- Amid weakening sellers, SOL consolidates key helps above and retains medium-term construction impartial

- Leverage cools as open curiosity stabilizes, suggesting aggressive brief promoting unwinding

- Worth stays range-bound as resistance cap rebounds and spot circulation reduces promoting

Solana’s worth motion stays carefully watched as merchants decide whether or not the present pause alerts stability or additional decline. Having failed to keep up momentum close to current highs, SOL is now buying and selling inside an outlined vary, reflecting uncertainty quite than panic.

Whereas market information reveals short-term power waning, the broader construction reveals sellers nonetheless lack full management. Due to this fact, contributors will concentrate on whether or not assist ranges can soak up stress whereas leverage and spot flows are adjusted.

Brief-term construction reveals stress, not collapse

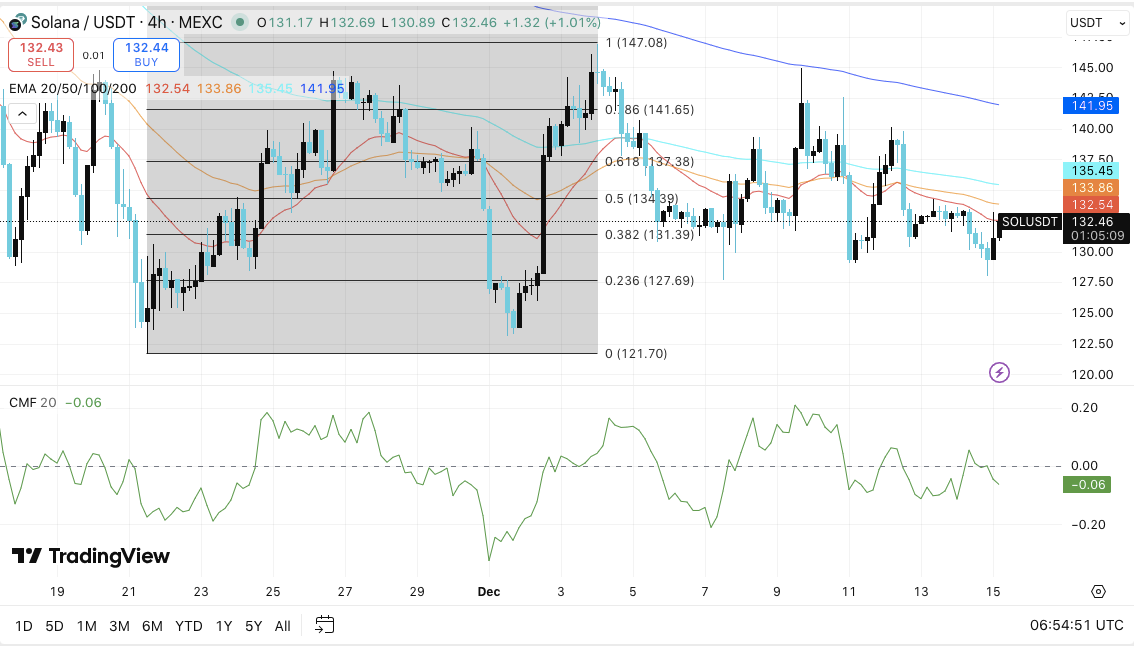

Solana worth entered a correction section after rejecting ranges close to $147. Since then, worth motion has shaped decrease highs on the 4-hour chart. Moreover, SOL is presently buying and selling beneath the 20, 50, and 100 exponential transferring averages. This coincidence confirms near-term bearish stress.

Nonetheless, the broader construction stays above the $121 space. This basis has beforehand supported robust rebounds. Due to this fact, the medium-term outlook isn’t definitively bearish and stays impartial. Whereas sellers have been gradual to maneuver, consumers are additionally hesitant to intervene aggressively.

Momentum indicators assist this cautious view. Chaikin’s cash circulation stays barely unfavourable, indicating a modest outflow quite than a panic promote. Furthermore, this indicator signifies weak demand quite than a big distribution. This means that merchants proceed to progressively cut back their publicity.

Associated: Cardano Worth Prediction: ADA Stays Supported With out Clear Bullish Conviction

A number of ranges are presently shaping Solana’s near-term route. The world between $133.80 and $135.45 would be the first resistance zone. This vary is in line with main transferring averages and former provide. Along with that, the $142 area stands as a stronger barrier after the earlier collapse.

Sentiment will change shortly if we get better $147. Such a transfer would restore the bullish construction and power merchants who have been on the sidelines again into the market. Nonetheless, worth must convincingly clear nearer resistance first.

