges and supply speeds. A studying under 50 suggests an financial slowdown, and November’s numbers affirm that the U.S. industrial sector has not but begun a significant restoration.

Why this issues for cryptocurrencies

Historic knowledge reveals that different seasons are likely to emerge solely when the general financial system is increasing. In each 2017 and 2021, the ISM index was above 55 when altcoins started their largest beneficial properties.

This additionally explains why many altcoins proceed to battle regardless of remoted beneficial properties and occasional optimism on social platforms.

Regardless of the present weak spot, forecasts for 2026 embody decrease rates of interest, improved liquidity, and a extra supportive coverage surroundings. These elements might steadily push the ISM index again into growth territory.

Market sentiment and technical outlook

The cryptocurrency neighborhood stays divided. Some traders have criticized the observe of classifying each small pullback as an alt-season, arguing {that a} 90% or extra drop in lots of tokens and doubling from the underside shouldn’t be a real restoration.

Some say altcoins have been suppressed for thus lengthy {that a} main rotation is inevitable.

Technical evaluation reveals Bitcoin’s dominance rejecting the 50-week shifting common, which has similarities to the sample seen earlier than the 2021 alternate options season. Analyst Michael van de Poppe stated the drop firstly of the month might be a part of the ultimate shakeout stage earlier than a rebound.

“Subsequent month will probably be no exception, with many macroeconomic occasions that may have an effect on the route of the market. Total, my private opinion is that BTC$ and ETH$ will rise reasonably than fall.”

Associated: That is the primary purpose why Bitcoin fell 5% to $85,000 on December 1st.

Disclaimer: The data contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any sort. Coin Version shouldn’t be accountable for any losses incurred because of using the content material, merchandise, or providers talked about. We encourage our readers to conduct due diligence earlier than taking any motion associated to our firm.