- BTC is buying and selling under its key EMA, indicating bearish-to-neutral momentum within the brief time period.

- Rising futures open curiosity signifies elevated dealer engagement and potential volatility.

- Schiff warns that Bitcoin might fall as capital circulates into gold and silver.

Bitcoin continues to commerce underneath strain as technical weaknesses, futures buying and selling, and shifts in market sentiment form the near-term outlook. On the 4-hour chart, BTC is buying and selling under a key resistance zone as traders weigh elevated derivatives participation towards recent crash warnings. Consequently, markets stay cautious as merchants wait to see if assist holds or if additional draw back emerges.

Bitcoin value is under key technical ranges

Bitcoin is buying and selling close to $86,800, reflecting the weak construction on the 4-hour timeframe. Costs are nonetheless under the 50, 100, and 200 exponential transferring averages. Subsequently, near-term momentum stays in favor of sellers. A descending value construction lowers the highs and strengthens the bearish-to-neutral bias.

Importantly, the 200 EMA is close to $92,300, persevering with to restrict any restoration makes an attempt. Patrons are having a tough time reclaiming the $89,500 to $90,000 zone that beforehand served as assist. This failure highlighted the bulls’ weak point in follow-through on current rebound makes an attempt. Volatility has additionally contracted, suggesting a stronger directional transfer might proceed.

Rapid resistance lies between $87,900 and $89,100, which is in keeping with the short-term transferring common. Past that, the $92,300 to $94,700 vary stays the important thing stage wanted for a broader development reversal. On the draw back, assist round $86,000 stays vital. A break might expose $83,800 and presumably $80,500.

Futures buying and selling indicators elevated market participation

Bitcoin futures market exercise steadily expanded all through 2025. Open curiosity rose sharply with value actions, peaking in the course of the mid-year rally. As of December seventeenth, open curiosity is near $58.84 billion and BTC is buying and selling round $87,783.

Associated: Solana Worth Prediction: SOL faces short-term strain as a dealer…

Moreover, this development suggests elevated dealer involvement and speculative positioning. Traditionally, elevated open curiosity throughout consolidation can enhance volatility threat. Subsequently, merchants are actually monitoring whether or not leverage is supporting continuation or accelerating liquidation throughout value actions.

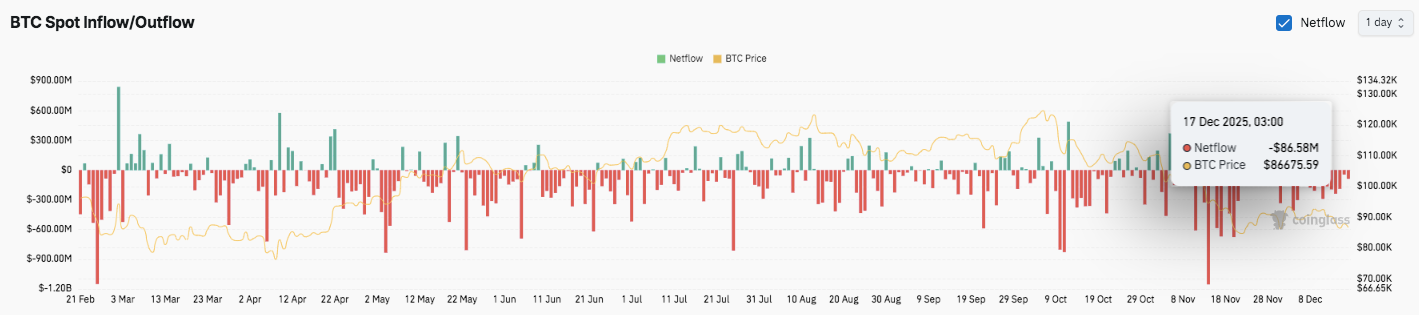

Spot influx and outflow knowledge additionally replicate adjustments in sentiment. Constructive internet flows usually coincide with rising costs, however current detrimental flows have coincided with falling costs. In mid-December, we noticed a big outflow because the inventory fell to $86,675, indicating cautious positioning and revenue taking.

Schiff updates Bitcoin crash warning

Bitcoin critic Peter Schiff reiterated his considerations about extra severe draw back dangers. He factors to report highs in gold and silver as proof of capital rotation into conventional safe-haven property. Moreover, Schiff argues that confidence in Bitcoin’s hedge story has waned.

In his view, traders who anticipated safety in instances of financial stress might face disappointment. Consequently, rising threat aversion might put strain on Bitcoin slightly than assist it. Though the market doesn’t absolutely share this stance, his warning provides to near-term uncertainty.

Technical outlook for Bitcoin value

Bitcoin’s key ranges stay well-defined as value actions are compressed on decrease time frames.

Rapid upside hurdles are at $87,900 and $89,100, with a psychological stage at $90,000. A sustained breakout above $90,000 might open the door to $92,300 the place the 200 EMA limits upside momentum. A decisive transfer above $94,700 would change the medium-term bias to bullish.

On the draw back, $86,000 stays the primary line of protection alongside the vital Fibonacci stage. A break under this zone dangers a fall in the direction of $83,800-$84,000, with $80,500 appearing as deeper macro assist and liquidity goal. The technical construction exhibits that Bitcoin is buying and selling inside a downtrend, reflecting falling highs and sustained promoting strain.

Will Bitcoin go up?

Bitcoin’s near-term outlook depends upon whether or not patrons can confidently return to the $89,500 to $90,000 vary. Continued compression indicators extra volatility forward.

If the bullish momentum strengthens together with enhancing inflows, BTC might retest $92,300 and $94,700. Nevertheless, failure to carry $86,000 might speed up draw back threat in the direction of $83,800 and even $80,500. For now, Bitcoin stays at a key inflection level, and affirmation from value and quantity will form its subsequent huge transfer.

Associated: Shiba Inu value prediction: Downward channel holds as regulated futures add new volatility

Disclaimer: The data contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any type. Coin Version shouldn’t be accountable for any losses incurred because of the usage of the content material, merchandise, or providers talked about. We encourage our readers to do their due diligence earlier than taking any motion associated to our firm.