- XRP stays compressed close to $2.05, awaiting a breakout that may outline a short-term development.

- The rise in futures open curiosity signifies that dealer confidence stays steady regardless of low volatility.

- Spot outflows are predominant, indicating cautious accumulation and chronic profit-taking stress.

XRP continues to be in a tightening construction as merchants look ahead to the following decisive transfer. Costs are hovering round $2.05 because the market continues to react to modifications in flows in each derivatives and spot trades. Moreover, the broader construction is exhibiting indicators of compression as key help and resistance ranges converge.

Because of this, merchants at the moment are targeted on a breakout that would set the tone for the approaching weeks. The present vary has held for a number of classes, with market contributors anticipating volatility to return as soon as XRP clears a key stage.

Key ranges outline short-term construction

XRP is buying and selling under the most important transferring averages on the 4-hour chart. This setting retains the market in a consolidation part. The worth stays just under the $2.06-$2.09 zone, which stays a strong ceiling.

Moreover, the chart exhibits resistance close to $2.12, which coincides with the 38.2% Fibonacci marker. A break above that stage may invite a take a look at of $2.26 and a downtrend line between $2.25 and $2.28. An in depth above this space would strengthen the bullish momentum and pave the best way for $2.36 and $2.50.

Associated: Bitcoin Value Prediction: Monetary Establishments Enhance Publicity as Market Waits for Breakout

These ranges stay the main target of the transition from compression to growth. Nonetheless, help close to $2.02 and $1.99 nonetheless anchors the construction. A break under $2.00 may expose the lows of $1.82.

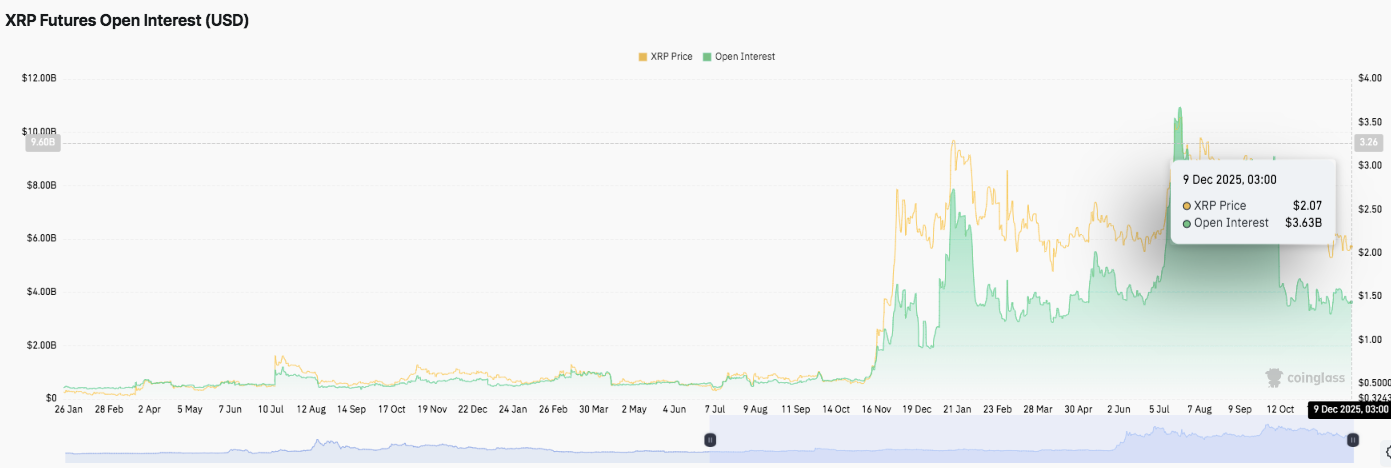

Derivatives positioning stays excessive

XRP futures open curiosity continues to indicate sturdy motion this 12 months. This indicator expanded via mid-2025 and additional accelerated from July to September. This improve coincided with elevated worth volatility and leveraged positioning. Open curiosity peaked at greater than $3.6 billion, however subsided throughout October as merchants decreased their publicity.

Moreover, current readings of almost $3.63 billion affirm that speculative positioning stays excessive. Though market volatility is at present decrease, the positioning nonetheless displays steady confidence. This backdrop means that merchants stay looking out for catalysts that would spark new momentum.

