- Ethereum has damaged above short-term resistance inside the triangle, and the bulls are concentrating on the $3,477 to $3,566 zone.

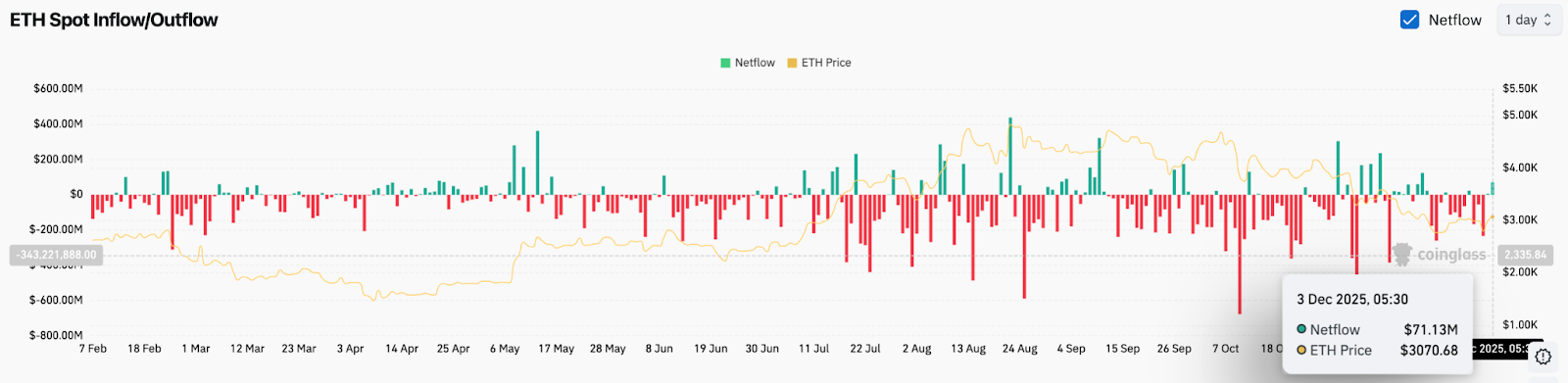

- Spot inflows turned constructive as merchants moved from distribution to accumulation, with $71 million flowing into the market.

