- Senator Cynthia Lummis lampoons the Franklin Bitcoin meme as BTC rebounds close to $92,000

- Her bullish tone leans towards ETF, financial institution custody, and 401k adoption as coverage clears

- Supporters hyperlink her message to pushing for Bitcoin laws and making the Fed dovish in 2026.

U.S. Sen. Cynthia Lummis posted a bullish message for Bitcoin following the latest backlash, positioning it as a path to financial freedom. Professional-Bitcoin lawmakers joined different outstanding voices in repeating the “purchase on the sting” argument because the market weathers latest volatility.

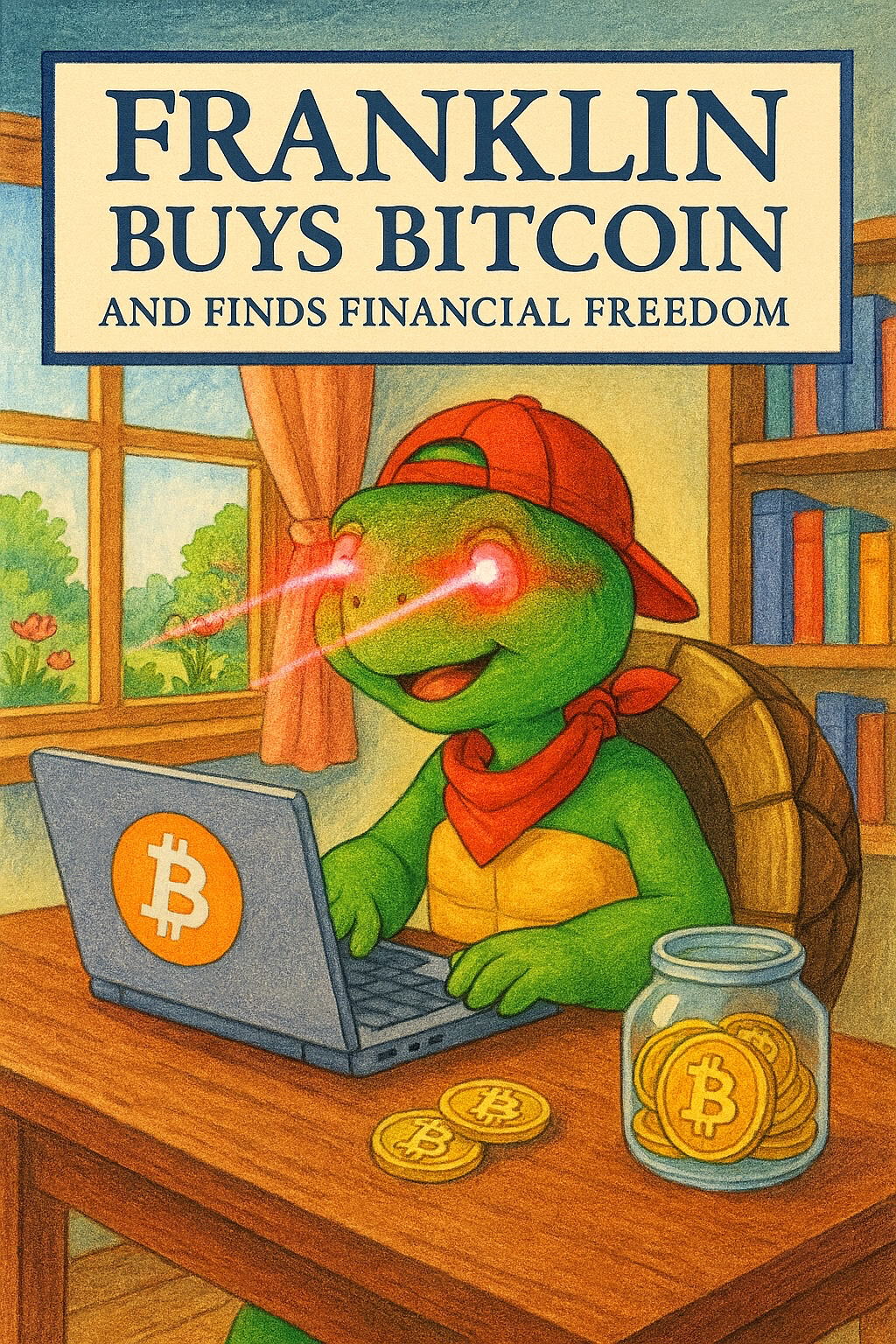

As Bitcoin regained its key liquidity zone round $92,000, Sen. Lummis shared a picture of Franklin the turtle with glowing “laser eyes” and a caption that joked, “Franklin buys Bitcoin and achieves monetary freedom.” The put up garnered vital consideration for X, reaching roughly 741,000 views on the time of publication, reinforcing the concept one other crypto summer time may very well be upon us if coverage and liquidity align.

Associated: The Federal Reserve carries out a large liquidity injection of $13.5 billion. “Silent” liquidity pump boosts crypto costs

Why is Senator Lummis so bullish on Bitcoin?

Institutional adoption and financial institution safety make her bullish case clear

Sen. Lummis has repeatedly advocated that the U.S. authorities can buy Bitcoin as a reserve, positioning it as a strategic retailer of worth alongside extra conventional belongings. Her newest message builds on the continued adoption of BTC by institutional traders and the rising base of retail holders accessing the asset by way of regulated channels.

Supporters level to latest regulatory approvals permitting U.S. banks to retailer Bitcoin on behalf of their clients, a change that prompts main monetary establishments to formalize their BTC methods. This background offers Lummis house to argue that Bitcoin has moved past fringe buying and selling and now features as a digital commodity that may be invested inside conventional methods.

Vanguard, which manages an estimated $9 trillion in belongings, joins BlackRock and Franklin Templeton in increasing entry to Bitcoin. Earlier this week, Vanguard reversed its stance and allowed greater than 50 million clients to commerce spot BTC ETFs from third-party issuers led by IBIT and FBTC.

Regulatory Readability, The Story of Bitcoin Regulation, and Fed Politics

Lummis additionally hyperlinks her optimism to what she describes as elevated regulatory transparency in the USA. Supporters argue that below President Trump, bitcoin has gained sufficient construction and authorized footing to draw lots of of billions of {dollars}, together with allocations from once-sidelined 401k plans and different retirement autos.

Moreover, the US authorities is regularly rising its strategic Bitcoin holdings and is anticipated to expedite the method by way of the approval of the Bitcoin Act.

“We’re on the trail to Congressional approval for the U.S. authorities to start accumulating Bitcoin (SBR) at an unprecedented fee. Slowly, instantly, and unexpectedly!” the X account replied to Lummis.

Why supporters say the timing of her message issues

Bitcoin is anticipated to guide the general crypto market with a bullish rally within the first quarter of 2026. In keeping with Alice Liu, head of analysis at CoinMarketCap, the crypto market will document a restoration within the first quarter of 2026.

“The market will get well within the first quarter of 2026. Primarily based on a mixture of macro indicators, February and March shall be one other bull market,” Liu stated.

Bullish posts from Binance-related social accounts may have a big impression on FOMO (concern of lacking out) for retail merchants. As such, Lummis could also be encouraging traders to look to Bitcoin to realize the monetary freedom they want.

Associated: Polish president rejects digital foreign money regulation invoice regardless of EU stress

Disclaimer: The data contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any form. Coin Version is just not accountable for any losses incurred on account of using the content material, merchandise, or providers talked about. We encourage our readers to do their due diligence earlier than taking any motion associated to our firm.