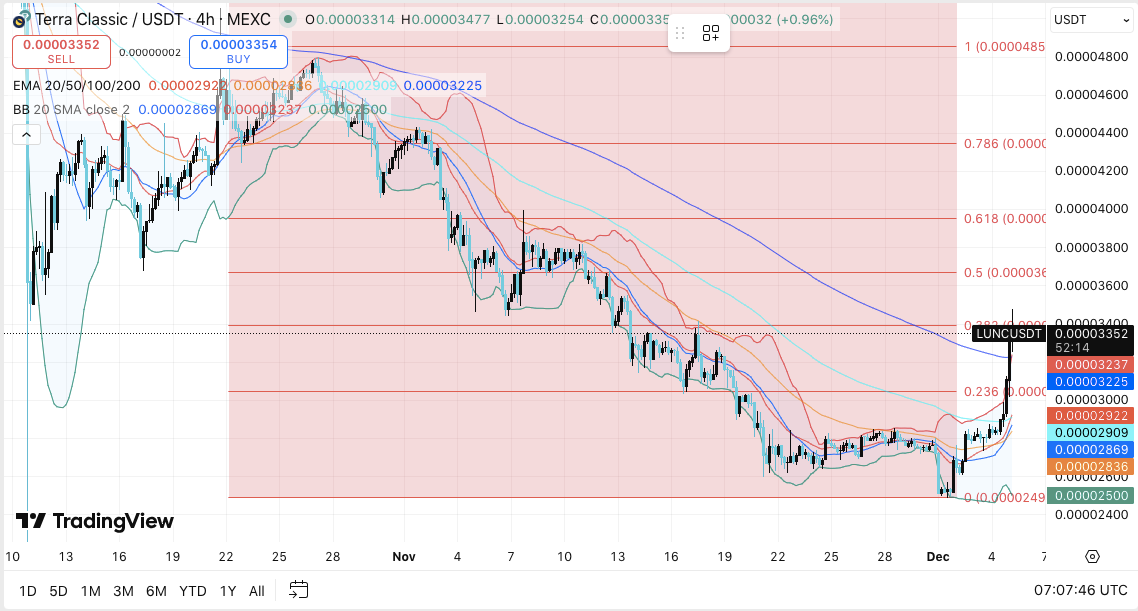

- LUNC faces a decisive check as worth meets the 200 EMA and key Fibonacci ranges.

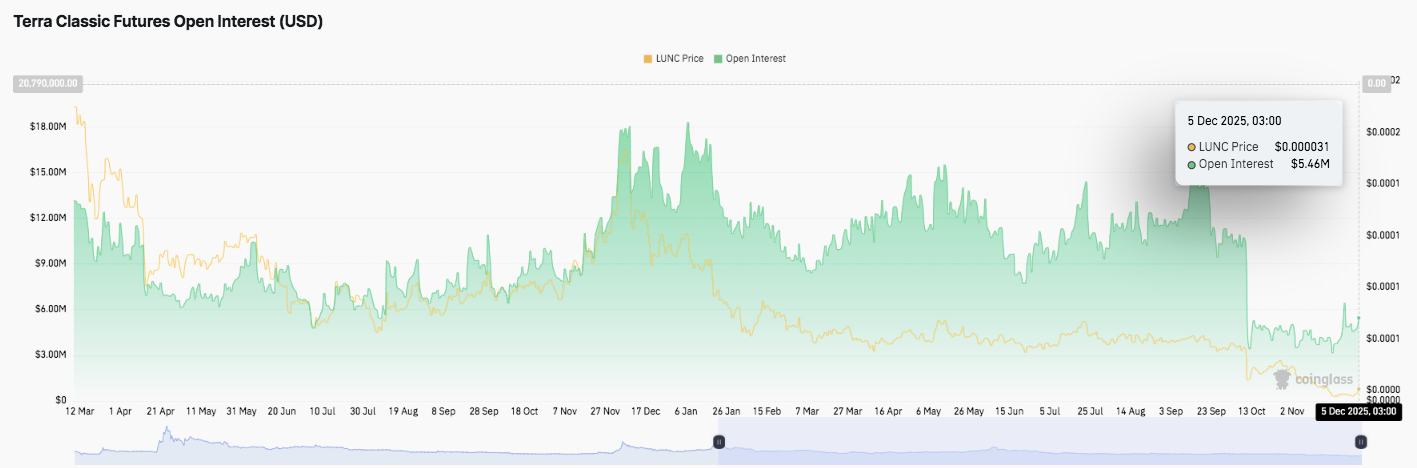

- The decline in open curiosity highlights weak leverage and waning speculative conviction.

