- ETF outflows of $77 million and spot outflows of $76 million point out a defensive place, with Bitcoin buying and selling on the apex of a symmetrical triangle.

- Value stays under the important thing EMA and downtrend line, with $95,500 wanted to substantiate a breakout try.

- A lack of $91,000 would lead to outflows of $88,500 and $85,000, however a restoration above $96,478 may convey momentum again to $103,500.

Bitcoin value right this moment is buying and selling round $92,530, on the high of a decent symmetrical triangle on the every day chart. Spot and ETF outflows proceed to weigh on sentiment, whereas the market struggles to interrupt out of the downtrend line that has restricted any restoration makes an attempt since mid-October.

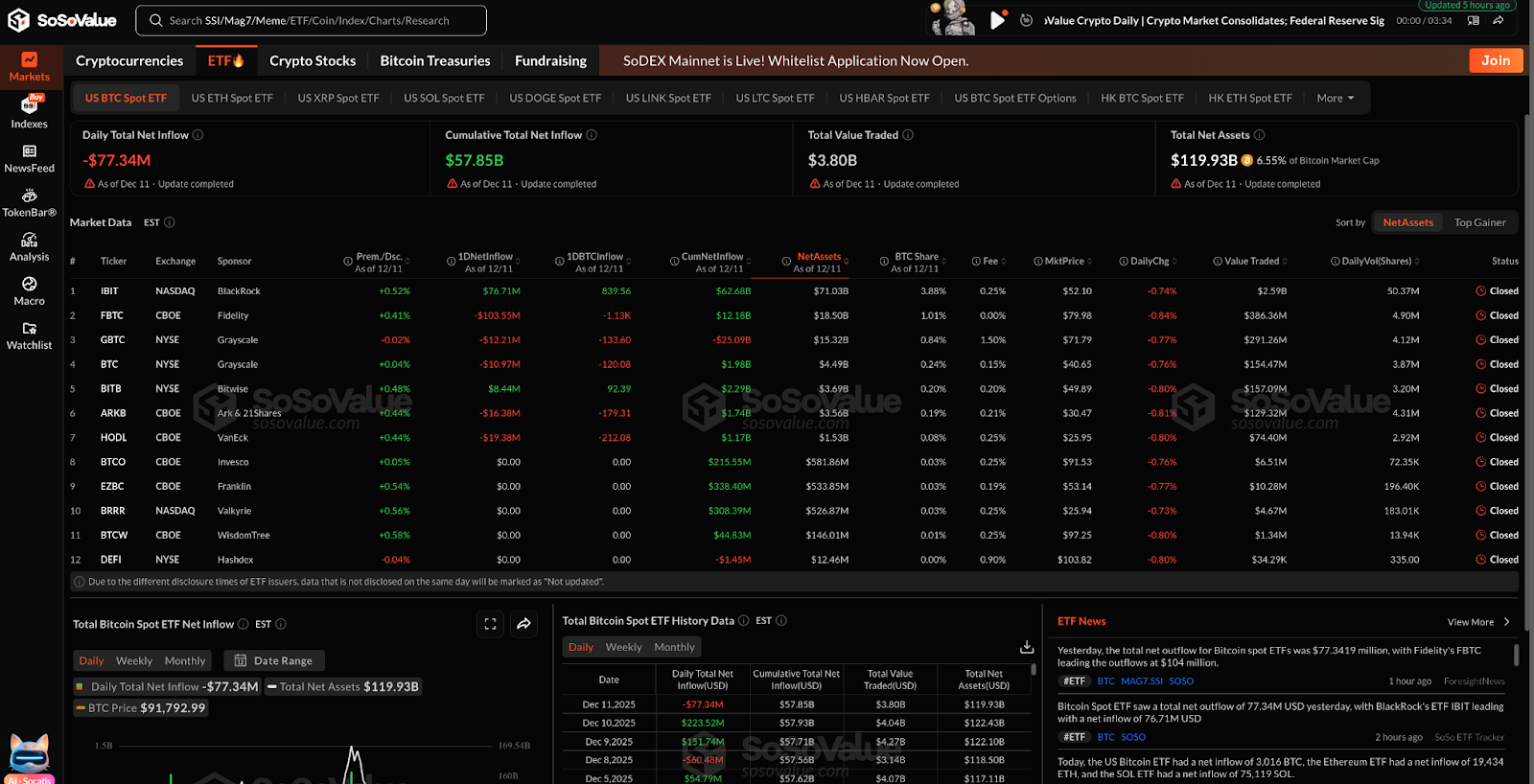

ETF outflows improve as monetary establishments cut back publicity

In accordance with knowledge from SoSoValue, there was a web outflow of $77.34 million throughout the US Bitcoin Spot ETF on December eleventh. Constancy’s FBTC alone recorded redemptions of $103.55 million, whereas Grayscale noticed withdrawals of $12.21 million and $10.97 million throughout its GBTC and BTC ETF merchandise.