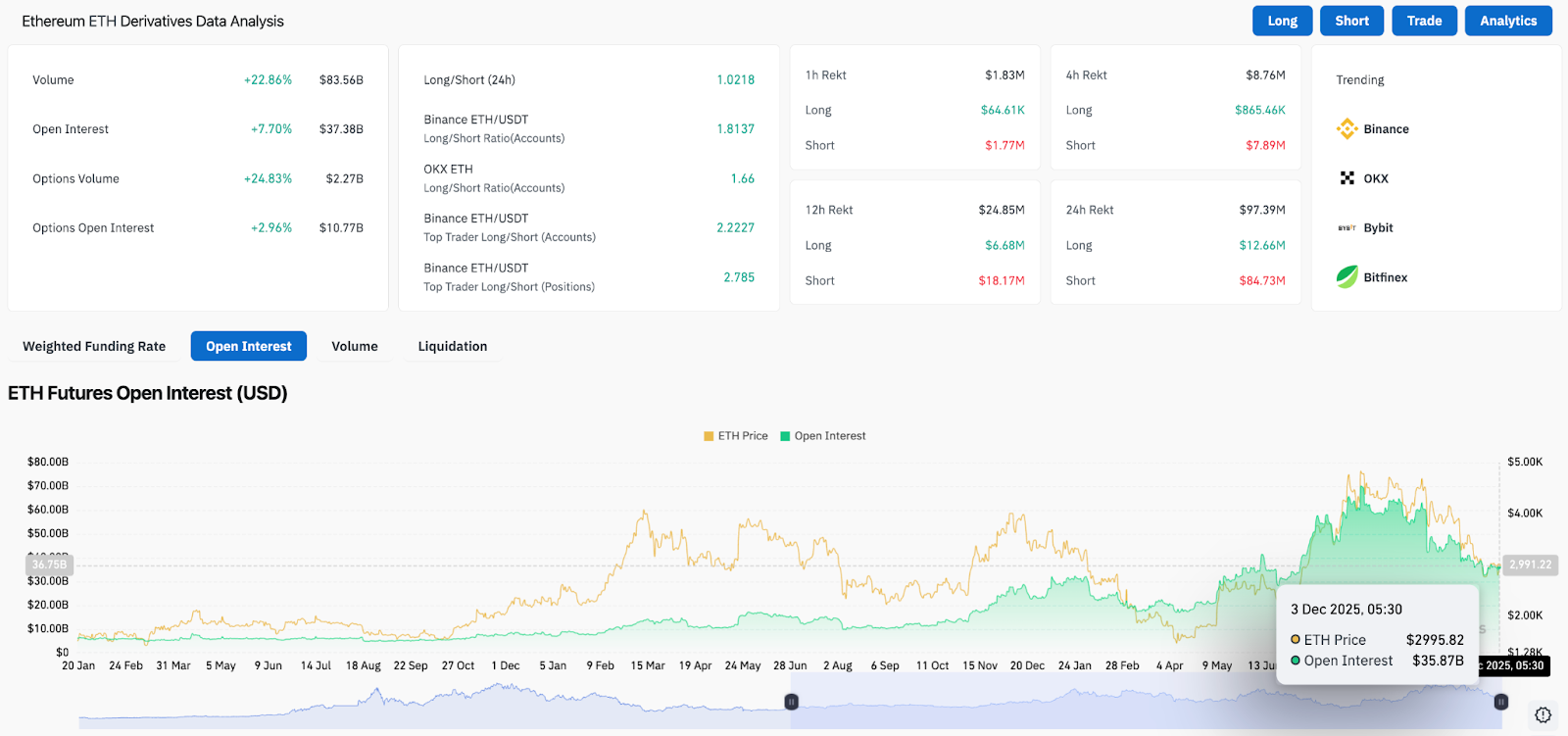

- Futures open curiosity rose 7.7%, indicating elevated leverage and bullishness throughout main exchanges.

Ethereum worth is buying and selling round $3,070 immediately, breaking above the downtrend line that has capped any pullback since late October. This transfer offers consumers a short-term benefit inside a big symmetrical triangular construction, however overhead resistance from the EMA cluster and supertrend high continues to restrict momentum.

Pattern line break offers Bulls first technical win in weeks

The every day chart exhibits that Ethereum is approaching a confluence of resistance ranges. Value has regained the psychological threshold of $3,000 and is testing the underside of the development line that intersects the 20-day and 50-day EMAs close to $3,363 and $3,477. A definitive breakout above this zone will full the triangle sample and open the door to the 200-day EMA close to $3,566.

The supertrend sign stays bearish at $3,382. Except costs overcome that set off, the rally might face renewed promoting stress, particularly from algorithmic merchants who had been energetic throughout latest development reversals.

Assist stays effectively outlined. The triangle’s decrease upside intersects close to $2,850. This stage was examined a number of instances throughout November and represents the primary structural ground.

Quick-term chart exhibits aggressive breakout try as a consequence of overbought sign

The 1-hour chart offers a clearer view of the state of affairs in the course of the day. Ethereum has damaged above the downtrend line that rejected a number of beneficial properties from November to early December. Though costs have risen sharply, the RSI has reached an overbought stage above 76, reflecting each energy and short-term pullback danger.

MACD stays bullish with widening divergence and constructive histogram bars. Consumers have regained short-term management, however continuity requires consolidation relatively than new vertical strikes.

Associated: Solana Value Prediction: Bullseye to Breakout on Elevated Internet Inflows at $155

If Ethereum fails to rise above $3,050 after the consolidation section, the breakout turns into susceptible to a pointy intraday reversal in the direction of $2,950. Consumers must defend increased lows on shorter time frames to maintain the breakout construction.

Spot inflows return as market turns into cumulative

Spot circulation information exhibits web inflows on December third had been $71 million. This marks a change from the heavy distribution that dominated most of November and coincides with a break above resistance. Traditionally, constructive flows throughout a breakout improve the probability of a continuation, particularly if the influx persists over a number of periods.

Nonetheless, whereas the latest inflows are usually not giant sufficient to outline a development, they’re significant as a result of they seem after weeks of web outflows.

Futures markets present rising leverage and elevated danger urge for food

Spinoff information signifies adjustments in positioning. Open curiosity in Ethereum futures elevated by 7.7% to $37.38 billion, with quantity rising by greater than 22%. Choices buying and selling elevated almost 25%, with choices open curiosity rising in the direction of $10.8 billion.

The long-short ratio signifies a bullish skew. The Binance account ratio is above 1.8 and the positions of high merchants are rising in the direction of 2.8. This variation signifies that merchants are including lengthy publicity relatively than merely exiting shorts.

The danger is that leverage stays excessive and will unwind rapidly if worth fails to withstand. Nonetheless, will increase in leverage throughout up breaks usually mirror participation and confidence relatively than desperation.

Futures markets are gearing up for continuation, however sustained worth beneficial properties would require assist from circulation and spot quantity.

outlook. Will Ethereum go up?

Ethereum broke above short-term resistance as a consequence of improved flows and rising leverage, giving bulls their first official alternative to problem the primary resistance. Momentum favors continuation, however the construction has not reversed from correction to bullish.

- Bullish case: A clear break above $3,477 and a subsequent shut above $3,566 would set off a development reversal and open the door from $4,000 to $4,100.

- Bearish case: Failure on the present resistance stage dangers sending the value again contained in the triangle and a break in the direction of $2,850. A break under this stage will expose a deeper draw back in the direction of $2,650.

If Ethereum regains the EMA cluster round $3,566 with rising quantity, management of the development will shift. In the event you lose $2,850, the breakout turns into a failure sample relatively than a restoration.

Disclaimer: The data contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any type. Coin Version isn’t answerable for any losses incurred on account of using the content material, merchandise, or companies talked about. We encourage our readers to do their due diligence earlier than taking any motion associated to our firm.