- Bitcoin has rebounded from $85,000 however stays constrained under the downtrend line and the important thing Fibonacci resistance close to $97,000.

- Spot flows stay damaging, suggesting distribution somewhat than accumulation, as liquidity stays skinny because the October wipeout.

- Fed coverage danger will encourage a place shift, however upside would require a decisive breakout of quantity and key resistance zones.

Bitcoin costs are buying and selling round $91,300 right now, recovering from early December lows of round $85,000, however the rebound stays restricted under the downtrend line, rejecting all makes an attempt to maneuver larger since late October. The rebound comes as merchants anticipate the Federal Reserve’s closing rate of interest choice of the 12 months and a spike in jobless claims that might have an effect on the coverage outlook.

Patrons push costs in the direction of Fibonacci ranges, however construction stays weak

On the each day chart, Bitcoin is buying and selling in a contractionary construction with falling highs and rising lows. Value is testing the decrease facet of the downtrend line close to $92,000, however it’s positioned close to the 0.382 retracement at $90,811, a zone that has served as short-term assist for a number of periods. A break above the 0.5 retracement at $93,995 can be the primary signal of development power, however that degree has repeatedly resisted a rebound.

Above the value, the 0.618 retracement at $97,179 coincides with a broader provide zone that fashioned through the earlier circulation, which is a key barrier. So long as Bitcoin stays under that degree, the restoration seems to be extra tactical than structural.

Associated: XRP Value Prediction: Sustained Downtrend Threatens $2 Assist…

The $98,103 supertrend indicator reinforces that higher restrict. Sellers held this degree through the failed breakout try in November, forcing the market to consolidate again to its present value. A definitive shut above the supertrend will flip sentiment in the direction of a development reversal.

Spot outflows present distribution as liquidity stays skinny

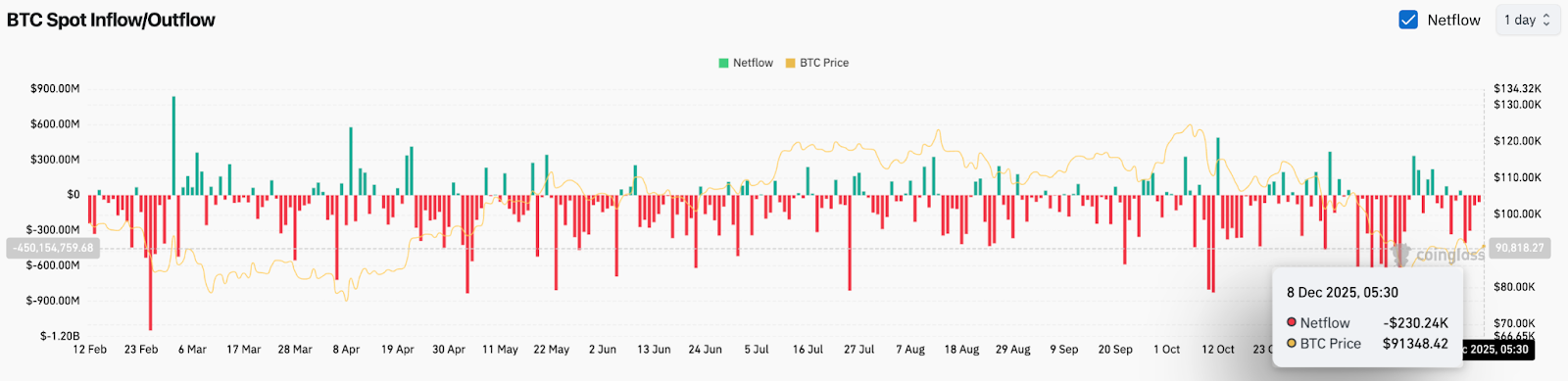

Spot flows stay damaging, however the magnitude of latest actions has been compressed. Bitcoin recorded web outflows of about $230,240 on December 8, in line with knowledge from Coinglass, a small quantity in comparison with the deep deficits seen in October and November, when single periods frequently exceeded $200 million.

The decline within the dimension of outflows signifies that liquidation pressures have eased however haven’t was sustained accumulation. Positioning stays cautious, with capital flowing out somewhat than getting into with confidence.

Brief-term momentum improves, however resistance cluster limits upside

On the 4-hour chart, Bitcoin is making an attempt to construct a basis above the ascending channel that has guided the value since late November. Intraday momentum has improved, with the value rallying above the 20-day EMA of $90,403 and testing the 50-day EMA of $90,978. The 100-day EMA of $92,203 is a direct barrier, however the 200-day EMA of $94,277 stays the extent that defines a authentic shift in development route.

Bollinger Bands present compression after a spike in volatility, indicating vitality is build up forward of a directional transfer. If the value clears the 100-day EMA, the band could develop to the upside. A failure would reintroduce promoting strain in the direction of the channel decrease certain close to $88,300.

The RSI was round 47 on at the present time, indicating neutrality somewhat than exhaustion, leaving room for each side to resolve on their subsequent transfer.

Macro Catalysts Drive Place Shifts Heading into Fed Week

Bitcoin is recovering after per week dominated by the U.S. Federal Reserve’s closing rate of interest choice of the 12 months and stories of unemployment claims anticipated to rise considerably. Economists count on the variety of insurance coverage claims to rise by 30,000 from the earlier 191,000, a change that strengthens hopes for a primary charge reduce because the Fed ends quantitative tightening.

After $19 billion of leverage disappeared in October, liquidity by no means absolutely returned. Market makers stay cautious and the depth of the order ebook continues to say no. “The order ebook has been worn out and market makers are hesitant to regain scale,” one investor informed Decrypt. This background explains why the rally is shallow and reactive somewhat than trend-driven.

Monetary establishments’ desks are additionally adjusting their monetary methods in preparation for the coverage shift. Michael Wu of Amber Group stated funding spreads and borrowing prices have moved in tandem with rate of interest steerage, and desks are diversifying liquidity throughout CeFi and DeFi venues to isolate volatility. This alteration displays a defensive adjustment somewhat than speculative positioning.

The disparity in efficiency between Bitcoin and metals is including to the alarm. In response to latest knowledge, gold and silver have returned 60% and 86% this 12 months, whereas Bitcoin has returned -1.2%. Whereas merchants deal with the metallic as a hedge towards coverage errors, Bitcoin stays tied to liquidity fluctuations somewhat than macro safety.

Some traders count on the temper to alter rapidly if the Fed takes motion. Ryan McMillin of Merkle Tree Capital stated the choice to finish QT and the potential of a charge reduce might set off a market rebound, including: “A charge reduce could possibly be the catalyst to begin it.”

Due to this fact, Bitcoin’s present restoration shouldn’t be as a consequence of robust demand, however somewhat as a consequence of positioning changes to high-impact coverage dangers. Till flows develop and liquidity deepens, macro optimism stays a narrative, not a bid.

outlook. Will Bitcoin go up?

A bullish case requires improved stream and quantity and a detailed above $97,000. If this occurs, the development line shall be damaged and the construction will shift from compression to growth, paving the best way to $104,000.

If the value loses $88,000, the bearish case is triggered, confirming that the consumers have been unable to defend the assist. This breakdown reveals much more extreme corrections in the direction of $86,800 and $80,500.

Disclaimer: The data contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any type. Coin Version shouldn’t be answerable for any losses incurred because of the usage of the content material, merchandise, or providers talked about. We encourage our readers to conduct due diligence earlier than taking any motion associated to our firm.