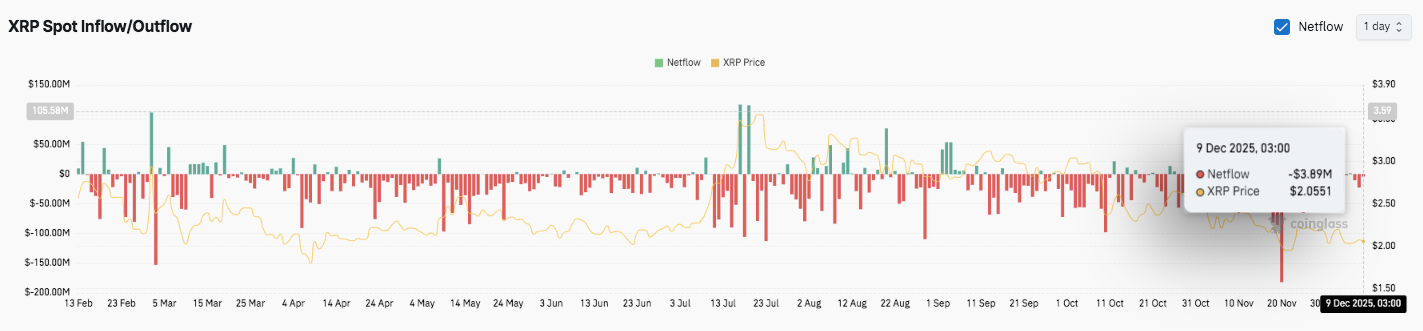

Spot flows reveal warning amongst merchants

The inflow-outflow development of XRP exhibits that outflows proceed to dominate. This development factors to deep revenue taking and weak point in spot demand. Furthermore, a surge in inflows of greater than $50 million failed to alter broader imbalances. In accordance with current knowledge, the value is hovering round $2.05, with web outflows of roughly $3.89 million.

Associated: Terra Basic (LUNC) Value Prediction: Market Response Intensifies…

Subsequently, merchants proceed to attend for stronger confirmations earlier than accumulating bigger positions. Importantly, whereas a surge in inflows typically coincides with a short-term restoration, promoting stress outweighed the rise. Market contributors at the moment are searching for indicators of recent demand earlier than anticipating a stronger transfer.

Technical outlook for XRP worth

Even because the market consolidates, the important thing ranges of XRP stay clearly outlined.

The highest worth ranges are $2.12, $2.26, and $2.36, that are the fast hurdles for continued bullishness. A breakout above $2.28 may prolong in the direction of a broader resistance band round $2.50 and presumably $2.62. These areas symbolize the brink wanted to reverse the broad pullback from late November.

Draw back ranges start with trendline help at $2.02, adopted by $1.99, and a serious cumulative shelf at $1.82. This construction fixes the bass vary. The higher resistance stays at $2.26, which coincides with the downtrend line and serves as a key stage for a flip to medium-term bullish momentum.

Technical pictures present that XRP is compressed between converging help and resistance bands, making a volatility coil forward of a decisive transfer. A narrowing construction suggests an impending growth part in both course.

Will XRP rise?

The course of XRP will depend upon whether or not patrons can defend $2.02 lengthy sufficient to problem the resistance cluster between $2.12 and $2.26. Compression and up to date derivatives exercise recommend elevated volatility forward. If the bullish development strengthens, XRP may retest $2.36 and probably $2.50, making development affirmation extra apparent.

Nonetheless, if $2.02 can’t be sustained, there’s a danger of breaking the consolidated base and exposing the value to deeper retracement ranges of $1.99 and $1.82.

For now, XRP remains to be within the necessary zone. Market confidence and clear breakthroughs of key boundaries will decide the following leg.

Associated: Cardano Value Prediction: Channel Prime Rejects Bulls Once more as Downtrend Strengthens

Disclaimer: The knowledge contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any variety. Coin Version is just not liable for any losses incurred because of the usage of the content material, merchandise, or providers talked about. We encourage our readers to do their due diligence earlier than taking any motion associated to our firm.