- Worth stays above key EMAs as patrons defend rebound and keep bullish construction

- Elevated open curiosity suggests new leverage and elevated volatility danger close to resistance

- The focus of provide will increase the momentum of the highest value, however the danger of a draw back value will increase within the occasion of a pullback.

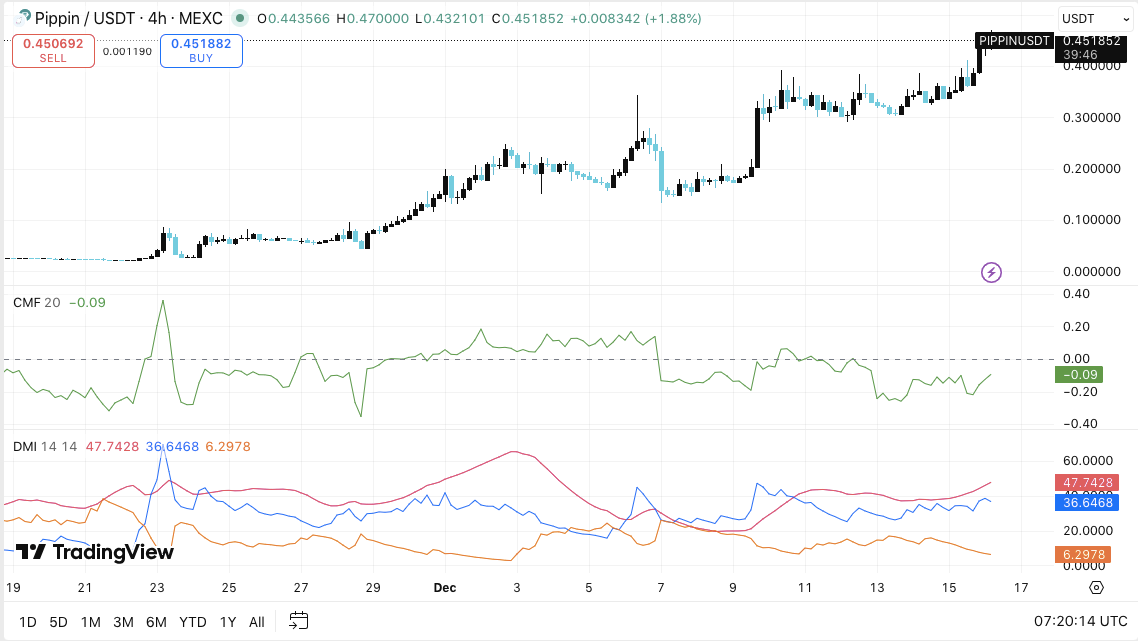

PIPPIN continues to draw the eye of the market as the value motion strengthens on the 4-hour chart. The token lately rallied in the direction of $0.45, setting new highs and reinforcing its broad bullish construction. Merchants are actually monitoring whether or not momentum expands or pauses close to overhead provide.

PIPPIN value development exhibits bullish management

On the 4-hour body, PIPPIN is buying and selling above all main exponential transferring averages. Worth stays above the 20, 50, 100, and 200 EMAs, confirming the development match. Due to this fact, patrons will proceed to defend the decline as an alternative of blindly following the breakout. The supertrend indicator additionally stays constructive, confirming continued upward stress.

Resistance is close to $0.45 to $0.47, the place sellers intervened earlier. A definitive pullout above this zone might pave the best way to $0.50. Nevertheless, a rejection from this vary might set off a managed retracement. Consequently, merchants monitor the construction fairly than short-term candlesticks.

Help is situated close to $0.40 and $0.39, in line with latest consolidation. Moreover, the 20 EMA and breakout construction make the $0.37 space necessary.

A deeper pullback might take a look at $0.31 to $0.30 close to the 50 EMA. Shedding this zone will weaken the credibility of the development. Moreover, $0.26 stays the final main help related to the 100 EMA.

Indicators reflecting energy in early consideration

Momentum indicators proceed to favor patrons, however there may be additionally a way of warning. DMI exhibits a constructive directional index resulting in a damaging line. The energy of ADX confirms an energetic development fairly than depletion. Nevertheless, CMF outputs a barely damaging studying. This implies average revenue taking fairly than heavy distributions.

So, whereas merchants are maintaining a tally of the modifications, capital flows are nonetheless supporting costs. A sudden drop in CMF might point out a deeper correction. Till then, the construction above $0.37 stays constructive.

Volatility danger will increase because of speedy enhance in open curiosity and provide management

Derivatives information exhibits important modifications in market developments. For a number of months, PIPPIN futures open curiosity was flat, indicating restricted leverage. The scenario modified in late November as open curiosity started to rise together with the value. Importantly, in December, the value approached $0.43 and open curiosity exceeded $200 million.

This rally helps new speculative positioning, fairly than simply quick masking. Consequently, leverage will increase the potential liquidation danger within the occasion of sudden withdrawal. A failed breakout try may end up in sharp volatility.

https://twitter.com/wublockchain12/standing/2000787425216569355

On-chain information provides one other layer. In response to GMGN information, PIPPIN was as soon as valued at greater than $450 million. One handle invested roughly $179,600 and bought 8.2 million tokens valued at almost $0.022.

After holding for 53 days, the place reached roughly $3.4 million, reflecting an enormous revenue. Moreover, earlier evaluation urged that one entity controls greater than 70% of the availability by way of a number of wallets. Such focus amplifies each upside momentum and draw back danger.

Technical outlook for PIPPIN value

PIPPIN value continues to commerce inside a well-defined bullish construction on the 4-hour chart, with momentum in favor of patrons regardless of elevated volatility danger. Worth lately hit a excessive close to $0.45, confirming the continuation of the development whereas testing a close-by provide zone. The broader bullish setup stays in place so long as PIPPIN stays above key structural helps.

High stage: Quick resistance is situated at $0.45-$0.47, the place sellers appeared earlier. A definitive 4-hour shut above this vary might allow a continuation in the direction of the psychological stage of $0.50. Past that, if the quantity expands, momentum can persist and expose greater growth zones.

Cheaper price stage: Preliminary help is between $0.40 and $0.39, according to the latest consolidation construction. A deeper decline might take a look at $0.37, which coincides with the 20 EMA and the earlier breakout base. If this stage can’t be sustained, the main target will shift to $0.31 to $0.30 close to the 50 EMA. The $0.26 zone stays the most important development help.

Higher restrict of resistance: The $0.45-$0.47 space serves as a key stage to transform short-term continuation. Acceptance above this vary would strengthen the bullish momentum and scale back draw back stress.

From a technical perspective, PIPPIN is exhibiting indicators of managed growth fairly than depletion. Worth remains to be above all main EMAs and development indicators proceed to favor patrons. Nevertheless, futures open curiosity has expanded quickly together with costs, rising the danger of a spike in volatility throughout a correction.

Will PIPPIN rise additional?

PIPPIN’s short-term path will rely upon whether or not patrons can defend the $0.37 help zone through the pullback. Holding this stage will preserve the bullish construction intact and keep stress on the $0.45-$0.47 resistance band. If the breakout is confirmed, it might pave the best way to $0.50.

Conversely, a breakdown under $0.37 might set off a deeper retracement in the direction of $0.31. For now, PIPPIN stays within the pivotal zone, the place leverage, liquidity, and technical confirmations will decide the following leg.

Disclaimer: The data contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any variety. Coin Version isn’t liable for any losses incurred on account of using the content material, merchandise, or providers talked about. We encourage our readers to do their due diligence earlier than taking any motion associated to our firm.