- Solana stays range-bound amid repeated rejections of the $145 ceiling momentum restoration.

- Reducing open curiosity suggests decrease leverage and general cautious positioning.

- Sustained spot outflows spotlight weak demand and continued distribution pressures.

Solana continues to endure in depth consolidation as market situations reset following November’s chapter. The token maintains a impartial stance inside this broad construction whereas merchants monitor volatility and positioning. Furthermore, costs stay beneath a number of key pattern indicators and sentiment stays cautious.

Market restructuring has been proven to be sluggish after large-scale liquidations earlier within the quarter. Due to this fact, traders at the moment are searching for affirmation earlier than deciding on a course. This setting has stored Solana locked between outlined help and resistance ranges, whereas broad danger urge for food stays subdued.

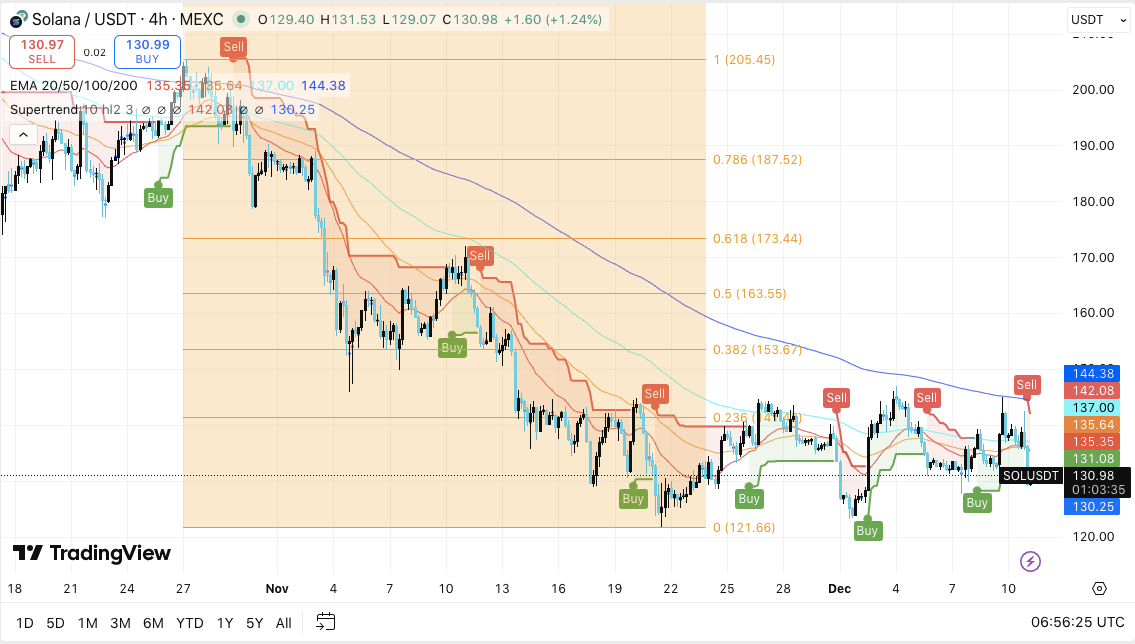

Solana trades beneath key EMA as consolidation widens

Solana continues to be capped on the 200-EMA and continues to behave as dynamic resistance. The worth has additionally confronted repeated rejections round $137 to $145. This space combines pattern indicators and Fibonacci retracement ranges to kind a dense provide zone.

Moreover, the construction displays steady compression as decrease trebles are pressured into the identical ceiling. Merchants see this band as the primary battleground that have to be cleared to achieve additional momentum. Above $145 may open up area in direction of the $153 and $163 areas. These ranges kind the following checkpoint at which broader tendencies might change.

Assist lies between $130 and $131, the place the latest purchase sign appeared. This zone helps preserve the present buying and selling vary. Nevertheless, a definitive breakdown may expose the $121 space. This degree marks the foremost flooring of the cycle and a possible reset level. Due to this fact, merchants proceed to observe how worth reacts to this help cluster.

