- BTC approaches key resistance as compression and leverage trace at impending breakout

- Elevated open curiosity signifies elevated participation, but in addition will increase volatility threat

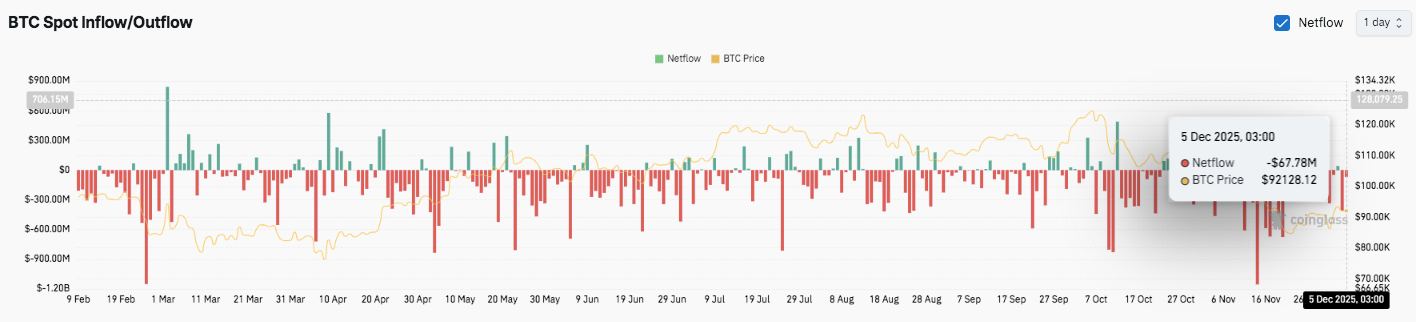

- Regardless of latest worth restoration, sustained spot outflows recommend cautious sentiment

Bitcoin continued to stabilize after forming a neighborhood backside close to $80,527, however the market stays exhibiting combined alerts as merchants assess resistance ranges, futures positioning, and ongoing bodily outflows. On December fifth, the worth hovered round $92,200, persevering with a modest improve after a tough begin to the fourth quarter.

The broader setup displays the market bracing for a decisive transfer as technical compression, elevated leverage publicity and sustained distribution pressures form near-term expectations. This mix suggests {that a} tipping level could also be occurring relying on how Bitcoin reacts to the upcoming resistance zone.

Key ranges form short-term path

Bitcoin is under the 0.382 Fibonacci stage at $94,251, which is the rapid ceiling for any upside makes an attempt. This stage acted as an space of categorical rejection in latest periods. A confirmed shut above this level might change sentiment and push the worth in the direction of $98,491. This intermediate zone has traditionally attracted sturdy demand and sometimes signifies enhancing momentum.

Moreover, a breakout of $102,730, which corresponds to the golden ratio space, would point out a strong development reversal. Nevertheless, bullish progress stays restricted with the 200-EMA close to $95,000, which stays important for a structural shift.

Associated: Ethereum Worth Prediction: ETH Reversal Await Important Bullish Breakout

The assist stage stays properly outlined, with the Fibonacci space at $89,006 offering the closest security internet. Worth has additionally gained short-term stability from the EMA cluster round $91,000. Nevertheless, the transfer in the direction of $80,527 will once more present weak spot and up to date restoration plans can be cancelled.

Improve in open curiosity suggests elevated market participation

Open curiosity in Bitcoin futures elevated steadily all year long. Merchants elevated their leveraged publicity as volatility picked up, particularly within the second half of the third quarter. Open curiosity on December fifth reached roughly $59.37 billion, with Bitcoin buying and selling close to $92,110.

Every time the open curiosity recovered, a better base was fashioned. Because of this, markets now mirror deeper liquidity and stronger engagement from energetic members. This improve will increase leverage throughout main venues and subsequently will increase sensitivity to cost actions.

Spot flows present continued outflows regardless of worth restoration

Bitcoin spot flows inform a unique story. Bigger holders continued to make distributions all year long, making a sustained internet outflow development. Robust promoting strain was recorded in most months, though there have been occasional spikes in inflows in March, April, and August.

Associated: Terra Traditional Worth Prediction: Outflow slows LUNC restoration…

In line with information on December 5, Bitcoin was buying and selling round $92,128, with internet outflows of roughly $67.78 million. Importantly, deeper outflow clusters emerged in October and November, signaling profit-taking and warning amongst institutional traders. Moreover, inflows into ETFs have been subdued, suggesting uncertainty round near-term path.

Technical outlook for Bitcoin worth

Bitcoin enters a pivotal section as key ranges tighten on the 4-hour chart.

Upside ranges at $94,251, $98,491, and $102,730 pose rapid hurdles to development continuation. A transparent transfer by means of these zones might widen the prepayment in the direction of $105,600 and $109,300.

Draw back ranges are equally outlined, with $91,000 appearing as short-term assist, adopted by $89,006 at 0.236 Fib. The breakdown under this cluster reveals a latest swing low of $80,527.

The highest of the foremost resistance is round $95,000 close to the 200-EMA. This stage stays a barrier that have to be reversed to understand medium-term bullish momentum. The technical image exhibits Bitcoin compressing between the Fibonacci bands and the foremost EMA, forming a tightening construction forward of elevated volatility.

Will Bitcoin rise additional?

Bitcoin’s subsequent transfer will rely upon whether or not patrons can reclaim the $94,251 zone and set up power above the 200-EMA. A break above $98,491-$102,730 would verify new upward momentum and pave the way in which for mid-$100,000 territory.

Nevertheless, failure to carry $89,006 dangers a pullback into deeper consolidation, with $80,527 being the subsequent line of protection. For now, Bitcoin is buying and selling in a big vary. Whereas the broader setup factors to the potential for a decisive transfer, confidence flows, ETF exercise, and futures positioning will decide which path wins on the subsequent leg.

Associated: Cardano Worth Prediction: Patrons Battle to Reverse Persistent Downward Development

Disclaimer: The data contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any type. Coin Version shouldn’t be accountable for any losses incurred because of the usage of the content material, merchandise, or companies talked about. We encourage our readers to do their due diligence earlier than taking any motion associated to our firm.