- The quant value in the present day is buying and selling round $98 after a rejection above $100 and a provide zone at $105.

- A breakout above a serious development line will change the construction to a bullish one, whereas an outflow signifies profit-taking.

- Sustaining above $94-$95 maintains the upside in direction of $120, whereas lowering the danger of failure to the $80 area.

Quant costs are buying and selling round $98 in the present day, failing to interrupt above the important thing psychological degree of $100 after a breakout from a multi-month downtrend line. The transfer marks the primary clear technical shift in months, however the rejection pressured patrons to defend larger lows as spot flows remained damaging.

Breakouts trigger structural modifications in each day developments

The each day chart confirms a decisive break within the descending resistance that has dominated the worth motion because the second quarter. The breakout adopted a powerful rally from the $70 zone, reversing sentiment within the brief time period and turning the earlier resistance into a possible assist space.

The quant is at present buying and selling above all main transferring averages.

- 20-day EMA close to $87.93

- 50-day EMA close to $86.94

- 100 day EMA is round $90.73

- 200 day EMA is round $94.03

This cluster restoration is vital as a result of QNT spent a lot of final quarter buying and selling under this cluster. Retrieving all EMAs in a single impulse rally is often a bullish signal, however a profitable retest is required for it to proceed.

The rejection close to $110 signifies that sellers nonetheless management oblique liquidity. Any try above $105 is met by provide, leaving restricted house for the bulls. The value is at present in a zone the place patrons have to intervene to keep away from the breakout from failing.

The two-hour chart reveals a slim channel uptrend with slowing momentum.

The shorter timeframe reveals that the quant stays strong inside the post-breakout ascending channel. The construction of the 2 hours is tidy, however there’s a noticeable lack of momentum.

The supertrend is above $103 and serves as a right away resistance degree, however the higher channel line has repeatedly rejected the worth. Parabolic SAR has outperformed value through the rebound, indicating that the momentum inside the channel is slowing.

The underside of the channel is at present close to $95, and that degree ought to be the primary assist for intraday merchants. A detailed under this line would expose a deeper decline in direction of the 20-day EMA cluster round $90-$94. Holding above the decrease channel retains the construction intact and preserves the potential of a retest between $105 and $110.

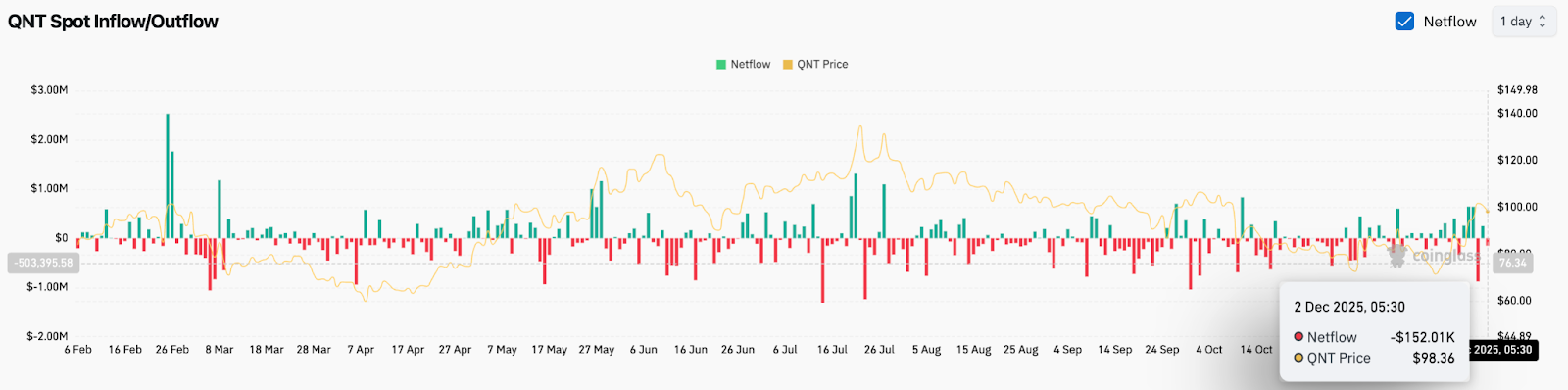

Spot outflows point out early revenue taking

Coinglass information reveals a web outflow of $152,000 on December 2nd, persevering with a modest however persistent promoting development.

Though not massive in comparison with market capitalization, its conduct displays distribution reasonably than accumulation. This circulation can also be in line with the rejection at $110, suggesting that holders used the power to exit positions reasonably than enhance publicity.

Over the previous yr, quants have proven an inclination for outflows to speed up round native peaks and inflows to dominate during times of worth accumulation. The present circulation sample is between these extremes, not a panic exit, however not aggressive positioning both.

outlook. Will quant go up?

Quant continues to take care of a constructive construction after its breakout, however patrons have to show they will keep momentum.

The bullish case stays so long as the worth sustains above $94-95 and regains $105 with growing quantity. This transfer would point out power behind the breakout and create a path from $120 to $125.

A bearish case emerges if the worth loses the channel and closes under $94-$90, through which case the rally fails to breakout and exposes draw back dangers in direction of $80-$70.

The development expands as patrons rise above the resistance and regain management. If the upper assist fails to defend, the market will deal with the transfer as a response reasonably than a reversal.

Disclaimer: The knowledge contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any sort. Coin Version just isn’t accountable for any losses incurred on account of the usage of the content material, merchandise, or providers talked about. We encourage our readers to conduct due diligence earlier than taking any motion associated to our firm.