On the draw back, instant assist lies between $131.40 and $130.90. A clear break beneath this band will expose the $127.70 stage. Due to this fact, consideration will shift to the lows of $121.70. Any losses there would make the broader development bearish.

Derivatives and spot flows reflecting cooling leverage

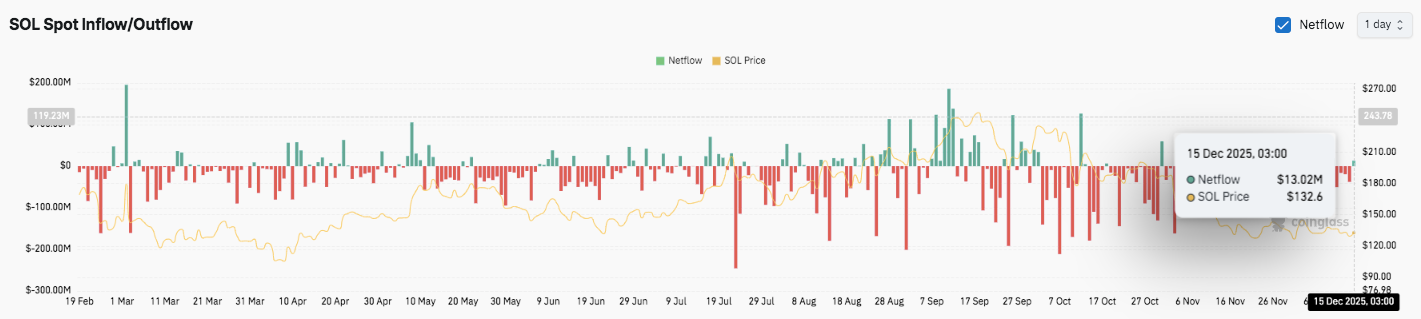

Futures information reveals that leverage expands throughout pullbacks and contracts throughout pullbacks. Open curiosity peaked close to the highest of the native worth, indicating crowded positioning. Open curiosity decreased through the decline, indicating unwinding of positions quite than new brief promoting.

Lately, open curiosity has stabilized at round $7.3 billion whereas the worth hovers round $130. This habits means that leverage decreased after volatility however nonetheless elevated. Furthermore, merchants are nonetheless displaying curiosity, whilst threat urge for food has declined.

The identical factor might be seen from the spot circulation information. Sustained capital outflows dominated a lot of the interval, particularly through the sharp decline. Nonetheless, inflows seem to have tapered off lately, suggesting that promoting stress has eased. Total, flows replicate vigilance quite than new accumulation.

Technical Outlook for Solana Costs

Solana’s worth motion stays tightly structured as merchants assess route after the current pullback. On the 4H chart, SOL is buying and selling inside a well-defined correction vary after being rejected close to the $147 swing excessive.

Because of this, short-term momentum stays restricted, whereas medium-term construction stays above key base assist. Worth compression between clearly marked assist and resistance zones means that volatility may enhance upon a breakout of a key stage.

Associated: Shiba Inu Worth Prediction: SHIB slides into channel each time Bounce sells

High stage: Speedy resistance lies between $133.80 and $135.45, the place the 20EMA and 50EMA converge. A sustained breakout above this cluster may begin a transfer in the direction of $141.95-$142.00. Past that, $147 stays the higher finish of the vary and the extent wanted to regain bullish momentum.

Lower cost stage: Preliminary assist is between $131.40 and $130.90. Failure there would expose $127.70, which coincides with the foremost Fibonacci response zone. The important thing draw back stage stays $121.70, the low of the vary and key structural assist. A break beneath this space will doubtless point out a bearish medium-term development.

Key pivot stage: The $135.50 space serves as a short-term set off. A 4-hour shut above that will shift momentum to the upside, however the rejection would depart costs weak to additional draw back assessments.

Will Solana go to nice heights subsequent?

Brief-term Solana worth prediction will depend on whether or not consumers are in a position to defend the $130 zone and reclaim the resistance cluster on the EMA. Continued consolidation signifies market indecision, not distribution. If quantity expands above $135.50, SOL may retest $142 and problem $147.

Nonetheless, failure to maintain $130 will increase the chance of a deeper transfer in the direction of $127.70 and even $121.70. For now, Solana stays in a pivotal vary, with leverage cooling and spot flows regular as merchants await affirmation.

Associated: Dogecoin Worth Prediction: Downward Channel Strain Continues as Patrons Defend $0.137

Disclaimer: The data contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any type. Coin Version isn’t liable for any losses incurred because of using the content material, merchandise, or companies talked about. We encourage our readers to do their due diligence earlier than taking any motion associated to our firm.