- Zhao’s new affect revives hopes for Binance.US, however possession dilution stays a hurdle

- Binance considers timing of U.S. re-entry as state approvals delay and federal transparency stalls

- Views on management, ties to Trump, and rivals will take a more in-depth have a look at Binance’s returns

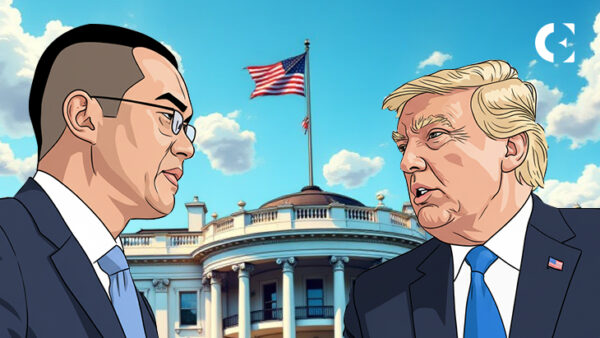

Binance has resumed inner discussions on its long-term place within the US as Changpeng Zhao regains prominence throughout cryptocurrencies. Though Mr. Zhao is now not operating day-to-day operations, Mr. Trump’s pardon on October 23, 2025 modified the context for the way traders and regulators learn Binance’s subsequent transfer.

Mr. Zhao, who was not too long ago pardoned by President Donald Trump, expressed robust assist for US crypto coverage. Because of this, his feedback have elevated hypothesis that Binance.US will resume its stalled progress. Exchanges at present have restricted room to maneuver because the political and regulatory panorama stays unsure.

Associated: CZ guarantees to speculate $4.3 billion in US as ‘thanks’ for controversial Trump pardon

Binance.US reboot plan faces friction over licensing and possession

Binance.US has struggled since dropping its trade standing resulting from U.S. enforcement actions that pressured it to vary management and cut back operations, tightening entry to cost rails and licenses. Binance is contemplating structural choices for its U.S. unit, together with a potential recapitalization that would change possession, which optical regulators have beforehand warned about.

State-by-state licensing nonetheless slows nationwide enlargement, and New York stays a gated marketplace for authenticity, even when quantity is elsewhere. Binance might want to determine whether or not to press forward beneath as we speak’s patchwork guidelines or anticipate clearer federal guardrails that Congress has but to offer.

Associated: CZ-backed YZi Labs launches hostile takeover of CEA trade after 90% inventory collapse

Management optics matter as Binance goals to turn out to be US-friendly

Binance not too long ago promoted Yi He to co-CEO alongside Richard Teng. The corporate positioned the transfer as a continuation of the delicate interval. As well as, Yi He takes on a bigger public position in main messaging and technique. However her visibility complicates efforts to display distance from Zhao. He nonetheless owns a big stake and influences the trade dialog.

In the meantime, Mr. Teng continues to handle regulatory outreach and international compliance efforts. He helped stabilize Binance after its authorized setbacks. Observers at the moment are questioning how decision-making energy is being divided between the 2 leaders. Importantly, as Binance refocuses on the US market, it must stability inner controls with exterior credibility.

BlackRock’s BUIDL Collateral Provides Institutional Significance to Binance Story

Along with administration modifications, Binance strengthened its relationships with current monetary gamers. Discussions with BlackRock spotlight that dedication. BlackRock already helps tokenized merchandise used on the Binance platform.

Moreover, Binance is rising its involvement with crypto ventures with ties to the Trump household. These measures signify a broader try and coordinate with influential US establishments.

Nonetheless, re-entry shouldn’t be simple to attain. Binance.US remains to be not authorised in lots of main states. Moreover, opponents like Coinbase maintain regulatory benefits and a stable person base. If Binance returns aggressively with low charges, rivals will really feel the strain. Because of this, regulators may scrutinize each transfer extra intently.

Disclaimer: The data contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any variety. Coin Version shouldn’t be answerable for any losses incurred because of using the content material, merchandise, or providers talked about. We encourage our readers to do their due diligence earlier than taking any motion associated to our firm.