- Bitcoin’s rally is constructing cautious energy as key EMAs nonetheless cap any clear upward momentum.

- Regardless of the current market decline, the rise in futures charges exhibits merchants’ agency perception.

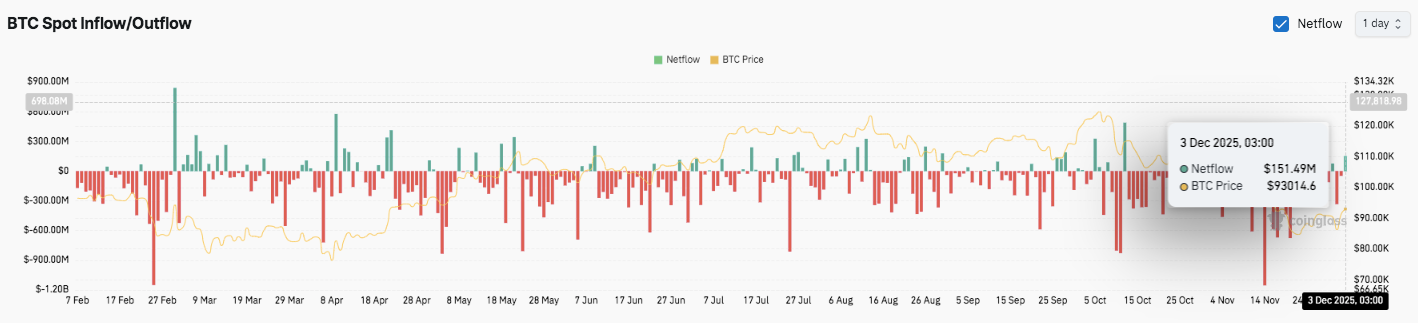

- New spot inflows point out a return to accumulation as Bitcoin stabilizes at main helps.

Bitcoin is stabilizing after falling sharply in direction of $80,527, with merchants keeping track of the 4-hour construction for route. The asset is buying and selling round $92,930 and attracts a number of technical layers. This sector is at present shaping its near-term outlook. Whereas the current restoration has boosted market confidence, the broader image nonetheless factors to a managed downtrend. B

Sides, by-product exercise, and spot flows reveal new dynamics that would affect the subsequent huge swing. Due to this fact, the present consolidation carries extra weight than the sooner retracement section seen this 12 months.

Worth construction builds cautious restoration

Bitcoin continues to battle with main shifting averages limiting its upward momentum. The 100 EMA is trending down close to $94,516 and the 200 EMA is trending down at $95,414, indicating broader stress. Nonetheless, patrons defended $89,006, which is in line with the 0.236 Fibonacci degree.

This protection created a possible high-low. Moreover, the 0.382 Fibonacci zone at $94,251 stays the primary actual barrier. Worth has failed us right here many instances. An in depth above this degree would intensify restoration makes an attempt.

The following main affirmation degree is situated close to the 0.5 retracement at $98,491. Past this space, there may be room to maneuver in direction of $102,730 and $108,766. These targets are in line with deeper Fibonacci ranges and early structural turning factors.

Brief-term help is forming close to $91,011, the place the 20, 50, and 100 EMAs converge. Sustaining this zone is important to rebuilding the pattern.

Associated: Ethereum Worth Prediction: Triangle Breakout Makes an attempt as Flows…

Moreover, the broader help space at $89,006 stays the anchor for the present construction. A break under $85,000 would weaken sentiment and expose the current cycle low of $80,527.

After the value reached the higher restrict, the Bollinger Bands narrowed. This compression indicators the arrival of volatility. A sustained break above $94,200 might widen the band and strengthen the bullish momentum.

Derivatives and spot flows point out new participation

Bitcoin futures open curiosity rose in direction of $58.8 billion by December third. This regular rise exhibits that merchants are holding on to their positions regardless of the pullback. In consequence, derivatives markets replicate robust confidence and heightened hypothesis.

After weeks of heavy outflows, spot flows have additionally turned constructive. The most recent influx of $151.49 million signifies an bettering accumulation round $93,014. Moreover, this transformation means that promoting stress will ease as Bitcoin stabilizes above a serious help degree.

Technical outlook for Bitcoin worth

As Bitcoin enters the subsequent section of the 4-hour market construction, key ranges stay clearly outlined.

High degree: Rapid hurdles are $94,251 (0.382 fib), $95,414 (200 EMA), and $98,491 (0.5 fib). A break above these ranges might widen the upside expectations to $102,730 and $108,766.

Cheaper price degree: $91,011 acts as the primary determination zone, adopted by $89,006 (0.236 Fib) and deeper help at $85,000. The principle structural ground stays pegged at $80,527.

Higher restrict of resistance: The 200 EMA at $95,414 is a key degree that Bitcoin should recuperate to regain medium-term bullish momentum. Clearing this degree would reverse the broader pattern and pave the best way for increased Fibonacci targets.

Bitcoin continues to compress under the descending EMA whereas forming a low above $89,000. This construction is much like a tightening vary inside a broader corrective downtrend. Exceeding this compression might set off a pointy improve in volatility, much like the earlier restoration in 2025.

Will Bitcoin go up?

Bitcoin’s worth outlook hinges on whether or not patrons can preserve stress above the $91,011-$89,006 help cluster lengthy sufficient to retest the robust resistance close to $94,251 and $95,414. Momentum merchants give attention to this zone as a result of it coincides with the confluence of shifting averages and Fibonacci thresholds.

Technical compression, bettering spot inflows, and elevated open curiosity counsel a build-up to an even bigger transfer. If inflows speed up and the value closes above the 200 EMA, Bitcoin might re-reach $98,491 and prolong in direction of $102,730.

Associated: Solana Worth Prediction: Bullseye to Breakout on Elevated Internet Inflows at $155

Nonetheless, if it fails to maintain above $89,006, the pattern might retrace deeper in direction of $85,000 and the cycle might discover a low close to $80,527. If this breaks down, sentiment will doubtless return to a risk-averse route.

For now, Bitcoin is buying and selling at a pivotal level. Market participation is rising, volatility is reducing, and key ranges are converging. The following decisive transfer will depend upon how the value interacts with the $94,251-$95,414 resistance band and whether or not patrons preserve management of the help ground.

Disclaimer: The data contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any variety. Coin Version isn’t chargeable for any losses incurred on account of using the content material, merchandise, or providers talked about. We encourage our readers to do their due diligence earlier than taking any motion associated to our firm.