- Bitcoin fell under $85,000, triggering a slide in cryptocurrencies, with Ethereum and Solana posting losses.

- Bitcoin ETFs skilled outflows, however XRP and Solana ETFs recorded modest features.

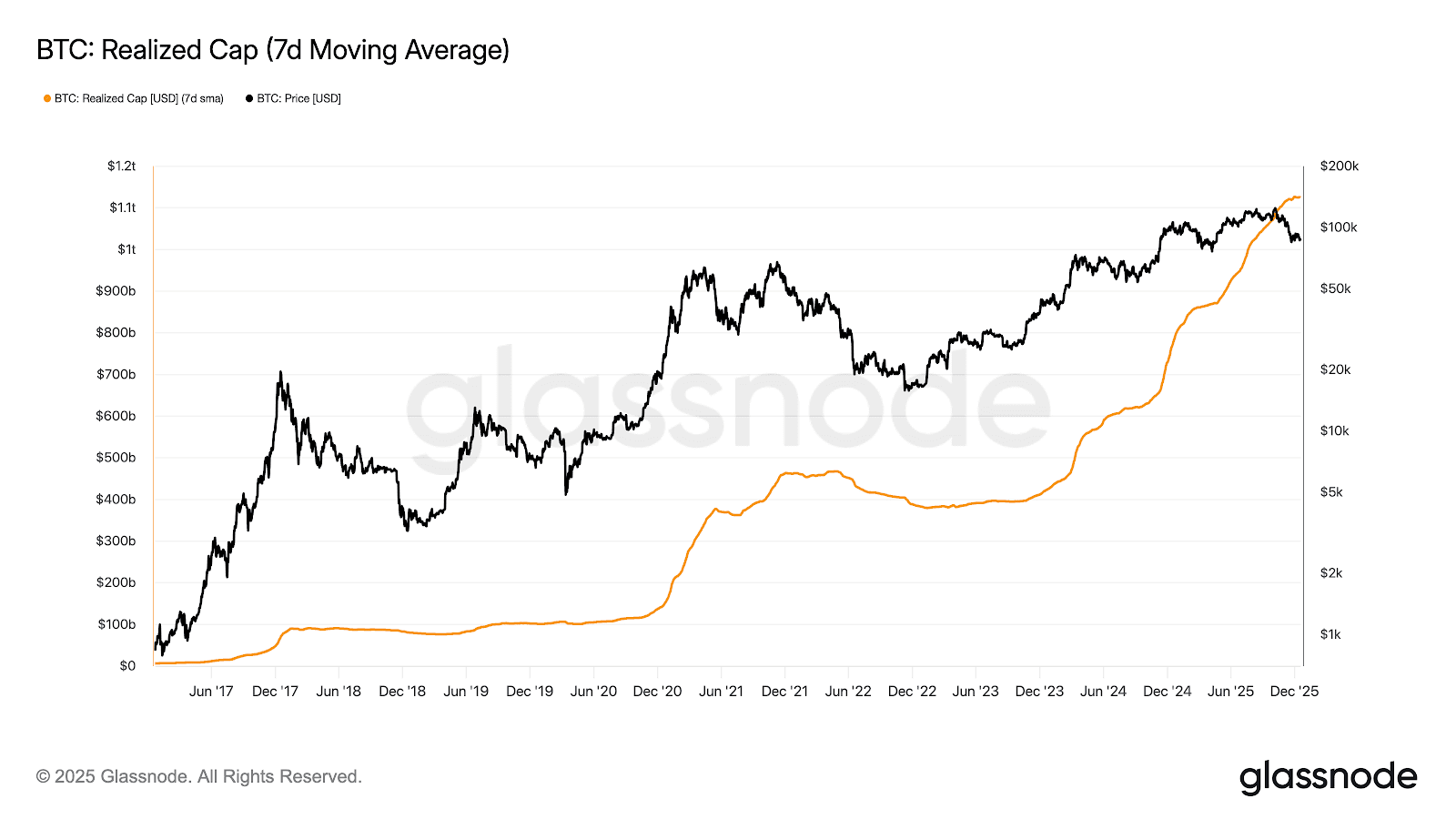

- Market fundamentals stay sturdy, with Bitcoin’s realized market capitalization reaching an all-time excessive of $1.125 trillion.

