- Ethereum stays pinned beneath the downtrend line and stacked EMA, and the broader construction stays bearish.

- ETF outflows exceeded $220 million in current classes, with elevated distribution to institutional traders quite than accumulation.

- The worth holds assist between $2,880 and $2,900, however a breakdown dangers an extension in direction of $2,750 and $2,500.

Ethereum worth is buying and selling round $2,925 in the present day after failing to maintain a short-term rebound earlier this week. The market stays beneath stress as costs stay anchored close to the decrease finish of the downward channel and sellers proceed to manage the construction whereas institutional flows stay unfavourable.

Downtrend construction stays intact

On the every day chart, Ethereum continues to commerce beneath the downtrend line that has capped its good points since October. Makes an attempt to push additional up beneath this diagonal resistance are rejected, reinforcing the bearish construction.

Worth continues to be beneath all main EMAs. The 20-day EMA close to $3,074 and the 50-day EMA close to $3,249 function rapid resistance. Above that, the 100-day EMA close to $3,452 and 200-day EMA close to $3,429 reinforce the broader downtrend and spotlight how far worth has strayed from pattern management.

Associated: Mantle Worth Prediction: Can MNT maintain its upward pattern above $1.23?

So long as Ethereum trades beneath this EMA cluster, any upward motion will stay corrective quite than pattern forming. Sellers proceed to defend the rebound and proceed to place stress on any restoration makes an attempt.

Help zone faces essential challenges

Regardless of its fragile construction, Ethereum has not definitively collapsed. Costs are consolidating simply above the $2,880-$2,900 zone, which has absorbed a number of declines over the previous two weeks.

This vary coincides with the decrease sure of the current descending channel and serves as a near-term demand space. The dearth of lively follow-through to the draw back suggests sellers are slowing down, however consumers haven’t but expressed conviction.

If the value closes beneath $2,880 for the day, the subsequent draw back worth goal will likely be round $2,750, and if the promoting accelerates, the $2,500 space will proceed. Holding above present ranges will hold Ethereum consolidating quite than persevering with to say no.

ETF outflows proceed to weigh on sentiment

On December sixteenth alone, the Ethereum ETF recorded web outflows of roughly $224.2 million. BlackRock accounted for about $221.3 million of that quantity, making it the most important single-day withdrawal in current weeks.

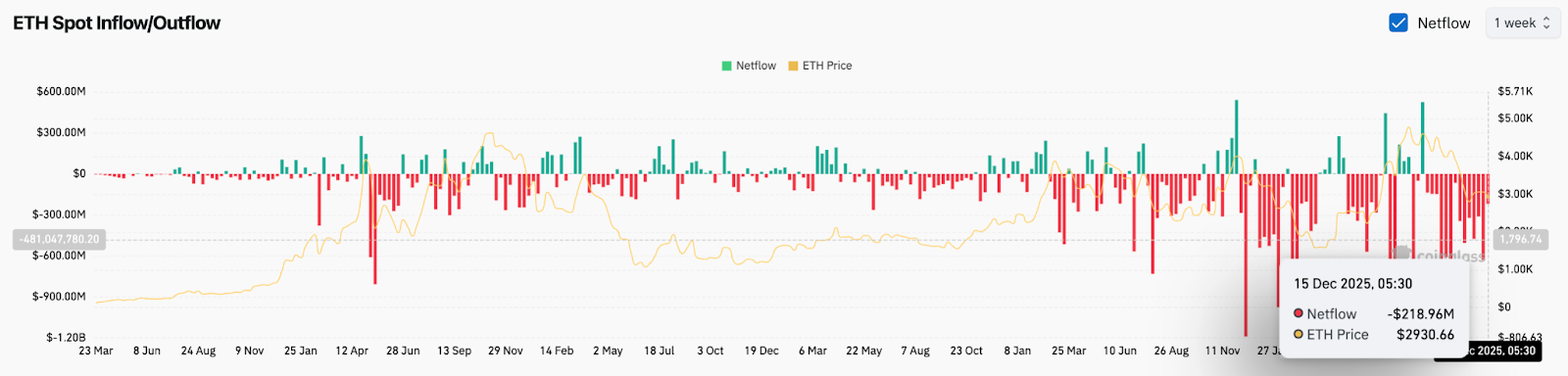

The identical factor will be seen from the spot movement knowledge. Ethereum has skilled repeated classes the place web alternate outflows flip unfavourable, indicating dispersion quite than accumulation.

Associated: Bitcoin Worth Prediction: BTC Extends Weak Part As a consequence of Technical Pressures…

Knowledge for the week beginning Dec. 15 exhibits ETF outflows of about $220 million over three days, persevering with a pattern that has been occurring since September.

Intraday chart exhibits fragile steadiness

On the 30-minute chart, Ethereum will not be trending. After a pointy decline, the value is calming down and is buying and selling inside a slim horizontal vary between $2,880 and $2,980.

This can be a post-decline foundation, not an extension of the decline.

The supertrend stays above the value close to $2,970, confirming that short-term pattern management has not reversed to consumers. Nonetheless, sellers’ repeated failure to push the value beneath $2,880 signifies that draw back stress has stalled.

The parabolic SAR dot has began to flatten because it approaches the value, however this displays a lack of bearish momentum quite than a brand new promoting impulse. Earlier aggressive SAR enlargement has ended.

outlook. Will Ethereum go up?

Ethereum stays caught between waning momentum and rising assist base. The short-term outlook is determined by whether or not consumers can defend present ranges in opposition to continued promoting from institutional traders.

- A powerful case. A every day shut above $3,074 adopted by a restoration of the 50-day EMA close to $3,249 would point out enhancing momentum and pave the way in which for the $3,450 resistance zone.

- bearish case. A decisive breakdown beneath $2,880 confirms new draw back stress, with a possible of $2,750, and dangers widening in direction of $2,500 if outflows proceed.

Associated: Solana Worth Prediction: SOL faces near-term stress as merchants reassess momentum

Disclaimer: The data contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any form. Coin Version will not be accountable for any losses incurred because of the usage of the content material, merchandise, or companies talked about. We encourage our readers to do their due diligence earlier than taking any motion associated to our firm.