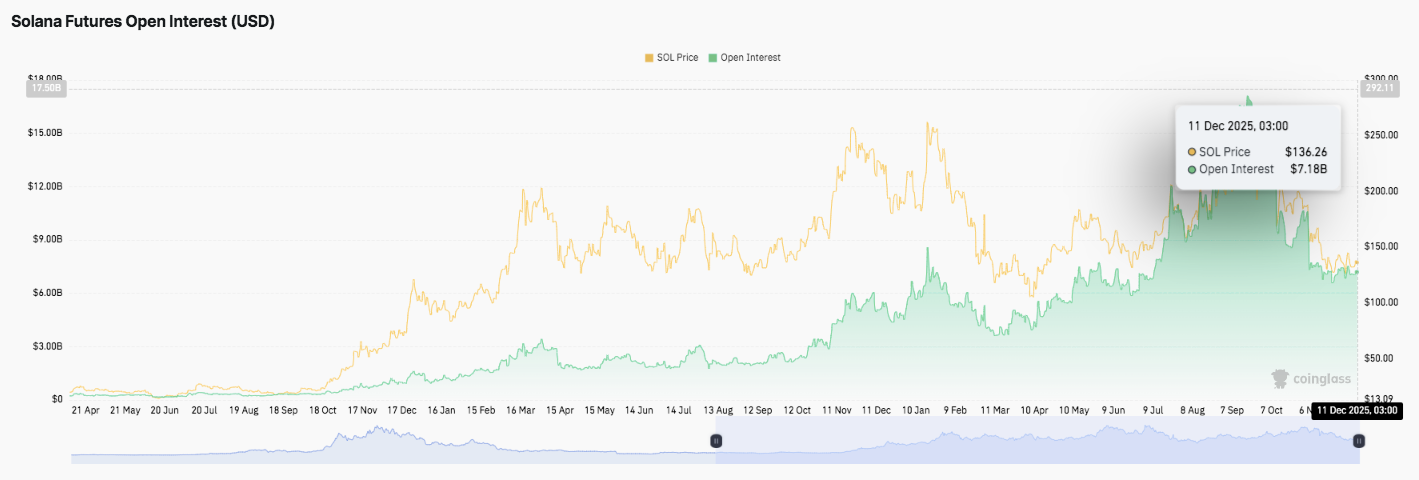

Reap the benefits of the reset as open curiosity declines from October highs

Open curiosity expanded quickly from September to October as leverage elevated throughout the Solana market. In the course of the interval of improve, the indicator exceeded $ 8 billion. Because of this, speculative exercise elevated whereas costs tried to hit new yearly highs.

Nevertheless, open curiosity declined quickly in November as merchants closed out their positions. This alteration occurred after a decline in momentum and a number of other liquidation levels. By December 11, open curiosity had fallen to roughly $7.18 billion. This pattern signifies a cautious restructuring section as volatility reduces and merchants scale back publicity.

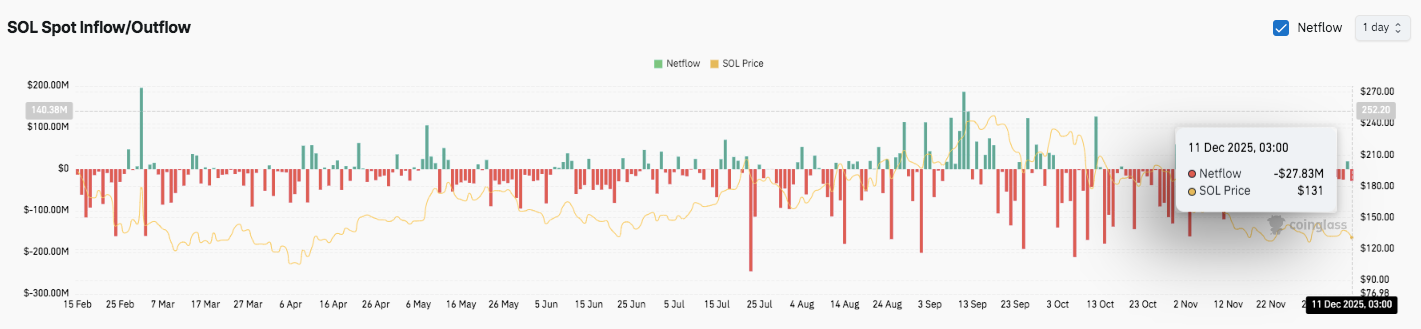

Spot flows present constant outflows and weak shopping for strain

Solana’s spot stream reveals continued outflows throughout latest classes. As well as, a number of print publications in October and November had internet gross sales of over $50 million.

The most recent statistics present that $27.83 million was outflowed whereas the worth hovered round $131. This sample signifies sustained supply and lowering bid depth. Market members proceed to navigate a construction formed by regular sell-side exercise.

Technical Outlook for Solana Costs

Key ranges stay properly outlined as Solana trades inside a variety heading into the following market section.

Prime degree: The primary main hurdle will likely be between $137 and $145, mixed with resistance on the EMA and a good provide block. The breakout may lengthen to $153.67 and $163.55. If the amount strengthens, the pair may attain $173.44 if the momentum continues.

Cheaper price degree: $130-131 serves as quick help, adopted by $124 and a significant cycle low of $121.66.

Higher restrict of resistance: The 200-EMA close to $144 stays a key degree for reversing medium-term bullish momentum. Costs stay beneath all main EMAs, sustaining overhead strain.

The technical images present that the Solana compresses inside a variety. Volatility continues to shrink whereas liquidity strikes away from aggressive positions. A decisive breakthrough from this construction could cause fast enlargement in both course.

Will Solana breakout or collapse?

Solana’s subsequent transfer will rely on whether or not patrons can defend $130 lengthy sufficient to problem the $137 to $145 resistance zone. This zone controls the restoration pathway and anchors your complete metaphase construction. Technical compression, weakening momentum, and blended flows point out that merchants are ready for affirmation earlier than committing to sturdy directional exposures.

A sustained break above $145 may speed up the rally in direction of $153 and $163, and if pattern power improves, $173 may emerge. Nevertheless, if the worth can’t maintain $130, there’s a danger of a fall in direction of $124 and even deeper at $121.66.

For now, Solana stays within the crucial zone. Market confidence, liquidity tendencies, and response across the $137-$145 ceiling will decide the following leg.

Disclaimer: The knowledge contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any variety. Coin Version is just not chargeable for any losses incurred because of using the content material, merchandise, or providers talked about. We encourage our readers to do their due diligence earlier than taking any motion associated to our firm.