Panama Metropolis – Blockman PR – December 4, 2025 — HTX Analysis, the specialised analysis arm of the world’s main cryptocurrency alternate HTX, has launched its newest report. Market predictions: from structural bottlenecks to infrastructure revolution to the way forward for sizzling propertysupplies a structured evaluation of the forecast market fundamentals, improvement trajectory and long-term potential. This examine discusses why prediction markets proceed to face structural limitations regardless of their speedy development, and whether or not prediction markets can finally turn out to be the pricing infrastructure for attention-based property.

Prediction markets as a sizzling rising economic system: a pointy distinction with meme cash

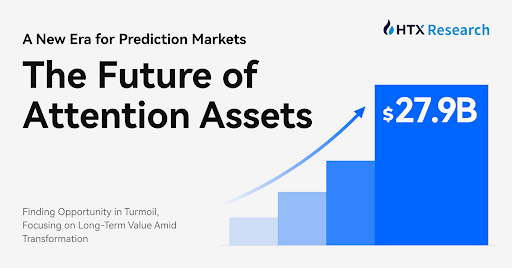

Prediction markets are rising quickly. Within the first 10 months of 2025, international buying and selling quantity reached $27.9 billion, a rise of 210% from 2024. Just like meme cash, prediction markets have a excessive focus of small-cap contributors. Nonetheless, the 2 function by means of essentially totally different mechanisms.

Prediction markets permit contributors to allocate small quantities of cash to a number of occasions with clear odds and clear downsides. Occasion constructions permit knowledgeable customers to show area information into measurable income, particularly in illiquid markets the place data gaps create alternatives.

Memecoin transactions observe a unique sample. Pump.enjoyable creates 10,417 tokens day-after-day, 98.6% of that are recognized as manipulated, and sometimes final lower than three months. Costs fluctuate based totally on social momentum fairly than chance. Data asymmetry closely favors token creators and leaves extraordinary customers reliant on hype cycles fairly than knowledgeable insights.

Prediction markets additionally unfold by means of social channels, however their traction comes from the dynamics of evolving occasions fairly than spikes in emotion. For many contributors, prediction markets operate as information-based competitions, whereas meme cash are extra like attention-seeking lottery tickets.

Speedy development and underlying structural weaknesses

Regardless of the rise in contributors, prediction markets stay structurally weak. Liquidity on many platforms nonetheless depends on incentives. Some used to spend greater than $50,000 a day on market-making subsidies, however that depth has shrunk as incentives have declined. As loss outcomes settle to zero, it turns into troublesome for the market to build up everlasting depth, and as issues get nearer to decision, knowledgeable merchants achieve more and more favorable pricing and market makers’ losses improve.

Different structural limitations additionally stay. Binary codecs have restricted expressive energy. Discovery is weak when the market is skinny. Creation of occasions with out permission is restricted. And Oracle’s cost processes face dangers of delay and tampering. These challenges reveal that prediction markets are nonetheless within the early levels of infrastructure improvement.

Structural innovation alerts the following stage

New system designs are rising to handle these constraints. Simply-in-time liquidity injects capital solely when wanted, rising effectivity. Steady combinatorial markets cut back fragmentation as a result of views might be expressed throughout a steady vary fairly than in remoted binaries.

New forecasting constructions, together with perpetual contracts constructed on predictive market knowledge and fast-settlement binary codecs, lengthen expressive energy past conventional designs. Distribution can also be evolving. Stochastic path charts are a pure match for social feeds, and new platforms are more and more embedding commerce flows into social networks, turning prediction markets into “monetary codecs” distributed by means of consideration channels.

These improvements don’t instantly remedy all structural challenges, however they do sign a shift towards extra scalable architectures.

The rise of attention-based finance

HTX Analysis factors out that sizzling property have gotten the third main asset class after money move property and provide and demand property. Consultant tokens inside this class embody BAT, KAITO, and so forth. Based on HTX knowledge, BAT has risen greater than 30% up to now 30 days and KAITO as soon as hit the market in H1 2025.

Along with these tasks, HTX Analysis means that prediction markets may turn out to be the core pricing infrastructure for warm property. Current user-generated featured property comparable to NFTs and creator tokens begin from scratch and fail to seize established cultural associations. In distinction, prediction markets generate time-based worth and liquidity alerts that may be aggregated right into a featured index that displays real-world visibility.

Such an index has a number of benefits. Precise capital is required to function the index. Current consideration might be expressed with out ranging from scratch. Contributors can then take lengthy or quick positions as their consideration shifts. As this framework matures, prediction markets could evolve from a instrument for predicting outcomes to an infrastructure that may measure and worth cultural relevance, a supporting automobile comparable to Consideration Perpetual.

conclusion

Prediction markets are transferring from speedy development to structural sophistication. Challenges stay, however improvements throughout fluidity, expressiveness, and distribution are reshaping market design. As attention-based property turn out to be extra clearly outlined, prediction markets could more and more function a connecting layer between cultural and financial values.

In comparison with the emotion-driven volatility of meme cash, prediction markets supply information-driven, probability-based participation. Because the structure matures, its function within the digital asset ecosystem is more likely to increase considerably.

About HTX Analysis

HTX Analysis is the specialised analysis division of HTX Group and is chargeable for conducting in-depth evaluation, producing complete reviews, and offering professional assessments throughout a variety of matters, together with cryptocurrencies, blockchain know-how, and rising market tendencies. HTX Analysis is dedicated to offering data-driven insights and strategic foresight, taking part in a pivotal function in shaping the business panorama and supporting knowledgeable decision-making within the digital asset area. By way of rigorous analysis methodologies and cutting-edge evaluation, HTX Analysis stays on the forefront of innovation, driving thought management and fostering a deeper understanding of evolving market dynamics. Please come and go to us.

Contact the HTX analysis staff: (e-mail protected)

Disclaimer: The knowledge contained on this article is a part of sponsored/press launch/paid content material and is for promotional functions solely. Readers are inspired to train warning and conduct their very own investigation earlier than taking any motion associated to the content material on this web page or our firm. Coin Version just isn’t chargeable for any loss or harm suffered on account of or in reference to the usage of any content material, services or products talked about.