- Bitcoin has rebounded greater than 12% from its November lows, however stays beneath $94,100 as spot outflows proceed to weigh on momentum.

- Anticipated Fed price cuts have been a key set off, and analysts say indicators usually precede a macro-driven reversal.

- Consumers will defend the ascending channel and break above $94,100-$98,100 to succeed in the opening goal in direction of $107,500 on sturdy quantity.

Bitcoin has recovered greater than 12% from its November lows, with the worth immediately buying and selling round $92,950 after bouncing off the decrease finish of an ascending channel. The transfer comes as merchants await the Federal Reserve’s choice, which is anticipated to chop charges for the final time this 12 months. This setting locations Bitcoin at a important juncture the place macro coverage, ETF flows, and technical construction converge.

Spot outflows proceed as consumers depend on macro catalysts

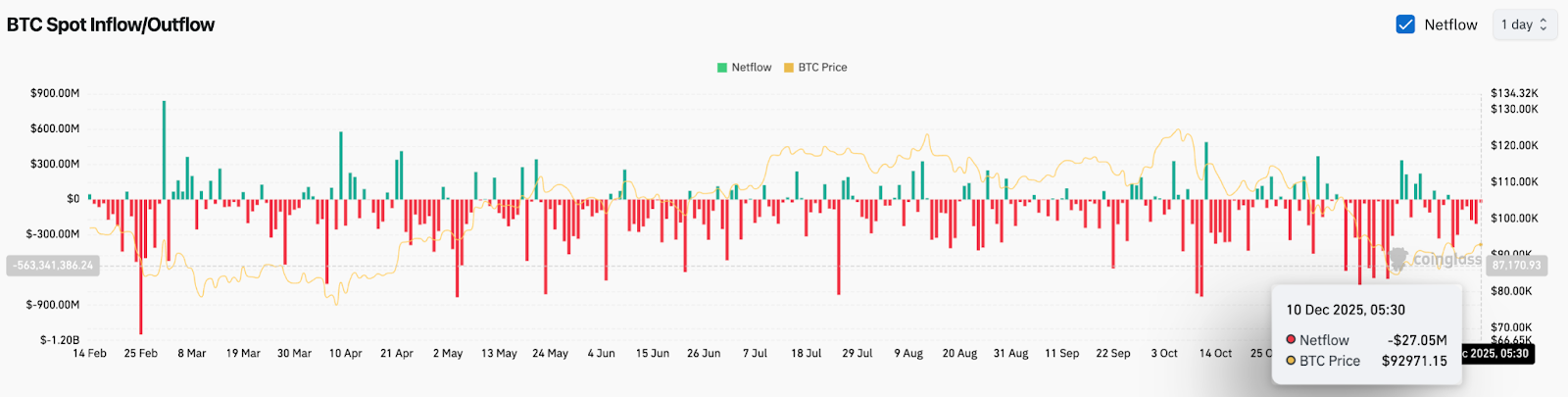

Overseas alternate flows proceed to be damaging. As of immediately’s open, web outflows had been roughly $27 million, in response to Coinglass information. Outflows have been predominant in current weeks, confirming that offer continues to return to exchanges quite than long-term storage.

If capital outflows proceed, intraday good points are typically restricted. Consumers have managed to guard the $90,000 zone, however a change in stream or an exterior catalyst is required for the upside to maintain. The market is now trying to the Fed to vary that.

Fed choice shapes Bitcoin’s near-term breakout path

Prediction markets replicate close to full confidence, with analysts anticipating a 0.25% price lower and CME futures displaying an 88% chance. If confirmed, the discount would cut back the chance price of holding digital property and decrease U.S. Treasury yields, which generally assist crypto good points.

Associated: Avalanche Worth Prediction: AVAX makes an attempt reversal as purchaser…

Analysis desks mentioned the assembly may mark a turning level within the current drawdown. The CF benchmark has traditionally highlighted volatility spike indicators that seem close to depletion. Historic circumstances have generated constructive returns in subsequent months, usually pushing Bitcoin decisively above main resistance zones.

Economists surveyed by Bloomberg anticipate one other price lower in 2026. Easing the coverage atmosphere strengthens long-term circumstances and improves liquidity circumstances. These two elements permit Bitcoin to react shortly throughout instances of macro uncertainty.

The general market stays cautious. Shares had been flat heading into the assembly, indicating merchants want to attend for Powell’s tone earlier than committing cash. This may give Bitcoin’s response much more weight as soon as the choice is made public.

Consumers defend ascending channel as key ranges tighten

The day by day chart exhibits Bitcoin buying and selling inside a clear upward channel that began after the November capitulation. Consumers proceed to guard the lows and sellers defend the 0.5 Fibonacci stage at $94,100. A break above this line will open the way in which to $97,200 and the 0.618 retracement.

Supertrend resistance is close to $98,100. This is without doubt one of the most vital zones on the chart. A detailed above this stage would bullishly reverse the construction and invalidate the broader downtrend from the October highs.

Associated: Chainlink Worth Prediction: LINK Makes an attempt Quick-Time period Restoration…

The parabolic SAR signifies assist beneath the worth, indicating that momentum is within the consumers’ favor in the intervening time. The dotted trendline above value stays a significant structural barrier. If this may be cleared, a sustained change in market path might be confirmed.

Most important ranges to concentrate on

- Quick assist: $90,900

- Channel assist: $87,500

- Breakout set off: $94,100

- Most important resistance: $98,100

- Upside extension: $107,500 on sturdy quantity

Intraday momentum helps the bullish case. The 30-minute chart exhibits that BTC is breaking out of the descending micro-trendline whereas the RSI is rising in direction of 60. The MACD maintains a gradual bullish cross, supporting new demand on the decline.

Sentiment and long-term forecasts compete as actuality outperforms fashions

Daring value targets dominated early 2025. Every company projected aggressive ranges, with predictions starting from $180,000 to greater than $1 million. Regardless of sturdy ETF adoption and greater than $250 billion in inflows, Bitcoin ended the 12 months at almost $88,000. The market rewarded disciplined construction over speculative predictions.

2025 has confirmed that narrative and objectives are extra vital than liquidity, rate of interest coverage, and on-chain positioning. Within the present setting, that actuality is as soon as once more within the highlight. Regardless of Bitcoin’s sturdy structural fundamentals, macro headwinds pushed the worth decrease than anticipated.

If the Fed confirms easing and danger urge for food improves, Bitcoin will transfer again towards the higher finish of its multi-month vary.

outlook. Will Bitcoin go up?

A detailed above $94,100 units the stage for a push in direction of $97,200 and the supertrend wall of $98,100. A break above these ranges will verify the energy of the pattern and open the way in which to $107,500.

Failure to get well $94,100 will hold BTC throughout the midrange. A break beneath $90,900 will put stress on the channel assist at $87,500. A lack of $87,500 turns the pullback right into a deeper correction.

Associated: Zcash Worth Prediction: Bulls Take a look at Key Fib Ranges As Spot Inflows…

If consumers react strongly to the Fed price lower and regain $98,100, momentum will shift in favor of a year-end breakout. If the worth falls beneath $90,900, sellers regain management and hold Bitcoin in a sideways consolidation.

Disclaimer: The knowledge contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any form. Coin Version isn’t accountable for any losses incurred because of using the content material, merchandise, or providers talked about. We encourage our readers to do their due diligence earlier than taking any motion associated to our firm.