- Aggressive bidding constructed round $2,750-$2,800 allowed Ethereum to type a short-term backside after the latest selloff.

- A decent cluster of EMAs between $2,920 and $3,120 continues to dampen any rebound and maintain the broader construction in correction.

- Derivatives knowledge reveals that leverage has been reset fairly than spot-driven accumulation, favoring vary buying and selling for now.

Ethereum value is buying and selling round $2,950 at present, stabilizing after a pointy pullback from the $3,100 space earlier this week. This rally adopted a push into the $2,750-$2,800 zone, the place aggressive bidding emerged and compelled short-term sellers to exit. Though this pullback supplies some short-term aid, Ethereum stays beneath key EMA resistance, leaving the broader construction below stress heading into December twentieth.

Consumers save $2,800 with order guide assist

The short-term downward momentum slowed after Ethereum fell to the $2,750-$2,800 space. Binance order guide knowledge reveals greater than $150 million in bids have been stacked throughout that zone, indicating energetic protection by massive contributors fairly than passive liquidity.

Value clearly revered that space and hit larger lows on the decrease time-frame earlier than pushing again in the direction of $2,950. This response is vital. Intervening throughout a measurement plunge typically marks at the least a short lived backside, even when the general pattern has not but reversed.

Nevertheless, protection alone won’t guarantee a turnaround. To decisively shift momentum, consumers nonetheless want to revive their overhead construction.

EMA cluster continues to cap assortment volumes

On the 4-hour chart, Ethereum continues to be trapped beneath a good EMA band. The 20 EMA close to $2,918 and 50 EMA close to $2,992 are presently straight above the value, whereas the 100 EMA at $3,036 and 200 EMA close to $3,120 outline the higher bounds of larger resistance.

Associated: Shiba Inu Value Prediction: Burn Charge Explodes as SHIB rallies 5%…

This compression of the EMA displays a market that has misplaced directional management. All makes an attempt to maneuver larger over the previous week have stalled inside this band, reinforcing its place as a promote zone fairly than a launching pad. Any try to maneuver larger will stay corrective till Ethereum closes above the 100 EMA with confidence.

Fibonacci ranges reinforce this view. The latest rally stalled across the 0.382 retracement close to $3,018, however the 0.5 degree close to $3,140 stays intact. These ranges intently match the EMA construction, rising its relevance.

Moreover, after falling into oversold territory on the 4-hour RSI, readings have recovered in the direction of the low 50% vary, indicating a decline in promoting stress.

Momentum improves within the brief time period, however pattern stays fragile

On the 30-minute chart, the parabolic SAR is beneath the value, supporting a short-term rebound. Directional motion indicators additionally point out that consumers are gaining momentum throughout the day, however the pattern power stays reasonable.

Associated: XRP Value Prediction: Pockets Development Soars Whilst XRP Falls

These indicators recommend upside potential however lack affirmation from larger time frames. Briefly, Ethereum just isn’t breaking, it’s stabilizing.