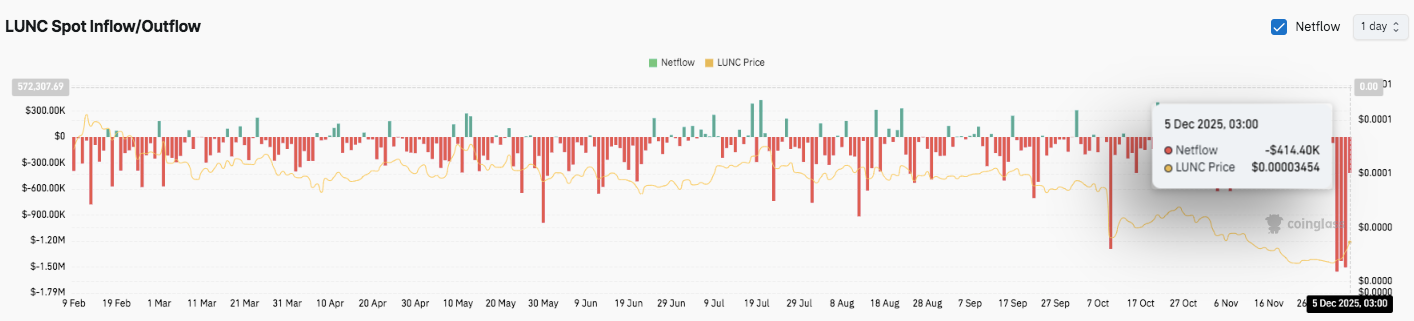

- Sustained spot outflows point out weak demand, limiting confidence in a full rebound.

Terra Basic ($LUNC) is attempting to stabilize after an prolonged interval of decline that pushed the token in direction of $0.00002500. Patrons intervened close to this zone, slowing down the tempo of promoting. The market is at the moment displaying early indicators of restoration, however confidence stays fragile.

The latest transfer above the 0.236 Fibonacci degree at $0.00003000 offered short-term power. It additionally urged merchants to reassess their near-term expectations. Nonetheless, the broader construction must be confirmed earlier than a sustained reversal. The main target now shifts as to whether it may construct momentum past the fast resistance.

Value checks vital cluster round 200EMA

Value motion on the 4H chart reveals that $LUNC is placing strain on the $0.00003350 to $0.00003400 band. This space coincides with the 200 EMA and presents a tough barrier. Moreover, this space is situated close to the 0.382 Fibonacci degree.

Due to this fact, this stays the primary massive check for bullish merchants. A break above $0.00003400 may pave the best way to $0.00003600. This degree corresponds to the 0.5 Fibonacci zone.

Moreover, continued motion above this midpoint usually signifies larger confidence within the development. Above $0.00003600, the tone may head in direction of $0.00004000 and extra provide may emerge.

Associated: Cardano Value Prediction: Patrons Wrestle to Reverse Persistent Downward Pattern

Assist is situated close to $0.00003000, which acts as the primary zone of protection. A clear maintain above this degree will assist keep the rising construction. Moreover, the vary from $0.00002830 to $0.00002890 features a short-term EMA. Beneath this vary, restoration makes an attempt weaken. Due to this fact, dropping $0.00002500 may finish the present rebound.

Derivatives dedication weakens as open curiosity decreases

Open curiosity additionally provides a cautious impression. Futures OI has fallen from a excessive of over $15 million earlier this yr to about $5.46 million on December fifth. This fall reveals decrease leverage and weaker speculative engagement.

The peaks in January and November didn’t help a stronger development. Furthermore, the sharp decline in September confirmed that urge for food for directional bets was waning. Due to this fact, a major enhance in OI is prone to require clear worth power and renewed confidence.

Spot flows mirror sustained outflows and weak demand

Spot flows present constant runoff all year long. A purple mark dominates the chart, outweighing a brief spike in inflows. The newest outflow of roughly $414,000 on Dec. 5 coincided with the latest decline round $0.000034.

Moreover, unfavorable internet flows from November to early December point out that liquidity is being drained from the market. Due to this fact, sentiment stays cautious. Merchants will probably watch for additional inflows earlier than supporting a sustained financial restoration.

Terra Basic Value Technical Outlook

LUNC trades inside a tightening construction because it approaches a serious choice zone on the 4H chart. After weeks of gradual decline, key ranges stay well-defined as momentum is about to vary.

High degree: The fast hurdle is $0.00003350 to $0.00003400, which is the zone that coincides with the 200 EMA. A break above this vary will open the best way to $0.00003600 after which $0.00004000, marking the 0.618 Fibonacci degree and a stronger resistance cluster.

Lower cost degree: Assist is $0.00003000 and serves as the primary checkpoint for patrons. A lack of this degree would reveal the short-term EMA vary between $0.00002830 and $0.00002890. The deeper breakdown targets the cycle low at $0.00002500, which anchors the broader construction.

Higher restrict of resistance: The $0.00003400 degree stays a key barrier to regaining bullish momentum within the medium time period. The decisive reversal on this area alerts the primary structural change in latest months.

LUNC is buying and selling inside a gradual compression zone shaped by falling highs and strengthening help. This setup will increase the chance of elevated volatility as costs break by way of both aspect of the tightening vary. Technical situations counsel that an inflection level that would decide December’s trajectory is pending.

Will Terra Basic go up?

The following course for LUNC will rely on whether or not patrons can defend $0.00003000 lengthy sufficient to problem the $0.00003350 – $0.00003400 resistance band. Sustained power above this ceiling may pave the best way for $0.00003600 and $0.00004000, with momentum prone to speed up as merchants regain confidence.

Associated: BOB (Bitcoin Base) Value Prediction 2025, 2026, 2027-2030

Nonetheless, failure to carry $0.00003000 will create new strain and enhance the danger of a fall in direction of $0.00002830 and $0.00002500. For now, LUNC is at a pivotal crossroads the place market confidence and the power of inflows will decide the following massive transfer.

Disclaimer: The knowledge contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any type. Coin Version shouldn’t be answerable for any losses incurred because of the usage of the content material, merchandise, or companies talked about. We encourage our readers to do their due diligence earlier than taking any motion associated to our firm.