BlackRock IBIT offset among the strain with inflows of $76.71 million, however the broader pattern nonetheless displays web promoting quite than accumulation. Cumulative inflows into ETFs stay constructive at $57.85 billion, however short-term habits has shifted to a defensive stance.

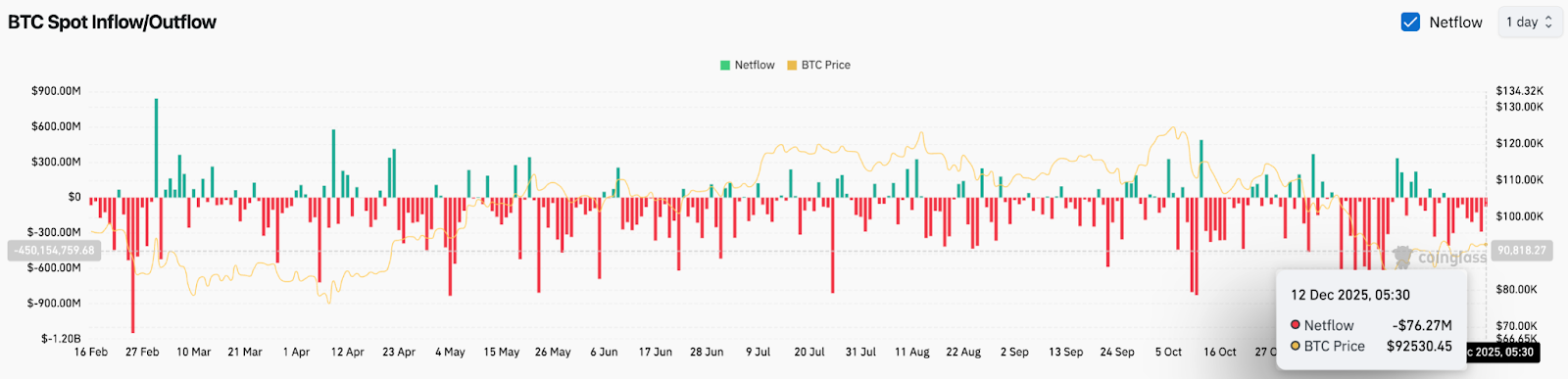

This matches the spot knowledge. Coinglass confirmed web outflows of $76.27 million on December twelfth, marking one other day of liquidity shifting from holding wallets to exchanges. A persistent purple bar throughout the weekly movement measurements underscores the warning, with the influx surge earlier this yr not returning.

Day by day chart exhibits BTC approaching determination zone

Bitcoin continues to commerce under the downtrend line that began after the failure close to $117,500. The supertrend stays bearish at $98,103 and the EMA on the every day chart strengthens the ceiling overhead. BTC stays under the 20-day EMA of $96,478, 50-day EMA of $91,770, 100-day EMA of $101,791, and 200-day EMA of $103,499.

The construction under is forming increased lows, with ascending triangle help holding close to $91,000. Value is at present caught between this rising help and falling resistance, forming a compression that may quickly be resolved.

A breakout above $95,500 clears the downtrend line and opens the door to the EMA cluster. The breakdown under $91,000 reveals a decrease liquidity pocket round $88,500 and a deeper draw back in the direction of $85,000.

At this stage, neither facet has the higher hand. As volatility diminishes, the following transfer is prone to be sudden.

Sino-Japanese construction is attempting to recuperate however lacks confidence

The 30-minute chart exhibits a gradual try at restoration after Wednesday’s pullback. BTC has regained $92,500, however the value stays flat with low quantity behind it. The RSI is round 58, indicating reasonable momentum, whereas the MACD remains to be above the sign line, however has leveled out.

Consumers are maintaining the short-term flooring close to $92,000, however the push is missing in pattern energy. Intraday pullbacks at all times present lowering amplitude, which signifies that short-term merchants are ready quite than actively taking positions.

A breakout of $93,200 on the decrease timeframe would present early energy, however motion may stay restricted except ETF or spot inflows are confirmed.

outlook. Will Bitcoin go up?

- Bullish case: A transfer above $95,500 will verify a transfer by means of the downtrend line. If BTC closes above the 20-day EMA of $96,478, it may acquire momentum in the direction of $98,100, adopted by a push in the direction of $101,800 and $103,500. As soon as the EMA cluster clears, the pattern will return in favor of consumers.

- Bearish case: A rejection on the pattern line and under $91,000 will expose $88,500, and if the movement stays destructive, the promote will deepen in the direction of $85,000. If ETF outflows proceed, that may add strain and forestall a clear restoration.

As soon as Bitcoin regains $95,500 with quantity, consumers regain management. The $91,000 loss confirms the bearish continuation because the symmetrical triangle resolves to the draw back.

Disclaimer: The knowledge contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any type. Coin Version is just not answerable for any losses incurred because of the usage of the content material, merchandise, or companies talked about. We encourage our readers to do their due diligence earlier than taking any motion associated to our firm.