Bitcoin plummeted on Thursday, falling under a key help stage and pushing the complete crypto market decrease. After failing to keep up the extent of $89,500, it fell under $85,000 and at one level reached $84,500, its lowest stage in about three weeks.

Different cryptocurrencies additionally fell. Ethereum fell under $2,800, Solana fell 4% to a multi-month low, and a number of other main altcoins fell greater than 5%. The sudden drop triggered an enormous liquidation of derivatives, wiping out almost $562 million, largely from lengthy positions.

The market is at the moment exhibiting some indicators of restoration. Bitcoin rose 0.7% to $87,071, however continues to be down 5.8% for the week. Ethereum rose 3.4% to $2,924, whereas XRP, BNB, and Solana noticed modest features, as did Bitcoin.

US inflation figures lead short-term restoration

The gradual restoration comes after November’s US inflation knowledge confirmed a slowdown within the fee of worth progress. Main client costs rose 2.7% year-on-year, decrease than market expectations, whereas core inflation fell to 2.6%. The numbers strengthened expectations that U.S. rates of interest might fall within the coming quarters.

Associated: Composite CPI fell to 2.7% in November, reflecting US inflation shock. Enhance sentiment in the direction of cryptocurrencies

Central banks ship conflicting alerts

Whereas US inflation knowledge led to a short-term rise, coverage selections exterior the US added to uncertainty. The Financial institution of England lower its key rate of interest by 0.25% to three.75%, citing slowing progress and easing inflation. Officers stated future rate of interest cuts would depend upon financial knowledge and the optimistic impression on danger belongings can be restricted.

In Asia, all eyes are on the Financial institution of Japan, which is anticipated to lift rates of interest to the best stage in 30 years. Rising rates of interest might trigger the yen to understand, impacting yen carry transactions, an necessary supply of worldwide liquidity. Previous rate of interest hikes in Japan have usually coincided with falls in Bitcoin costs.

ETF flows present the positioning of varied establishments

Institutional inflows into crypto-related exchange-traded funds (ETFs) confirmed a blended sample this week. The US Spot Bitcoin ETF recorded internet outflows of $161.3 million on Thursday, following a major internet influx of $457.3 million on Wednesday.

Flows amongst different digital asset ETFs had been blended. The XRP ETF has recorded internet inflows of $18.9 million and $30.4 million over the previous two buying and selling classes, indicating regular curiosity within the token. The Solana ETF additionally posted small optimistic inflows of $85,000 and $107,000 over the identical interval.

Ethereum ETFs continued to lag. These merchandise have seen internet outflows of $7,500 and $34,000 over the previous two days, additional extending the development of weaker institutional demand in comparison with Bitcoin and a few various cryptocurrencies.

Bitcoin fundamentals stay secure

Regardless of blended worth actions and ETF flows, Bitcoin’s long-term outlook seems to be stable. The realized market capitalization, which measures the worth of a coin on the time of its final transaction, reached a file $1.125 trillion, indicating regular capital inflows.

Analysts say that in contrast to previous downturns, the latest decline has not triggered a widespread selloff, suggesting market panic is proscribed.

Choice Expiry and Market Outlook

All eyes at the moment are on the expiration of $23 billion in Bitcoin choices subsequent Friday, an occasion that traditionally will increase short-term volatility. Curiously, $2.7 billion of Bitcoin choices and $475 million of Ethereum choices expire immediately, probably rising volatility throughout this era.

Associated: Why the Financial institution of Japan’s 25Bps rate of interest hike might trigger a fall in cryptocurrencies

Merchants are additionally keeping track of bond yields, forex actions and additional steering from central banks as the top of the 12 months approaches. Market members anticipate digital asset costs to stay delicate to macroeconomic developments and liquidity situations within the brief time period.

Disclaimer: The knowledge contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any variety. Coin Version just isn’t accountable for any losses incurred on account of the usage of the content material, merchandise, or providers talked about. We encourage our readers to do their due diligence earlier than taking any motion associated to our firm.