Derivatives knowledge reveals resetting fairly than accumulation of leverage

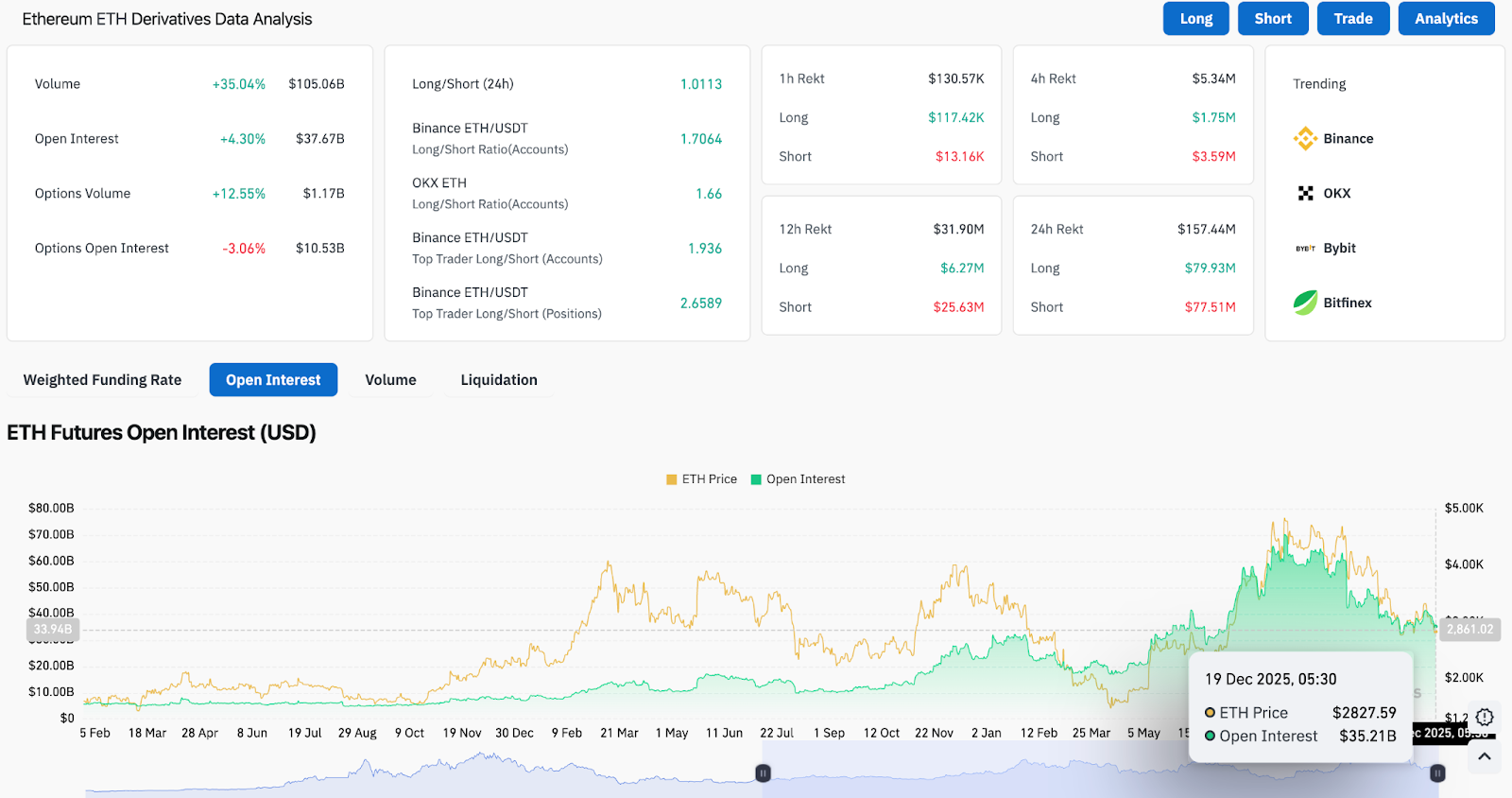

Spinoff knowledge provides vital context. Futures buying and selling quantity elevated by greater than 35% and open curiosity elevated by roughly 4%. This mix signifies that new positioning is getting into the market fairly than a rebound attributable to unwinding.

Prior to now 24 hours, liquidations totaled over $157 million, with a close to steadiness between long-term and short-term liquidations. This means bidirectional stress fairly than unilateral stress. Lengthy-to-short ratios stay elevated throughout main exchanges, suggesting that merchants are nonetheless positioned for upside regardless of latest volatility.

That is vital as a result of rallies constructed on crowded lengthy positions are likely to fade except spot demand continues. To this point, by-product exercise has stored costs steady, however a sustained breakout has but to happen.

Construction that favors vary buying and selling till December twentieth

From a structural perspective, Ethereum continues to commerce inside a variety between $2,800 and $3,100. The decrease sure is strengthened by seen bids and former demand, whereas the higher sure coincides with the EMA and former breakdown ranges.

Value traits are more likely to stay unstable till certainly one of them breaks out. Bulls want acceptance above $3,050 to open the door to above $3,200. Bears, however, will concentrate on whether or not the $2,800 degree continues to carry if promoting stress returns.

outlook. Will Ethereum go up?

The short-term outlook relies on how Ethereum behaves across the EMA cluster.

- Bullish Case: A sustained rally above $3,050 and a subsequent shut above the 100 EMA signifies that consumers are regaining management. This transfer places the subsequent upside targets at $3,200 after which $3,350.

- Bearish case: If the value fails to recuperate $3,000 and subsequently falls beneath $2,800, the present rebound will probably be nullified. This situation opens the door to a deeper pullback in the direction of $2,650.

Associated: Bitcoin value prediction: Downtrend line holds as netflows miss out on restoration

Disclaimer: The knowledge contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any form. Coin Version just isn’t chargeable for any losses incurred on account of the usage of the content material, merchandise, or companies talked about. We encourage our readers to do their due diligence earlier than taking any motion associated to our firm.