- The XRP Spot ETF continues to draw robust inflows from institutional buyers, approaching $900 million.

- The crucial $2.04 help stage will decide the subsequent transfer for XRP.

- Analyst Kashi means that XRP’s long-term goal might attain $7 to $10.

Institutional curiosity in XRP has been decoupled from short-term value fluctuations, with the U.S. spot ETF recording a statistical anomaly with 13 consecutive buying and selling classes with internet inflows and no outflows for a single day since its inception.

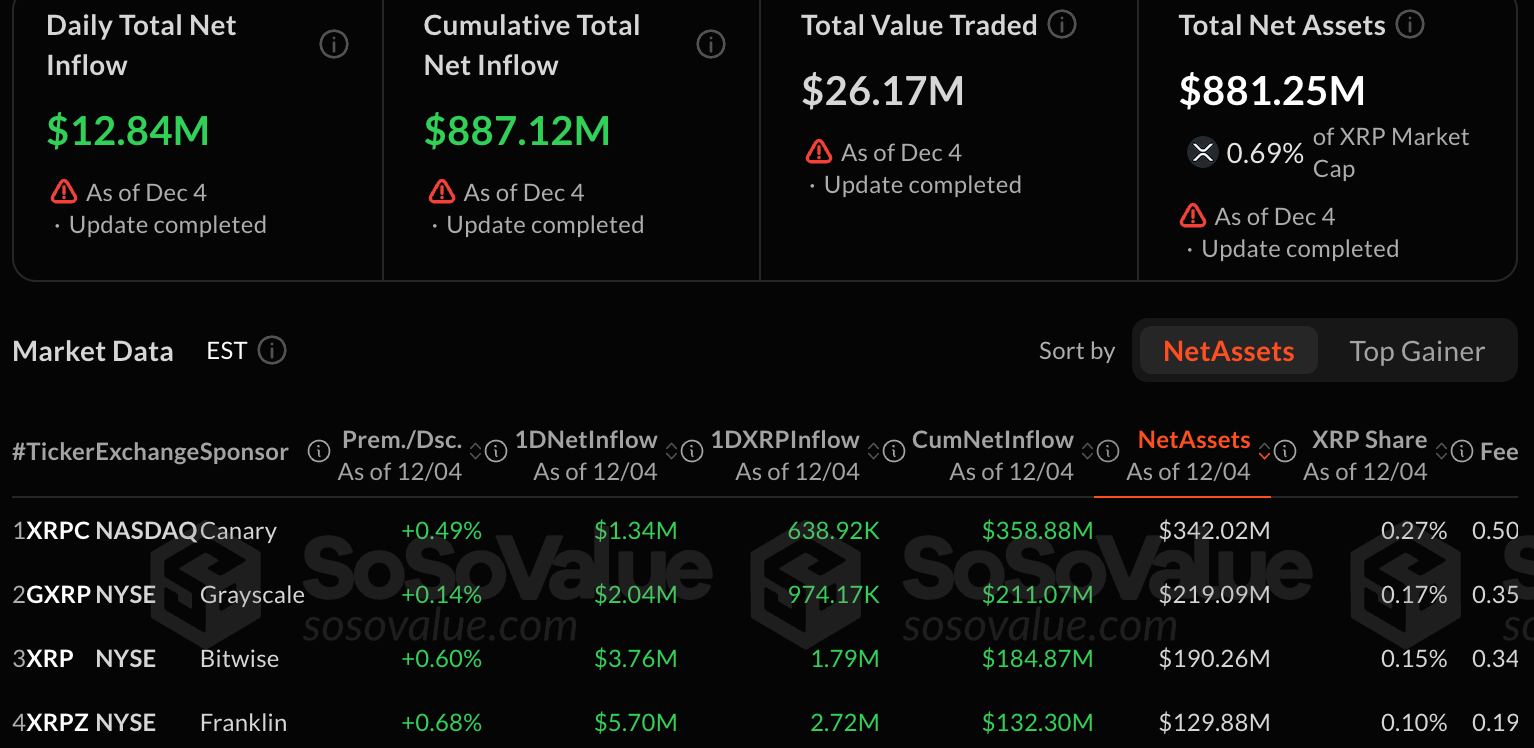

As of December 4, day by day XRP ETF internet inflows reached $12.84 million, and cumulative inflows reached $887.12 million, in accordance with SosoValue knowledge. This quantity brings XRP one step nearer. $900 million milestone The ETF’s whole inflows are an indication of persistent demand from regulated funds.

The full internet property of all XRP ETFs is $881.25 million. Buying and selling exercise stays wholesome, with $26.17 million traded in the latest session.

XRP ETF main the best way

Particular person issuers additionally mirror this strong publicity. Canary Capital’s XRPC has internet property of $358.88 million and cumulative internet inflows of $342.02 million. Grayscale’s GXRP internet price is $211.07 million, with cumulative inflows of $219.09 million.

Bitwise XRP ETF maintains a internet asset worth of $184.87 million with cumulative inflows of $190.26 million. Franklin Templeton’s XRPZ has a internet price of $132.3 million and cumulative inflows of $129.88 million.

Remarkably, since its launch, the XRP ETF has recorded new investments every buying and selling day and has but to expertise any outflows. These repeated capital injections reinforce the impression that institutional buyers proceed to build up XRP throughout unsure occasions, utilizing ETF constructions to safe publicity with regulatory safeguards.

Associated: XRP Ledger Velocity Soars to 2025 Excessive as Market Absorbs Ripple’s $101 Million Switch to Binance

Technical construction tightens, crucial retest at $2.04

Market analyst CasiTrades highlighted that XRP is shifting again in the direction of retesting the macro 0.5 Fibonacci stage at $2.04, which has been an important help within the present correction. The following take a look at at this stage is essential as it’ll decide whether or not XRP follows a bullish or bearish path.

XRP has lately rebounded from the native retracement at 0.618, indicating near-term bullish momentum. Nevertheless, affirmation depends upon whether or not the $2.04 stage holds as help.

Associated: Who’s shopping for XRP Dip? “Mega Whales” set a 7-year holding document

As much as $10 value enhance state of affairs

If $2.04 holds, XRP might break by the resistance at $2.41 and attempt to push in the direction of $2.65. Such a transfer would point out that the macro low has seemingly handed and a brand new bullish wave construction is forming.

CasiTrades additionally famous that if the momentum holds, it might finally goal for considerably increased ranges, with a broader uptrend doubtlessly reaching $7 to $10.

Draw back state of affairs: Macro 0.618 take a look at

If $2.04 can not maintain, XRP might head in the direction of the macro 0.618 help at $1.64. This transfer will full a full corrective retracement earlier than the market makes an attempt a bigger rally.

In the end, institutional flows and ETF positioning are prone to play a key function on this state of affairs. Continued allocation might result in market stabilization and quicker value restoration. Alternatively, a decline in ETF publicity might dampen sentiment and trigger draw back stress.

Disclaimer: The data contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any type. Coin Version isn’t answerable for any losses incurred because of the usage of the content material, merchandise, or companies talked about. We encourage our readers to do their due diligence earlier than taking any motion associated to our firm.